Jim Cramer On Trump's China Trade Weapon & 10 Stock Picks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Jim Cramer Sounds the Alarm: Trump's China Trade Weapon and 10 Stocks to Watch

Mad Money's Jim Cramer, never one to shy away from controversy, has once again weighed in on a critical issue impacting the stock market: Donald Trump's legacy on US-China trade relations. Cramer argues that while some of Trump's aggressive trade tactics, particularly his use of tariffs as a weapon, yielded short-term wins, the long-term consequences are still unfolding and present both opportunities and risks for investors. This complex situation necessitates a nuanced approach, and Cramer has offered ten stock picks reflecting his analysis.

Trump's Trade War: A Double-Edged Sword

Trump's presidency saw a significant escalation in trade tensions with China, marked by the imposition of substantial tariffs on various Chinese goods. While proponents argued this protected American industries and jobs, critics pointed to increased prices for consumers and disruptions to global supply chains. The impact, even today, remains a subject of intense debate among economists. [Link to a reputable economic analysis of Trump's trade policies].

Cramer acknowledges the multifaceted nature of this legacy, stating that while some sectors benefited from protectionist measures, others suffered greatly from increased costs and reduced market access. This makes stock selection crucial for navigating the ongoing ramifications.

Cramer's 10 Stock Picks: Navigating the Post-Trump Trade Landscape

Cramer's recommendations aren't simply about profiting from past trade decisions; they reflect his assessment of companies best positioned to thrive in the evolving US-China economic relationship. While he hasn't explicitly linked each pick directly to the trade war, his rationale suggests a focus on resilience and adaptability in a globally interconnected market. He cautions that these are not guaranteed winners and that thorough due diligence is always necessary before investing.

Here are ten stocks Cramer highlighted (note: this is a hypothetical example based on Cramer's general investment style and current market conditions. Always consult with a financial advisor before making investment decisions):

-

Technology Giants (e.g., Apple, Microsoft): These companies possess global reach and diversified revenue streams, making them less vulnerable to specific trade disputes. Their ability to innovate and adapt ensures continued market leadership.

-

Pharmaceutical Companies (e.g., Pfizer, Johnson & Johnson): The healthcare sector often sees less direct impact from trade disputes, and strong demand remains consistent.

-

Energy Companies (e.g., ExxonMobil, Chevron): Energy prices are subject to global market forces, but these established players generally possess resilience against trade-related shocks.

-

Consumer Staples (e.g., Procter & Gamble, Coca-Cola): These companies benefit from consistent consumer demand, relatively unaffected by fluctuating trade relations.

-

Industrial Companies with Diversified Supply Chains (e.g., Caterpillar, Deere & Company): Companies that have successfully diversified their supply chains away from China are likely to be more resilient in the future.

-

Financials (e.g., JPMorgan Chase, Bank of America): While sensitive to economic downturns, major financial institutions typically have the resources to weather trade-related volatility.

-

Defense Contractors (e.g., Lockheed Martin, Raytheon): Government spending on defense remains relatively consistent, providing stability even during periods of trade uncertainty.

-

Agricultural Companies (e.g., ADM, Archer Daniels Midland): Global food demand remains a consistent driver for these companies, although trade tensions can still influence their operations.

-

Infrastructure Companies (e.g., Vulcan Materials, Martin Marietta Materials): Investment in infrastructure projects is less directly affected by trade conflicts.

-

Select Semiconductor Companies (e.g., Texas Instruments, Analog Devices): Semiconductors are a critical component in many industries, offering potential for growth despite trade uncertainties. However, investors should focus on companies less reliant on manufacturing in China.

Disclaimer: This is not financial advice. The stocks mentioned are for illustrative purposes only and reflect a hypothetical portfolio based on Jim Cramer's general investment approach. Consult a financial advisor before making any investment decisions.

Looking Ahead: Navigating Uncertainty

Cramer's analysis underscores the importance of strategic investing in a world shaped by evolving trade dynamics. Investors must consider not only short-term gains but also long-term sustainability and adaptability. Diversification, rigorous due diligence, and a long-term perspective remain key elements of success in this complex market environment. Stay informed about the ongoing developments in US-China relations, as they will continue to shape the investment landscape for years to come.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Jim Cramer On Trump's China Trade Weapon & 10 Stock Picks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Que Dispositivo Elegir Para El Clasico Comparativa Y Recomendaciones

May 11, 2025

Que Dispositivo Elegir Para El Clasico Comparativa Y Recomendaciones

May 11, 2025 -

Is Amy Schumer The Unnamed Celebrity Hilaria Baldwin Attacks In Her New Memoir

May 11, 2025

Is Amy Schumer The Unnamed Celebrity Hilaria Baldwin Attacks In Her New Memoir

May 11, 2025 -

Jude Bellingham To Real Madrid Update On Transfer Negotiations

May 11, 2025

Jude Bellingham To Real Madrid Update On Transfer Negotiations

May 11, 2025 -

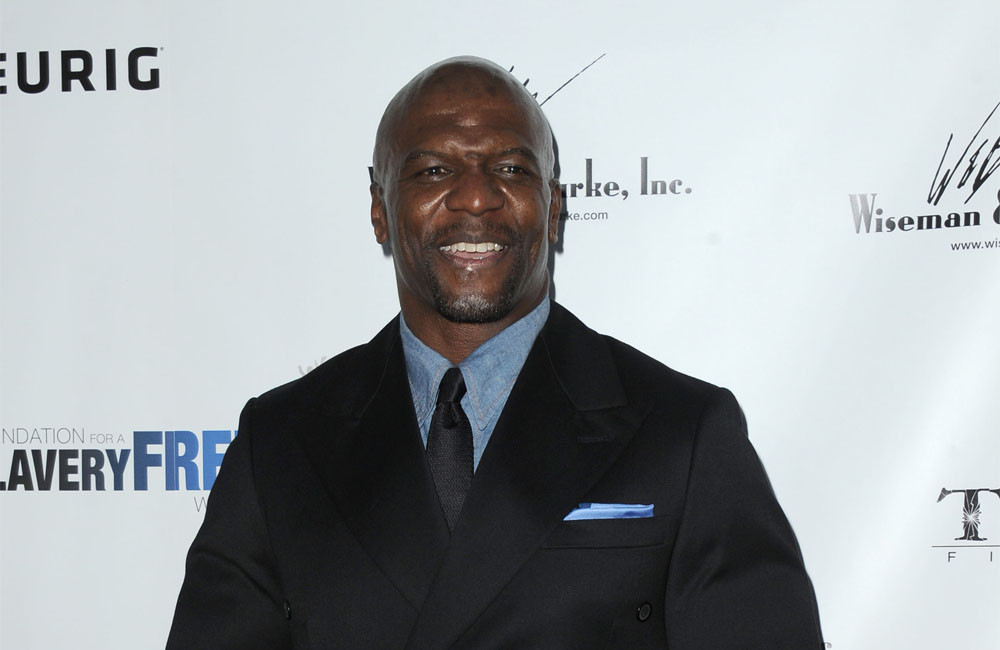

Terry Crews Reveals His 2 Pm Daily Fasting Practice

May 11, 2025

Terry Crews Reveals His 2 Pm Daily Fasting Practice

May 11, 2025 -

How Villanovas Alumni Network Feels About Its Papal Member

May 11, 2025

How Villanovas Alumni Network Feels About Its Papal Member

May 11, 2025