JPMorgan CEO Highlights Internal Risks To US Economic Stability

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

JPMorgan CEO Highlights Internal Risks to US Economic Stability

Jamie Dimon's stark warning underscores vulnerabilities beyond inflation and geopolitical tensions.

JPMorgan Chase & Co.'s CEO, Jamie Dimon, has once again sounded the alarm, this time highlighting significant internal risks to the US economic stability. While external factors like inflation and the war in Ukraine continue to dominate headlines, Dimon's recent comments emphasize a less discussed but potentially equally damaging set of vulnerabilities within the American economy itself. His warning serves as a crucial reminder that economic stability isn't solely dependent on external forces.

Dimon's concerns, expressed during [Insert Source - e.g., an earnings call, a conference, an interview], go beyond the typical anxieties surrounding rising interest rates and potential recession. He pointed to several key internal factors that could trigger a significant downturn:

Internal Threats to US Economic Stability: Dimon's Key Concerns

-

High Debt Levels: Dimon stressed the alarming level of US household and government debt. The prolonged period of low interest rates fueled borrowing, leaving many vulnerable to rising interest rates and potential economic shocks. This high debt burden reduces consumer spending power and increases the risk of defaults, potentially triggering a domino effect across the financial system. [Link to relevant article on US debt levels]

-

Political Polarization and Uncertainty: The CEO also highlighted the impact of political gridlock and partisan divisions on economic stability. Uncertainty surrounding government policies, particularly in areas like fiscal spending and regulation, creates an unpredictable environment for businesses and investors, hindering long-term planning and investment. This uncertainty can stifle economic growth and increase volatility.

-

Geopolitical Risks and Supply Chain Vulnerabilities: While often categorized as external factors, Dimon emphasized the interconnectedness of global events with the US economy. Supply chain disruptions, energy price volatility, and escalating geopolitical tensions can significantly impact domestic economic activity, exacerbating existing internal weaknesses. [Link to article on supply chain disruptions]

-

The Looming Threat of Recession: While not a purely internal factor, the likelihood of a recession significantly magnifies the risks posed by high debt levels and political uncertainty. A recession would severely impact consumer spending, business investment, and employment, potentially triggering a deeper and more prolonged economic downturn.

What Dimon's Warning Means for Investors and Consumers

Dimon's warnings are not simply pessimistic pronouncements; they are a call for proactive measures. Investors should carefully assess their portfolios and consider diversification strategies to mitigate risks. Consumers should focus on responsible debt management and build financial resilience to withstand potential economic headwinds.

Looking Ahead: Mitigation Strategies and Policy Recommendations

Addressing these internal vulnerabilities requires a multifaceted approach. Policymakers need to prioritize fiscal responsibility, promote economic diversification, and foster a more stable and predictable political environment. This might include initiatives aimed at reducing the national debt, streamlining regulations, and investing in infrastructure. Furthermore, bolstering the resilience of supply chains and promoting domestic manufacturing can also play a crucial role.

Dimon's frank assessment serves as a critical wake-up call. The future of the US economy hinges not only on external factors but also on addressing the internal fragilities that could trigger a significant crisis. It's time for proactive measures and a renewed focus on building a more robust and resilient economy.

Keywords: Jamie Dimon, JPMorgan Chase, US Economy, Economic Stability, Recession, Inflation, Debt, Political Risk, Supply Chain, Geopolitical Risks, Economic Outlook, Financial Markets, Investment Strategy, Consumer Spending.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on JPMorgan CEO Highlights Internal Risks To US Economic Stability. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Trumps Tariff Hike Doubled Steel And Aluminum Duties Spark Backlash

Jun 02, 2025

Trumps Tariff Hike Doubled Steel And Aluminum Duties Spark Backlash

Jun 02, 2025 -

Przedmiot Na Korcie Igi Swiatek Innowacyjna Metoda Przygotowan

Jun 02, 2025

Przedmiot Na Korcie Igi Swiatek Innowacyjna Metoda Przygotowan

Jun 02, 2025 -

Wielki Mecz Roland Garros Swiatek Walczy Z Rybakina Relacja Live

Jun 02, 2025

Wielki Mecz Roland Garros Swiatek Walczy Z Rybakina Relacja Live

Jun 02, 2025 -

Governor Walz Calls Trump Cruel Advocates For Stronger Democratic Pushback

Jun 02, 2025

Governor Walz Calls Trump Cruel Advocates For Stronger Democratic Pushback

Jun 02, 2025 -

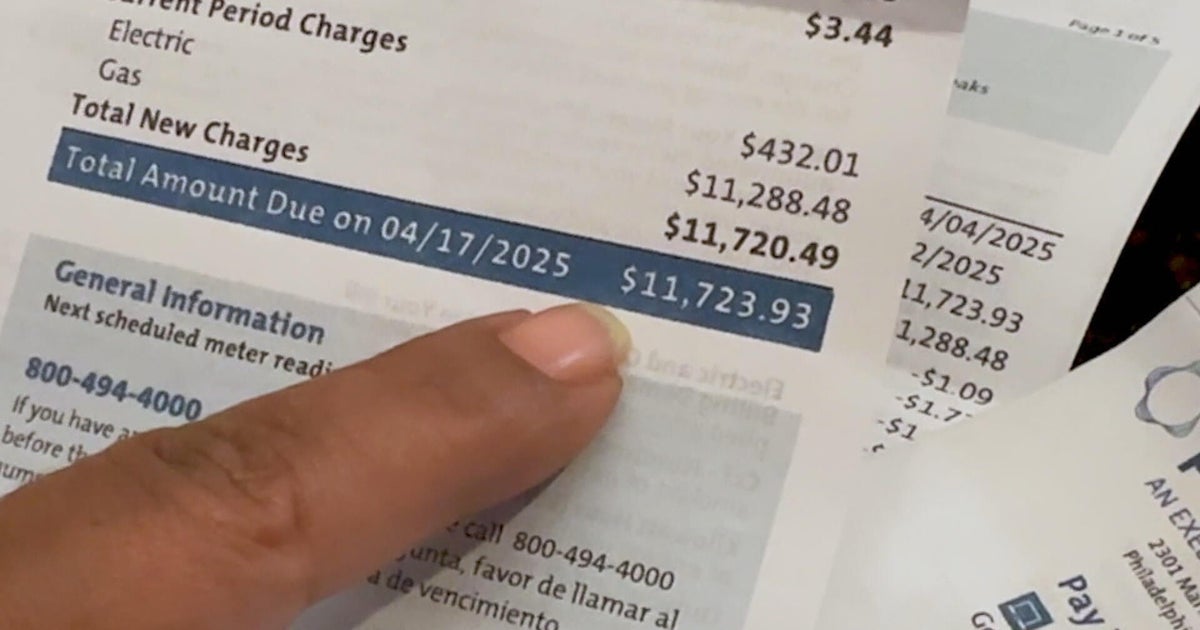

Peco Billing System Under Fire After Customer Hit With 12 000 Unexpected Charge

Jun 02, 2025

Peco Billing System Under Fire After Customer Hit With 12 000 Unexpected Charge

Jun 02, 2025