Jim Cramer's Picks: 10 Stocks To Track Amidst US-China Tensions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Jim Cramer's Picks: 10 Stocks to Track Amidst US-China Tensions

The escalating US-China trade war and geopolitical tensions have sent shockwaves through global markets. Investors are scrambling to navigate this uncertainty, seeking stocks positioned to weather – or even benefit from – the storm. Financial guru Jim Cramer, known for his outspoken opinions and market analysis on CNBC's "Mad Money," has offered his insights, identifying ten stocks to watch closely in this volatile climate. This article will delve into Cramer's picks, examining the rationale behind his selections and considering the potential risks and rewards.

Understanding the Geopolitical Landscape:

The current US-China relationship is characterized by intense competition across various sectors, from technology and manufacturing to intellectual property and national security. This rivalry significantly impacts global supply chains, investment strategies, and economic growth. Understanding this complex dynamic is crucial for investors attempting to make informed decisions. [Link to a reputable source discussing US-China relations]

Cramer's Top 10 Stocks to Watch:

While specific stock recommendations can change rapidly, we will examine the types of companies Cramer typically suggests during periods of US-China tension. These often fall into categories that show resilience or even potential for growth amidst geopolitical uncertainty. Remember, this is not financial advice, and thorough due diligence is essential before making any investment decisions.

1. Defense Contractors: Companies involved in defense technology and manufacturing often see increased demand during periods of heightened geopolitical risk. This sector is expected to remain strong, benefiting from increased government spending.

2. Domestically Focused Companies: Businesses primarily operating within the US market are less directly exposed to the vagaries of international trade disputes. These companies offer a degree of insulation from global economic shocks.

3. Tech Companies with Diversified Supply Chains: While the tech sector is heavily impacted by US-China relations, companies that have proactively diversified their manufacturing and supply chains are better positioned to mitigate disruptions.

4. Energy Companies (Specific Focus on Domestic Production): Energy independence is a key geopolitical consideration. Companies focused on domestic energy production could experience increased demand and investment.

5. Pharmaceutical Companies: The pharmaceutical industry often sees less direct impact from geopolitical shifts, offering a relatively stable investment option.

6. Infrastructure Companies: Investment in infrastructure projects, often driven by government spending, can provide a stable investment during uncertain times.

7. Agricultural Companies: The impact on the agricultural sector can be complex, but certain companies might find opportunities amid trade negotiations and shifting global demand.

8. Cybersecurity Companies: As geopolitical tensions rise, the demand for cybersecurity solutions increases across both the public and private sectors.

9. Semiconductor Companies (with Strategic Partnerships): While the semiconductor industry is highly susceptible to trade wars, companies with strong strategic partnerships and diversified operations can show resilience.

10. Consumer Staples Companies: These companies, providing essential goods and services, typically exhibit lower volatility than other sectors during periods of economic uncertainty.

Analyzing the Risks:

It's crucial to acknowledge the inherent risks associated with investing in any stock, particularly during times of geopolitical instability. Factors such as unexpected policy changes, further escalation of tensions, and unforeseen economic downturns can significantly impact investment returns.

Disclaimer: This article is for informational purposes only and should not be construed as financial advice. Consult with a qualified financial advisor before making any investment decisions.

Call to Action: Stay informed about current geopolitical developments and conduct thorough research before investing in any of the mentioned sectors. Regularly review your investment portfolio and adjust your strategy as needed to navigate the complexities of the US-China relationship.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Jim Cramer's Picks: 10 Stocks To Track Amidst US-China Tensions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Cramer On Trumps China Trade Strategy 10 Stocks To Watch

