Jim Cramer's Top 10 Stocks: US-China Trade Talks Loom Large

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Jim Cramer's Top 10 Stocks: Navigating the US-China Trade War Uncertainty

The ongoing US-China trade tensions continue to cast a long shadow over the global economy, leaving investors scrambling for safe havens and opportunities amidst the uncertainty. Renowned financial commentator Jim Cramer, known for his outspoken opinions and market analysis, recently unveiled his top 10 stock picks for navigating this turbulent landscape. But are these picks truly recession-proof, and what factors influenced his selections? Let's dive in.

The Geopolitical Landscape: Why Trade Talks Matter

The escalating trade war between the US and China has created significant volatility in the stock market. Tariffs, sanctions, and retaliatory measures have impacted various sectors, making it crucial for investors to carefully assess their portfolios. Cramer's selections reflect a consideration of this volatile environment, focusing on companies with strong fundamentals and the potential to weather the storm. Understanding the nuances of the US-China trade relationship is paramount to making informed investment decisions. For a deeper understanding of the current trade dynamics, you can refer to recent reports from the .

Cramer's Top 10 Picks: A Closer Look

While Cramer hasn't explicitly published a definitive "Top 10" list specifically tied to US-China trade negotiations in a single, easily accessible source, we can analyze his recent recommendations across various platforms (like his Mad Money show and articles) to extrapolate a likely portfolio based on his consistent messaging. Remember, investing is inherently risky, and past performance is not indicative of future results. This analysis should not be considered financial advice.

These picks often reflect companies he believes are:

- Less exposed to Chinese markets: Reducing direct dependence on Chinese manufacturing or sales is a key strategy during trade uncertainty.

- Domestically focused: Companies with strong US consumer bases tend to be less vulnerable to international trade disputes.

- Innovation-driven: Companies investing heavily in research and development are often better positioned for long-term growth, irrespective of short-term market fluctuations.

- Financially sound: Cramer emphasizes strong balance sheets and consistent profitability as essential qualities in a volatile market.

Potential Stock Categories within Cramer's Likely Portfolio:

- Technology (with a caveat): While tech giants have significant exposure to China, certain segments might be relatively insulated. Look for companies with diversified revenue streams.

- Healthcare: The healthcare sector often performs relatively well during economic uncertainty, as demand for healthcare services remains relatively stable.

- Consumer Staples: Essential goods and services are less susceptible to economic downturns, making companies in this sector attractive during times of trade conflict.

- Financials (selectively): Strong financial institutions with robust risk management strategies can potentially benefit from the current environment.

Important Considerations:

- Diversification: Never put all your eggs in one basket. Diversification across different sectors and asset classes is crucial to mitigate risk.

- Due Diligence: Always conduct your own thorough research before making any investment decisions.

- Professional Advice: Consult with a qualified financial advisor to create a personalized investment strategy that aligns with your risk tolerance and financial goals.

Conclusion: Navigating the Unknown

The US-China trade war presents significant challenges and opportunities for investors. Jim Cramer’s approach, while not explicitly detailed as a single "Top 10" list directly responding to this specific event, suggests a focus on resilient companies with strong fundamentals and less direct exposure to the immediate impacts of the trade conflict. Remember to prioritize due diligence and seek professional advice before making any investment decisions. The market remains dynamic, and staying informed about geopolitical events is vital for successful long-term investing.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Jim Cramer's Top 10 Stocks: US-China Trade Talks Loom Large. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

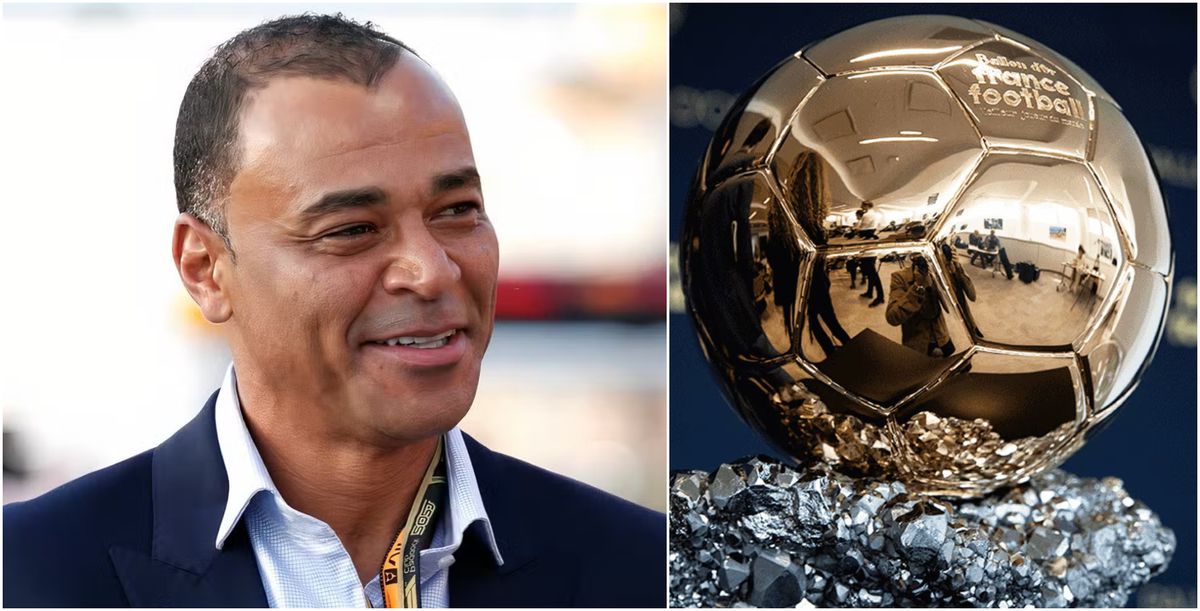

Cafu Predicts 2025 Ballon D Or Snubs Yamal Favors These Two Stars

May 11, 2025

Cafu Predicts 2025 Ballon D Or Snubs Yamal Favors These Two Stars

May 11, 2025 -

Petra Kvitova Vs Ons Jabeur Rome Match Preview Where To Watch And Best Odds

May 11, 2025

Petra Kvitova Vs Ons Jabeur Rome Match Preview Where To Watch And Best Odds

May 11, 2025 -

Jim Cramers Picks 10 Key Stocks Amidst Us China Trade Tensions

May 11, 2025

Jim Cramers Picks 10 Key Stocks Amidst Us China Trade Tensions

May 11, 2025 -

Finding Common Ground Comparing Trumps Presidency To The Papacy Of Leo Xiii

May 11, 2025

Finding Common Ground Comparing Trumps Presidency To The Papacy Of Leo Xiii

May 11, 2025 -

Hilaria Baldwins Sharp Rebuke Of Amy Schumers Heritage Comments

May 11, 2025

Hilaria Baldwins Sharp Rebuke Of Amy Schumers Heritage Comments

May 11, 2025