JPMorgan CEO Identifies Top Priority For Trump Administration

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

JPMorgan CEO Identifies Top Priority for Trump Administration: Tax Reform Takes Center Stage

Jamie Dimon, CEO of JPMorgan Chase & Co., the largest bank in the United States, has publicly identified tax reform as the top priority for the Trump administration. This statement, made during a recent interview, carries significant weight, given JPMorgan Chase's influential position within the global financial landscape and Dimon's reputation as a powerful voice in American business. His assertion underscores the critical role tax policy plays in the nation's economic trajectory and highlights the intense focus on this issue within the corporate world.

Tax Reform: A Catalyst for Economic Growth?

Dimon's emphasis on tax reform isn't simply a corporate plea for lower taxes. He argues that a comprehensive overhaul of the US tax code is crucial for stimulating economic growth, boosting investment, and ultimately creating jobs. He believes a simplified, more competitive tax system would encourage businesses to expand, invest in new technologies, and increase hiring – ultimately benefiting the American worker and the economy as a whole.

This perspective aligns with the Trump administration's own stated goals. The administration has consistently championed tax cuts as a key element of its economic agenda, promising they will lead to increased prosperity and a stronger American economy. However, the specifics of the proposed tax reforms have faced significant debate and scrutiny.

The Details Matter: Concerns and Criticisms

While the broad strokes of tax reform—lowering corporate tax rates, simplifying the tax code—enjoy widespread support within the business community, concerns remain regarding the potential impact on various sectors and income brackets. Critics have raised questions about the potential for increased national debt, the distribution of tax benefits, and the long-term effects on income inequality.

Some argue that focusing solely on corporate tax cuts without addressing broader social and economic issues could exacerbate existing inequalities and fail to deliver the promised economic benefits. Others express concern over the potential for loopholes and unintended consequences within a complex tax system, even a reformed one.

Beyond Tax Reform: Other Key Considerations

While tax reform is undoubtedly a major focus, it's important to note that it's not the only significant issue facing the Trump administration and the American economy. Other critical areas include:

- Infrastructure Investment: Modernizing America's infrastructure is a crucial long-term investment that could stimulate economic growth and create jobs. [Link to article about infrastructure investment]

- Regulation: Balancing the need for regulation with the desire for economic growth is a constant challenge. Finding the right balance is key to fostering a dynamic and competitive economy. [Link to article about economic regulation]

- Trade Policy: Navigating complex global trade relationships requires careful consideration and strategic planning. [Link to article about US trade policy]

Looking Ahead: The Impact of Tax Reform

Jamie Dimon's prioritization of tax reform underscores its central role in the current economic climate. The success or failure of these reforms will have profound implications for businesses, investors, and the American public. Whether the promised benefits materialize will depend heavily on the details of the legislation and its effective implementation. The coming months will be crucial in determining the long-term impact of this pivotal policy decision.

Call to Action: Stay informed about the latest developments in tax reform and its impact on the US economy by subscribing to our newsletter [Link to Newsletter Signup].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on JPMorgan CEO Identifies Top Priority For Trump Administration. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Brazils Finance Minister Spotlights Climate Change As A Key Economic Factor

Jun 02, 2025

Brazils Finance Minister Spotlights Climate Change As A Key Economic Factor

Jun 02, 2025 -

Co To Bylo Iga Swiatek I Dziwny Przedmiot Podczas Przygotowan Do Gry

Jun 02, 2025

Co To Bylo Iga Swiatek I Dziwny Przedmiot Podczas Przygotowan Do Gry

Jun 02, 2025 -

Homeland Security Actions Spark Outrage Incident Involving Rep Nadlers Staff

Jun 02, 2025

Homeland Security Actions Spark Outrage Incident Involving Rep Nadlers Staff

Jun 02, 2025 -

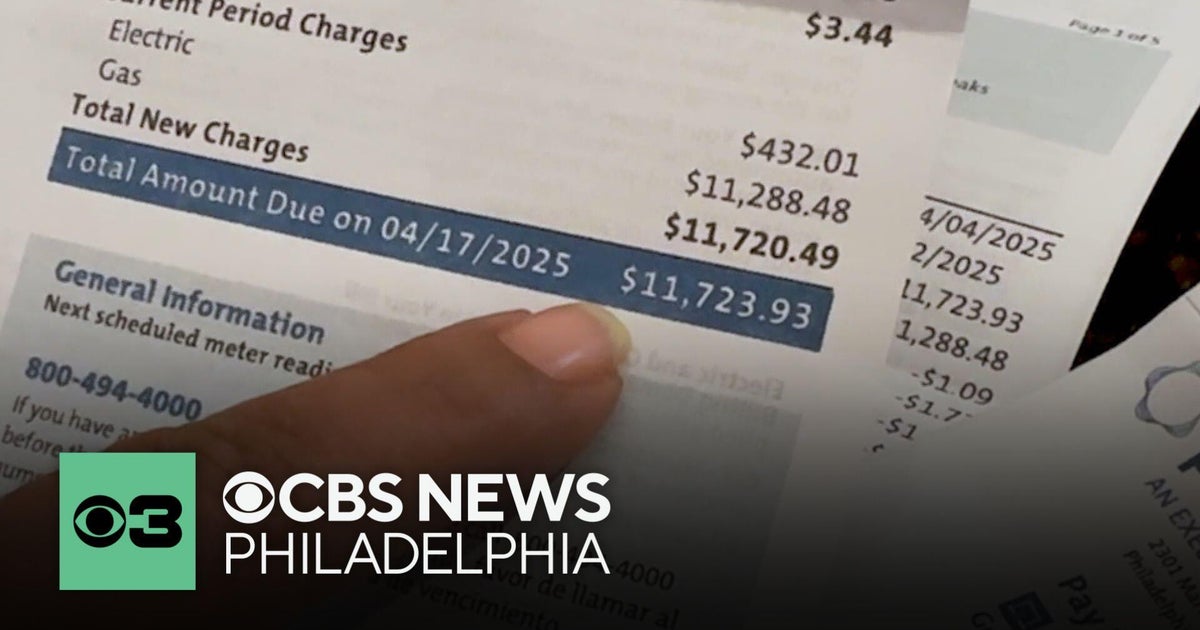

Peco Billing Glitch Leads To 12 000 Surprise For Pennsylvania Resident

Jun 02, 2025

Peco Billing Glitch Leads To 12 000 Surprise For Pennsylvania Resident

Jun 02, 2025 -

Climate Change Brazils Finance Ministry Highlights Economic Upsides

Jun 02, 2025

Climate Change Brazils Finance Ministry Highlights Economic Upsides

Jun 02, 2025