May 10, 2025

Cramer On Trumps China Trade Strategy 10 Stocks To Watch

May 10, 2025 -

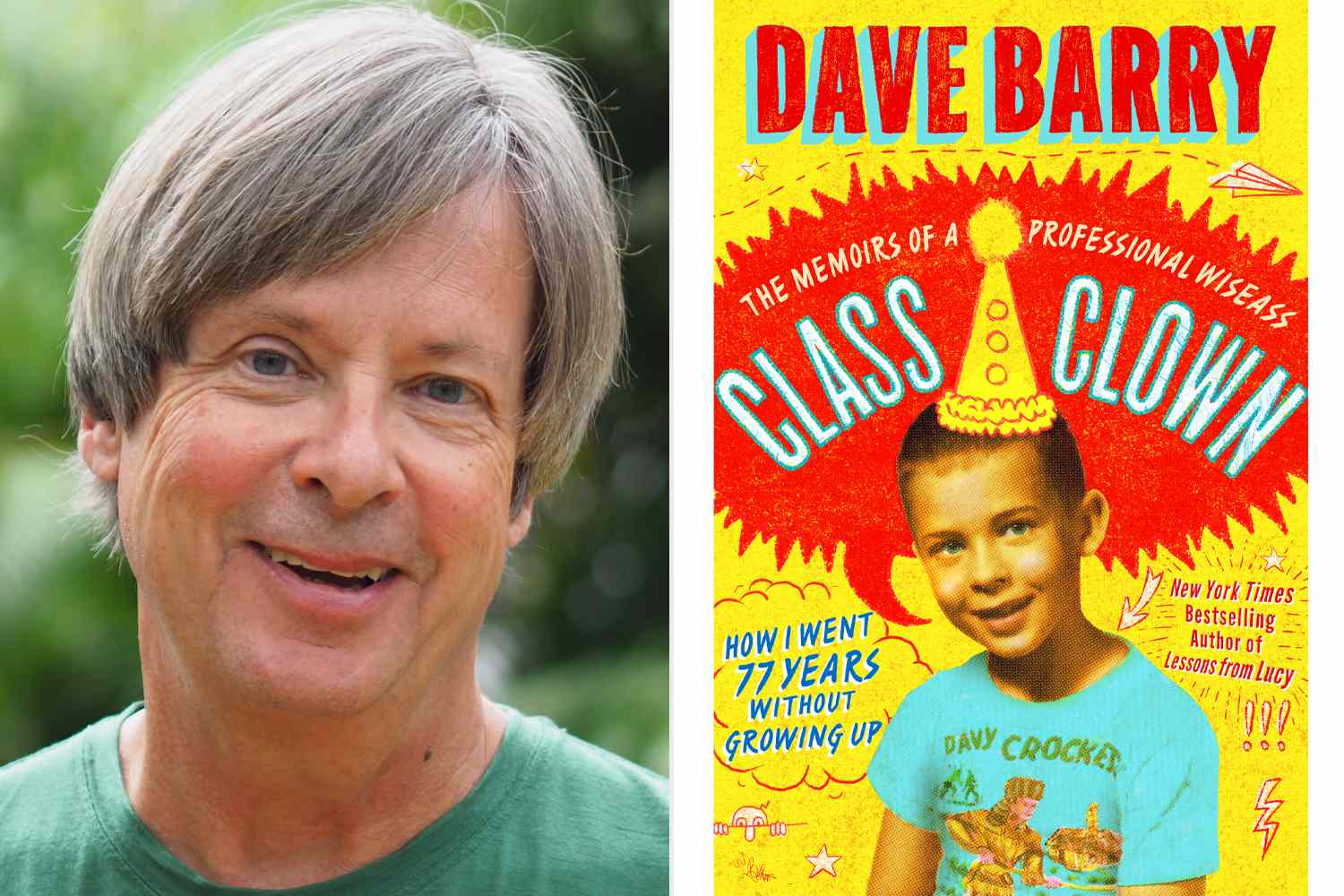

Dave Barry On Writing An Exclusive Interview Excerpt

May 10, 2025

Dave Barry On Writing An Exclusive Interview Excerpt

May 10, 2025 -

Paolini Vs Jabeur Head To Head And Italian Open 2025 Prediction

May 10, 2025

Paolini Vs Jabeur Head To Head And Italian Open 2025 Prediction

May 10, 2025 -

Papal Conclave Length From Days To Weeks A Shifting Landscape

May 10, 2025

Papal Conclave Length From Days To Weeks A Shifting Landscape

May 10, 2025 -

Nyt Spelling Bee Answers For May 9 Complete Guide

May 10, 2025

Nyt Spelling Bee Answers For May 9 Complete Guide

May 10, 2025