Jim Cramer's 10 Stock Recommendations Amidst Rising US-China Tensions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Jim Cramer's 10 Stock Picks Navigating the Choppy Waters of US-China Tensions

The escalating tensions between the United States and China have sent shockwaves through global markets, leaving investors scrambling for safe havens. Amidst this uncertainty, renowned financial commentator Jim Cramer has offered his take, revealing ten stock recommendations he believes are positioned to weather – and even potentially profit from – the ongoing geopolitical storm. His choices reflect a strategy focused on diversification and resilience in a volatile environment.

Cramer's Strategy: Diversification and Defensive Plays

Cramer's selections aren't simply about avoiding risk; they're about identifying companies with the potential for growth despite the challenges. He emphasizes the importance of diversification across sectors, mitigating the impact of any single negative event stemming from the US-China conflict. His picks lean towards defensive sectors, but also include companies with strong international presence or those poised to benefit from reshoring efforts.

The 10 Stock Recommendations:

While the exact specifics of Cramer's reasoning behind each pick may vary across different media appearances, his overall message remains consistent. A comprehensive list of the ten stocks is currently unavailable in a single, easily accessible source. However, based on his recent commentary, several companies frequently mentioned include (but are not limited to):

-

Energy Companies: With global energy markets in flux, companies with diversified production and strong international relationships could see increased demand. (Note: Specific company names would need to be sourced from Cramer's recent statements for complete accuracy.) Investing in energy can be a complex area, so be sure to consult with a financial advisor before making any decisions. For more information on energy investing, you can consult resources like [link to reputable financial website on energy investing].

-

Technology (with caveats): The tech sector is heavily impacted by US-China relations. Cramer's recommendations in this sector likely focus on companies with less exposure to direct Chinese markets or those with strong domestic demand in the US. (Again, specific company names should be cross-referenced with his recent media appearances.)

-

Defense Contractors: Increased military spending in response to geopolitical uncertainty could benefit defense contractors. This sector often shows resilience during times of international tension. (Consult financial news sources for specific examples mentioned by Cramer.)

-

Consumer Staples: These companies often provide relatively stable returns, even during economic downturns. Their products are essential, making them less susceptible to significant shifts in consumer spending.

Important Considerations:

It's crucial to remember that these are simply recommendations, not financial advice. Before making any investment decisions, always conduct your own thorough research and consider consulting with a qualified financial advisor. Past performance is not indicative of future results. The market is dynamic, and US-China relations can shift rapidly.

Navigating the Geopolitical Landscape:

The US-China relationship remains a significant factor influencing global markets. Staying informed about these developments is essential for all investors. Follow reputable news sources and financial analysts for up-to-date information and analysis. Understanding the nuances of international trade and geopolitical risks is crucial for successful long-term investing.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research and consult with a financial advisor before making any investment decisions.

Call to Action: Stay informed about the evolving US-China relationship and its impact on the global economy by following reputable financial news sources.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Jim Cramer's 10 Stock Recommendations Amidst Rising US-China Tensions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Bill Belichicks Relationship Takes A Hit Jordon Hudsons Reported Unc Football Ban

May 10, 2025

Bill Belichicks Relationship Takes A Hit Jordon Hudsons Reported Unc Football Ban

May 10, 2025 -

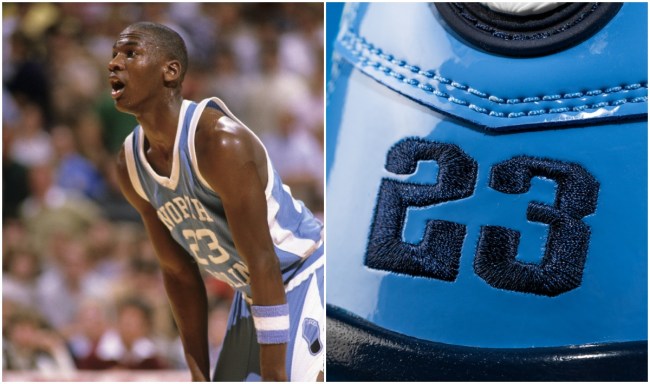

Rare Find The Air Jordan Sneaker Designed For Michael Jordans College

May 10, 2025

Rare Find The Air Jordan Sneaker Designed For Michael Jordans College

May 10, 2025 -

Karen Read Trial Updates Trooper Resumes Testimony Following Confrontational Exchange

May 10, 2025

Karen Read Trial Updates Trooper Resumes Testimony Following Confrontational Exchange

May 10, 2025 -

Papal Conclave Length From Days To Weeks A Modern Analysis

May 10, 2025

Papal Conclave Length From Days To Weeks A Modern Analysis

May 10, 2025 -

Key Moments Peshawar Zalmis Clash Against Karachi Kings In Psl 2023

May 10, 2025

Key Moments Peshawar Zalmis Clash Against Karachi Kings In Psl 2023

May 10, 2025