Jim Cramer's Stock Portfolio: 10 To Watch Amidst US-China Tensions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Jim Cramer's Stock Portfolio: 10 to Watch Amidst US-China Tensions

The escalating US-China trade war continues to send ripples through the global economy, leaving investors scrambling to navigate the uncertainty. Legendary investor Jim Cramer, known for his outspoken opinions and often contrarian strategies, has offered some insight into his portfolio, highlighting specific stocks he believes are poised to weather – or even profit from – the current geopolitical storm. While past performance doesn't guarantee future results, understanding Cramer's choices can provide valuable context for your own investment decisions.

Navigating the Geopolitical Minefield: Cramer's Strategic Picks

Cramer's portfolio selections aren't solely driven by the US-China tension; however, the current climate significantly influences his strategy. He's focusing on companies with strong domestic markets, diversified international footprints, and resilience to trade disruptions. His choices reflect a blend of defensive and offensive strategies, aiming to minimize losses while capitalizing on potential opportunities.

10 Stocks to Keep on Your Radar (According to Cramer's Insights):

It's crucial to remember that this is not a direct quote of Cramer's current holdings, but rather an interpretation based on his recent public commentary and known investment philosophies. Always conduct your own thorough research before making any investment decisions.

(Note: Specific ticker symbols are omitted here to avoid implying direct investment advice. You should consult reputable financial news sources and Cramer's own public statements for the most up-to-date information.)

-

Domestically Focused Tech Giants: Companies dominating the US tech landscape often benefit from reduced reliance on Chinese markets. These behemoths often possess the resources to weather international trade disputes.

-

Defense Contractors: Increased geopolitical tensions often translate into higher defense spending, benefiting companies involved in military technology and equipment.

-

Pharmaceutical Companies: The demand for pharmaceuticals remains relatively consistent, irrespective of broader economic fluctuations.

-

Energy Companies (Diversified): While susceptible to global price swings, diversified energy companies with strong domestic production can mitigate some of the risks associated with international trade.

-

Consumer Staples: Non-cyclical consumer goods – essentials like food and household products – remain in consistent demand regardless of economic uncertainties.

-

Companies with Strong International Diversification (Beyond China): Businesses with a robust presence in multiple global markets outside of China are better positioned to navigate trade disruptions.

-

Infrastructure Companies: Government investment in infrastructure projects can provide a buffer against economic downturns.

-

Agricultural Companies (with diversified markets): Agricultural businesses with global export markets, diversified crops, and robust supply chains can lessen the blow from trade restrictions.

-

Companies benefiting from "reshoring": Businesses involved in bringing manufacturing back to the US could experience significant growth as companies seek to reduce reliance on Chinese supply chains. This is a key theme in Cramer's recent analysis.

-

Financials (with strong domestic focus): Large financial institutions with a predominantly domestic focus might demonstrate resilience against global economic headwinds.

Important Considerations:

- Risk Management: Diversification is key. Don't put all your eggs in one basket.

- Due Diligence: Thoroughly research any stock before investing. Consult with a financial advisor if needed.

- Market Volatility: The stock market is inherently volatile, especially during times of geopolitical uncertainty. Be prepared for fluctuations.

- Long-Term Perspective: Investing should be a long-term strategy. Don't panic sell based on short-term market movements.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money. Always conduct your own thorough research or consult a financial advisor before making any investment decisions.

Call to Action: Stay informed about the evolving US-China relationship and its impact on the global economy. Regularly review your investment portfolio and adjust your strategy as needed. Consider subscribing to reputable financial news sources for updates and analysis.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Jim Cramer's Stock Portfolio: 10 To Watch Amidst US-China Tensions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

