JPMorgan CEO Highlights Domestic Threats To US Economic Stability

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

JPMorgan CEO Highlights Growing Domestic Threats to US Economic Stability

Jamie Dimon's warning underscores concerns beyond inflation and geopolitical tensions.

JPMorgan Chase & Co.'s CEO, Jamie Dimon, recently issued a stark warning about the growing domestic threats to the U.S. economy, adding another layer of complexity to an already challenging economic landscape. While inflation and geopolitical instability remain significant concerns, Dimon's comments highlight a worrying trend of internal pressures that could significantly impact American economic stability. His remarks, delivered during [insert context: e.g., an earnings call, a conference, etc.], sent ripples through financial markets and sparked renewed debate about the nation's economic trajectory.

Beyond Inflation: A Deeper Dive into Dimon's Concerns

Dimon's concerns extend beyond the well-publicized inflationary pressures and the ongoing war in Ukraine. He specifically pointed to several key domestic factors:

1. The Debt Ceiling Crisis: The ongoing political battle surrounding the debt ceiling looms large. Dimon warned that a failure to raise the debt ceiling could trigger a catastrophic economic downturn, potentially leading to a default on U.S. Treasury bonds – a scenario with potentially devastating global consequences. This uncertainty is already impacting investor confidence and could hinder economic growth. [Link to relevant news article about the debt ceiling].

2. Political Polarization and Gridlock: The intense political polarization in the U.S. is hindering effective policymaking, Dimon argued. This gridlock prevents the swift implementation of necessary economic reforms and creates uncertainty for businesses, hindering investment and job creation. The inability to address critical issues in a timely manner further destabilizes the economy.

3. Government Spending and the National Debt: The persistently high levels of government spending and the burgeoning national debt represent a significant long-term threat, according to Dimon. This unsustainable fiscal trajectory could lead to higher interest rates, inflation, and ultimately, slower economic growth. [Link to relevant article on US national debt].

4. The Impact of Geopolitical Uncertainty: While not solely a domestic issue, the impact of global geopolitical instability is being felt domestically. Supply chain disruptions, energy price volatility, and the overall uncertainty stemming from global conflicts contribute to economic fragility within the U.S.

What Does This Mean for the Average American?

Dimon's warnings are not just for Wall Street; they have significant implications for everyday Americans. The potential for economic instability could translate into:

- Higher interest rates: Making borrowing more expensive for mortgages, auto loans, and business investments.

- Increased inflation: Eroding purchasing power and impacting household budgets.

- Job insecurity: Reduced economic growth can lead to job losses and a weakened labor market.

- Reduced consumer confidence: Uncertainty about the future can lead to decreased spending and slower economic activity.

Looking Ahead: Navigating the Challenges

The challenges outlined by Dimon require a multifaceted approach. Addressing the debt ceiling crisis, fostering bipartisan cooperation on economic policy, and implementing sustainable fiscal reforms are crucial steps towards stabilizing the U.S. economy. Furthermore, proactive measures to mitigate the impact of global geopolitical events are necessary.

While the outlook presents significant challenges, Dimon's comments serve as a crucial wake-up call. Addressing these domestic threats proactively is essential to ensuring the long-term economic health and prosperity of the United States. [Link to JPMorgan Chase website – for context only, avoid overt promotion]. The time for decisive action is now.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on JPMorgan CEO Highlights Domestic Threats To US Economic Stability. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Arrest Made North Texas Murder Suspect Captured After Extensive Manhunt

Jun 03, 2025

Arrest Made North Texas Murder Suspect Captured After Extensive Manhunt

Jun 03, 2025 -

Patti Lu Pone Issues Apology For Disrespectful Remarks

Jun 03, 2025

Patti Lu Pone Issues Apology For Disrespectful Remarks

Jun 03, 2025 -

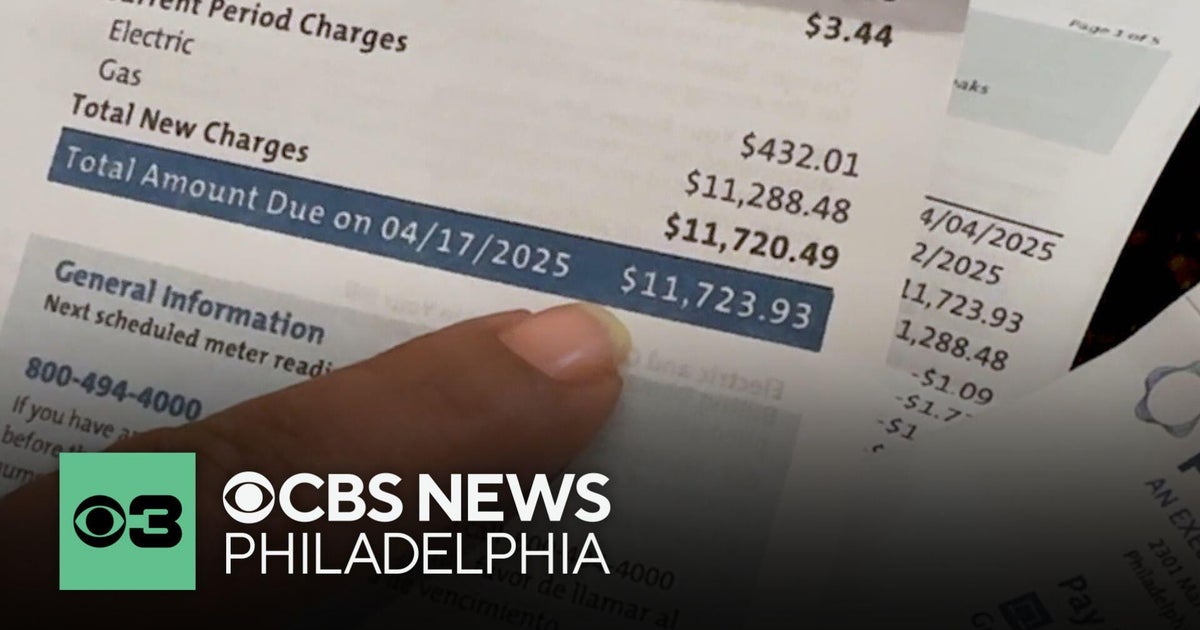

Massive Peco Energy Bill 12 000 Shock For Customer After Missed Statements

Jun 03, 2025

Massive Peco Energy Bill 12 000 Shock For Customer After Missed Statements

Jun 03, 2025 -

Police Capture Murder Suspect Following Interstate Manhunt

Jun 03, 2025

Police Capture Murder Suspect Following Interstate Manhunt

Jun 03, 2025 -

Jp Morgan Chase Ceo Sounds Alarm China Unafraid Of Us Tariffs

Jun 03, 2025

Jp Morgan Chase Ceo Sounds Alarm China Unafraid Of Us Tariffs

Jun 03, 2025