Jim Cramer's Insight: Trump's China Card & 10 Promising Stocks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Jim Cramer's Insight: Trump's China Card and 10 Promising Stocks to Watch

Introduction: The potential for renewed trade tensions between the US and China is a hot topic, and Mad Money host Jim Cramer has weighed in, offering insights into how this geopolitical chess match could impact the stock market. He's also highlighted 10 stocks he believes are poised for growth, regardless of the outcome. This article delves into Cramer's analysis, examining the implications of Trump's potential re-entry into the political arena and offering a closer look at his promising stock picks.

Trump's Return and its Impact on US-China Relations: Donald Trump's recent announcements have reignited concerns about a potential escalation in trade disputes with China. His past aggressive trade policies, including tariffs and trade wars, significantly impacted market sentiment and individual company performance. Cramer acknowledges the uncertainty this introduces, suggesting investors should be prepared for volatility. However, he emphasizes that certain sectors and companies are better positioned to weather this storm than others. The key, according to Cramer, is understanding which companies have diversified supply chains and strong domestic markets. This uncertainty creates both risks and opportunities for shrewd investors. [Link to a reputable news source discussing Trump's political activities]

Cramer's 10 Promising Stocks: While Cramer cautions against making rash decisions based solely on geopolitical events, he's identified 10 stocks that he believes represent compelling investment opportunities. These selections, while not explicitly named as "Trump-proof," demonstrate resilience and growth potential in a potentially volatile market. It's crucial to remember that this is not financial advice, and thorough due diligence is always recommended before making any investment decisions.

Here are some of the key sectors represented in Cramer's picks (specific stock tickers are omitted to avoid appearing as financial advice, readers should refer to Cramer's original broadcast for the complete list):

- Technology: Companies focusing on domestic innovation and less reliant on Chinese manufacturing are likely to perform well.

- Energy: The energy sector often benefits from geopolitical instability, as energy prices can fluctuate significantly.

- Defense: Increased defense spending in response to global uncertainties often boosts related companies.

- Consumer Staples: Companies producing essential goods typically see stable demand regardless of economic fluctuations.

H2: Navigating Market Volatility: The current climate demands a cautious, yet opportunistic approach. Cramer suggests focusing on companies with strong fundamentals, robust balance sheets, and a proven track record. Diversification remains crucial in mitigating risk. Investors should avoid panic selling and instead focus on a long-term investment strategy.

H3: The Importance of Due Diligence: It's essential to conduct thorough research before investing in any stock mentioned. Consider factors beyond Cramer's analysis, including financial statements, industry trends, and competitive landscapes. Consult with a qualified financial advisor before making any investment decisions.

H2: Beyond the Headlines: A Long-Term Perspective: While short-term market fluctuations are inevitable, investors should maintain a long-term perspective. Focusing solely on immediate reactions to headlines can lead to poor investment choices. A strategic approach that accounts for both short-term volatility and long-term growth potential is key to success.

Conclusion: Jim Cramer's insight offers a valuable perspective on the interplay between geopolitics and the stock market. While the potential impact of Trump's actions remains uncertain, a well-researched, diversified portfolio, combined with a long-term perspective, can help investors navigate market volatility and capitalize on promising opportunities. Remember to always conduct thorough due diligence and consider seeking professional financial advice before making any investment decisions. [Link to a reputable financial planning resource]

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Jim Cramer's Insight: Trump's China Card & 10 Promising Stocks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

New 2024 2025 Mens Away Jersey Travis Scott Limited Edition Design

May 11, 2025

New 2024 2025 Mens Away Jersey Travis Scott Limited Edition Design

May 11, 2025 -

Official Launch Travis Scotts Fc Barcelona Clothing Line

May 11, 2025

Official Launch Travis Scotts Fc Barcelona Clothing Line

May 11, 2025 -

Bournemouth Vs Aston Villa Premier League Game Live Score Radio And News

May 11, 2025

Bournemouth Vs Aston Villa Premier League Game Live Score Radio And News

May 11, 2025 -

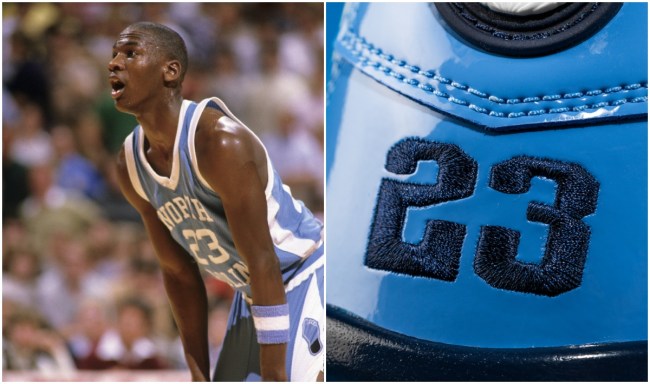

Rare Air Jordan Unc Sneakers A Collectors Dream

May 11, 2025

Rare Air Jordan Unc Sneakers A Collectors Dream

May 11, 2025 -

Air Pollutions Deadly Toll The Impact Of Emission Cuts On Public Health

May 11, 2025

Air Pollutions Deadly Toll The Impact Of Emission Cuts On Public Health

May 11, 2025