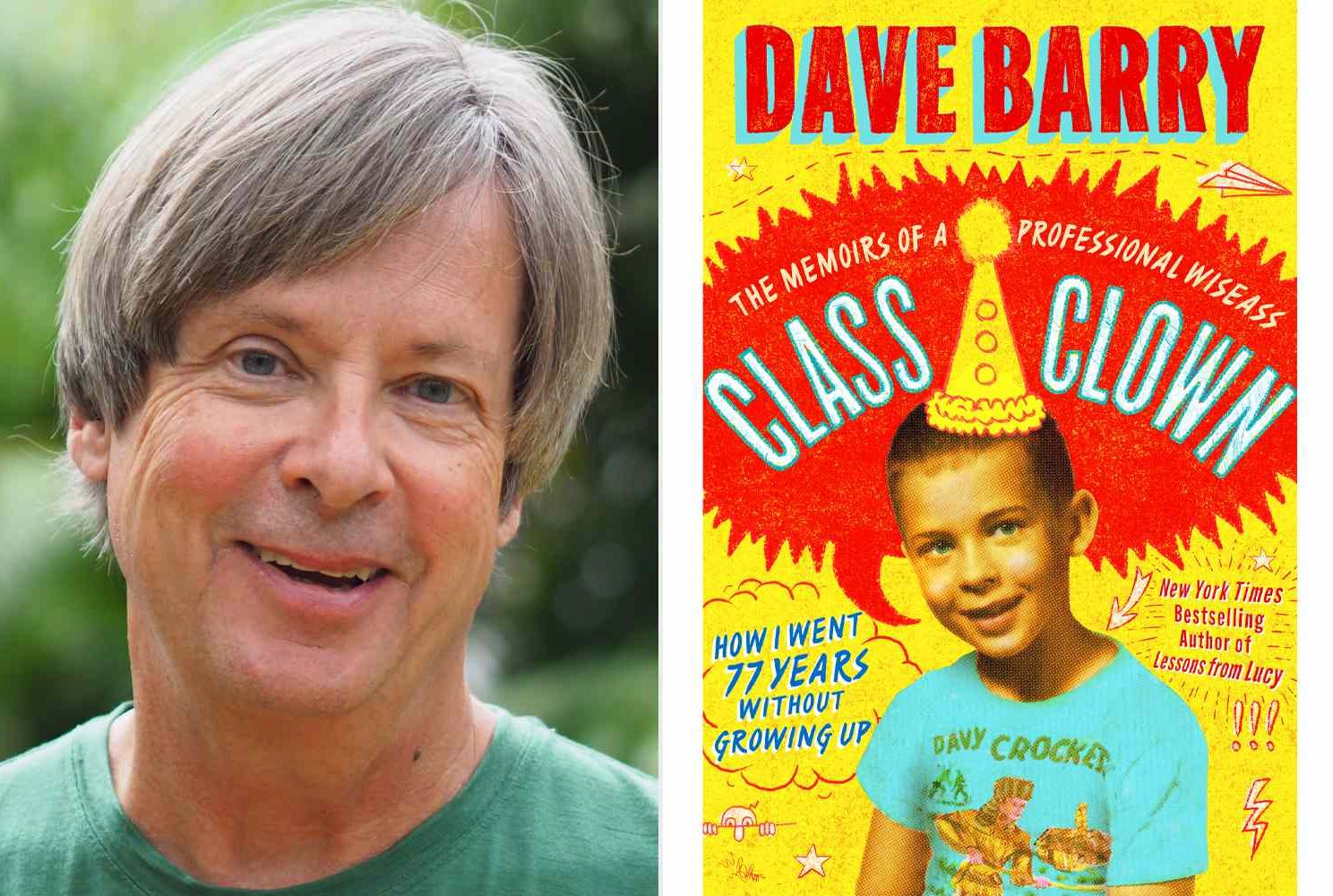

Dont Miss Dave Barry And Angie Corio In Conversation At Keplers May 12

May 11, 2025

Dont Miss Dave Barry And Angie Corio In Conversation At Keplers May 12

May 11, 2025 -

Tras La Caducidad De La Licencia 80 Analisis Del Sector Petrolero En Venezuela Y El Rol De Las Empresas Estadounidenses

May 11, 2025

Tras La Caducidad De La Licencia 80 Analisis Del Sector Petrolero En Venezuela Y El Rol De Las Empresas Estadounidenses

May 11, 2025 -

Limited Edition Travis Scott Mens Away Football Jersey 24 25 Season

May 11, 2025

Limited Edition Travis Scott Mens Away Football Jersey 24 25 Season

May 11, 2025 -

Oceans Deep A Vast Unexplored Frontier

May 11, 2025

Oceans Deep A Vast Unexplored Frontier

May 11, 2025 -

Panorama Global Retirada De Ee Uu De Venezuela Llamado A La Paz Ecuador Ratifica Resultados Electorales China Controla El Clima Con Lluvia Artificial

May 11, 2025

Panorama Global Retirada De Ee Uu De Venezuela Llamado A La Paz Ecuador Ratifica Resultados Electorales China Controla El Clima Con Lluvia Artificial

May 11, 2025