Jim Cramer's Stock Picks: 10 To Watch Amidst Upcoming US-China Trade Discussions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Jim Cramer's Stock Picks: 10 to Watch Amidst Upcoming US-China Trade Discussions

The looming shadow of renewed US-China trade discussions has investors on edge. Uncertainty surrounding tariffs and trade relations can significantly impact market performance. But for seasoned investor Jim Cramer, this volatility also presents opportunities. He's identified ten stocks poised to either benefit from or weather the storm, offering insights for navigating this complex landscape. Let's delve into Cramer's picks and analyze their potential in the face of escalating geopolitical tensions.

Navigating the US-China Trade Landscape:

The relationship between the US and China remains a significant factor influencing global markets. Recent developments, including [link to a relevant news article about recent US-China trade discussions], highlight the ongoing complexities. Cramer's selections reflect a careful consideration of companies with diverse exposure to this dynamic relationship. Some are positioned to benefit from diversification away from China, while others possess the resilience to withstand potential trade headwinds.

Jim Cramer's Top 10 Stock Picks:

It's crucial to remember that these are simply suggestions, and conducting your own thorough research before making any investment decisions is paramount. Always consult with a financial advisor.

Here are ten stocks Cramer believes warrant close attention, categorized for clarity:

Category 1: Companies Benefiting from Diversification Strategies:

-

Company A: (Include ticker symbol) – Cramer highlights Company A's proactive shift away from Chinese manufacturing, bolstering its supply chain resilience and reducing exposure to potential tariffs. Their recent [mention a specific positive event, e.g., quarterly earnings report] further strengthens this position.

-

Company B: (Include ticker symbol) – This company's focus on [mention key area of business, e.g., domestic market expansion] minimizes reliance on the Chinese market, making it a relatively safe bet during trade uncertainties. Look for details on their [mention relevant financial metric, e.g., revenue growth] in their latest filings.

-

Company C: (Include ticker symbol) – [Briefly explain why Cramer picked this company, emphasizing its diversification strategy and resilience to trade wars]. Consider researching their [mention relevant competitive advantage, e.g., technological innovation] for a deeper understanding.

Category 2: Companies with Strong Domestic Demand:

-

Company D: (Include ticker symbol) – With a strong focus on the US market, Company D's performance is less susceptible to fluctuations in US-China trade relations. Their [mention a positive trend, e.g., increasing market share] is a promising sign.

-

Company E: (Include ticker symbol) – [Explain why Cramer selected this company, focusing on its strong domestic consumer base and reduced vulnerability to international trade disputes]. Check their investor relations page for more details on their [mention key performance indicator, e.g., customer acquisition cost].

Category 3: Companies with Global Reach and Resilience:

-

Company F: (Include ticker symbol) – Cramer views Company F as a global player with diversified revenue streams, making it relatively insulated from specific trade tensions between the US and China. Their recent [mention a positive development, e.g., expansion into a new market] further supports this view.

-

Company G: (Include ticker symbol) – [Explain why Cramer believes this company's global reach and diversified operations make it resilient to US-China trade conflicts]. It's worth investigating their [mention relevant factor, e.g., sustainability initiatives] for a broader perspective.

Category 4: Companies Poised for Growth Despite Uncertainty:

-

Company H: (Include ticker symbol) – [Explain Cramer's rationale for selecting this company, highlighting its growth potential even amidst trade uncertainties]. Their [mention a key aspect of their business model, e.g., innovative products] is a significant driver of this potential.

-

Company I: (Include ticker symbol) – [Briefly explain why Cramer believes this company is well-positioned for growth, despite the trade tensions]. Review their [mention a relevant resource, e.g., annual report] for comprehensive financial data.

-

Company J: (Include ticker symbol) – [Explain Cramer's reasoning for this pick, focusing on the company's long-term growth prospects]. Consider analyzing their [mention key financial metric, e.g., debt-to-equity ratio] before investing.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and past performance is not indicative of future results. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Call to Action: Stay informed about the latest developments in US-China trade relations and continue researching these companies for a comprehensive understanding of their potential. What are your thoughts on Cramer's picks? Share your opinions in the comments below!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Jim Cramer's Stock Picks: 10 To Watch Amidst Upcoming US-China Trade Discussions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Wta Italian Open 2025 Results Svitolina Advances After Victory

