Jim Cramer's Market Outlook: 10 Key Stocks Amidst US-China Tensions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Jim Cramer's Market Outlook: 10 Key Stocks to Watch Amidst US-China Tensions

The escalating tensions between the US and China have sent shockwaves through the global market, leaving investors scrambling to navigate the uncertainty. Financial guru Jim Cramer, known for his outspoken market analysis on CNBC's "Mad Money," has weighed in, offering his perspective on the situation and highlighting 10 key stocks to watch closely. This volatile climate presents both significant risks and potential opportunities, and understanding Cramer's outlook is crucial for informed investment decisions.

Navigating the Geopolitical Storm: Cramer's Top 10

Cramer's analysis emphasizes the impact of US-China trade relations and geopolitical instability on various sectors. He isn't predicting a market crash, but he advocates for a cautious, selective approach. His suggested stocks reflect a blend of defensive plays and companies poised to benefit from the shifting global landscape. While he doesn't explicitly endorse buying or selling any specific stock, his commentary provides valuable insight into potential winners and losers. Remember, this is not financial advice; always conduct your own thorough research before making any investment decisions.

Here are 10 key stocks Cramer has highlighted (in no particular order) and the reasoning behind his assessment:

-

Nvidia (NVDA): A leading player in AI and semiconductor technology, Nvidia is crucial for both US and global technological advancement. Its position in a rapidly growing sector makes it a potential beneficiary despite the geopolitical headwinds. Cramer views NVDA as a long-term growth stock with strong prospects.

-

Microsoft (MSFT): A tech giant with a diverse portfolio, Microsoft is seen as a relatively safe haven during times of uncertainty. Its cloud computing division, Azure, is a particularly strong point, and its broad reach minimizes exposure to any single geopolitical risk.

-

Apple (AAPL): Despite some supply chain concerns related to China, Apple's global brand recognition and loyal customer base offer a degree of insulation from the current tensions. However, Cramer suggests monitoring its performance closely.

-

Boeing (BA): The aerospace industry is highly sensitive to global relations. While Boeing faces its own challenges, its long-term prospects are intertwined with the overall state of international trade and travel. Cramer suggests a cautious approach to Boeing, acknowledging both its potential and risks.

-

ExxonMobil (XOM): Energy prices are always influenced by geopolitical factors. ExxonMobil, a major oil and gas producer, could see fluctuating performance depending on the evolution of the US-China relationship and global energy demands.

-

UnitedHealth Group (UNH): The healthcare sector is generally considered defensive. UnitedHealth Group, a major player in the US healthcare market, might see increased demand during economic uncertainty, making it an attractive option for risk-averse investors.

-

Procter & Gamble (PG): As a consumer staples giant, Procter & Gamble offers relative stability. Its products are in constant demand, making it a relatively resilient stock during times of economic turbulence.

-

Johnson & Johnson (JNJ): Similar to Procter & Gamble, Johnson & Johnson's diverse healthcare portfolio provides a degree of protection against the effects of the US-China trade war.

-

Berkshire Hathaway (BRK.A, BRK.B): Warren Buffett's conglomerate is known for its long-term investment strategy and diversification. Holding Berkshire Hathaway can be seen as a bet on overall market stability.

-

Caterpillar (CAT): The construction and mining equipment manufacturer is heavily exposed to global economic activity. Caterpillar's performance will depend heavily on the ongoing trade relationship between the US and China.

Disclaimer: This article provides commentary on Jim Cramer's market outlook and should not be interpreted as financial advice. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Further Reading:

Call to Action: Stay informed about the evolving US-China relationship and its impact on the market by following reputable financial news sources. Remember that diversification is key to mitigating risk in uncertain times.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Jim Cramer's Market Outlook: 10 Key Stocks Amidst US-China Tensions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Fellow F1 Driver Offers Support To Lewis Hamilton Amidst Challenges

May 11, 2025

Fellow F1 Driver Offers Support To Lewis Hamilton Amidst Challenges

May 11, 2025 -

Ai Advantage Boosts Microsoft Over Amazon According To Analyst

May 11, 2025

Ai Advantage Boosts Microsoft Over Amazon According To Analyst

May 11, 2025 -

New Night Egg Pets In Grow A Gardens Lunar Update Where To Find Them

May 11, 2025

New Night Egg Pets In Grow A Gardens Lunar Update Where To Find Them

May 11, 2025 -

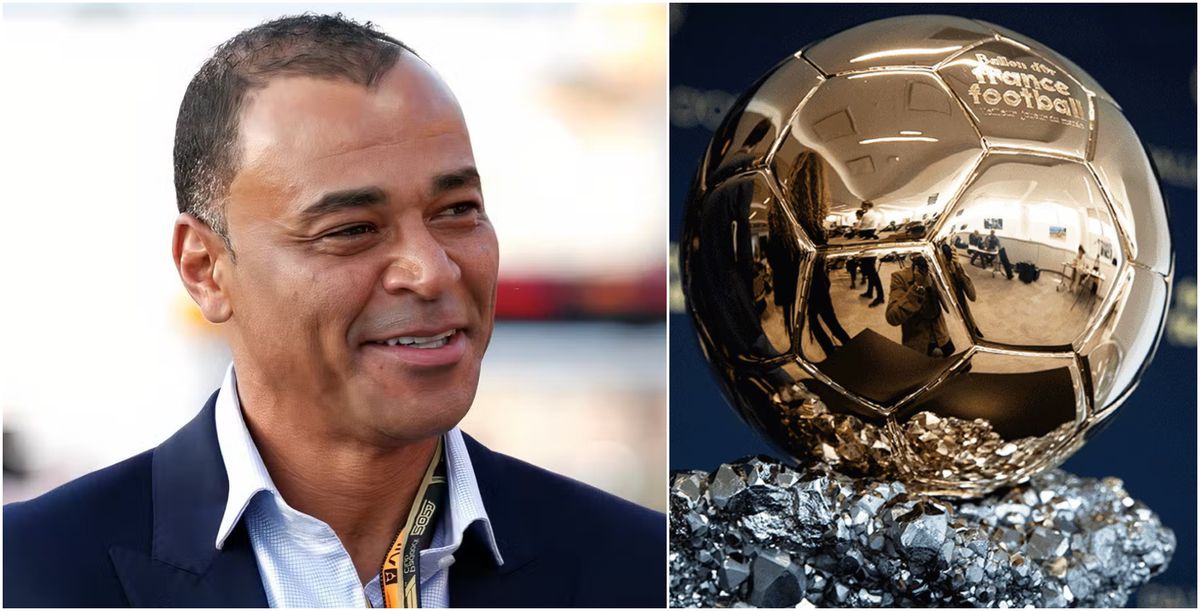

Cafu Predicts Ballon D Or 2025 Winners Leaving Out 17 Year Old Sensation

May 11, 2025

Cafu Predicts Ballon D Or 2025 Winners Leaving Out 17 Year Old Sensation

May 11, 2025 -

Jasmine Paolini Vs Ons Jabeur Wta Italian Open 2025 Round Of 32 Preview And Prediction

May 11, 2025

Jasmine Paolini Vs Ons Jabeur Wta Italian Open 2025 Round Of 32 Preview And Prediction

May 11, 2025