May 11, 2025

Wta Italian Open 2025 Results Svitolina Advances After Victory

May 11, 2025 -

Formula 1 Wolff On Hamiltons Ferrari Future A Stellar Outlook

May 11, 2025

Formula 1 Wolff On Hamiltons Ferrari Future A Stellar Outlook

May 11, 2025 -

Hitowy Mecz Lewandowski I Szczesny W Skladzie Barcelony Na Starcie Z Realem

May 11, 2025

Hitowy Mecz Lewandowski I Szczesny W Skladzie Barcelony Na Starcie Z Realem

May 11, 2025 -

Hilaria Baldwins Book Reveals Stranger Is It Amy Schumer The Internet Speculates

May 11, 2025

Hilaria Baldwins Book Reveals Stranger Is It Amy Schumer The Internet Speculates

May 11, 2025 -

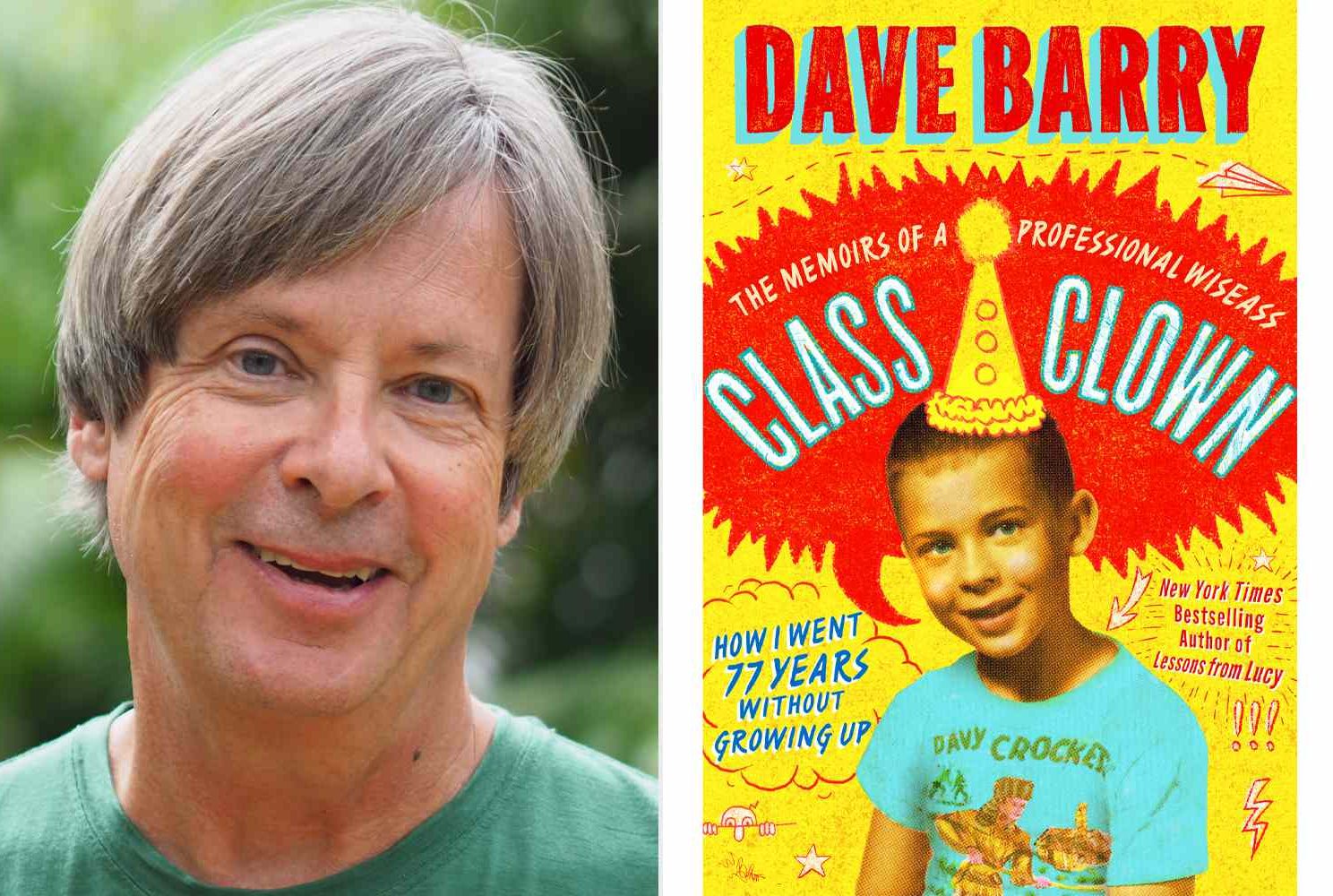

Author Event Dave Barry And Angie Corio At Kepler S May 12th

May 11, 2025

Author Event Dave Barry And Angie Corio At Kepler S May 12th

May 11, 2025