January Highs Reclaimed: Bitcoin's Surge Past $102,000 Explained

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

January Highs Reclaimed: Bitcoin's Surge Past $102,000 Explained

Bitcoin (BTC) has once again broken through the psychological barrier of $102,000, reclaiming its January highs and igniting a wave of excitement among crypto investors. This significant surge, after a period of relative consolidation, has left many wondering about the driving forces behind this bullish momentum. Let's delve into the key factors contributing to Bitcoin's remarkable price increase.

What Fueled Bitcoin's Recent Rally?

Several interconnected factors have likely contributed to Bitcoin's impressive climb past the $102,000 mark:

-

Increased Institutional Adoption: The growing interest from institutional investors remains a crucial driver. Major corporations and financial institutions are increasingly incorporating Bitcoin into their investment strategies, viewing it as a hedge against inflation and a potential store of value. This institutional demand exerts significant upward pressure on the price.

-

Regulatory Clarity (or Lack Thereof): Ironically, both positive and negative regulatory developments can fuel price volatility. While clear and consistent regulations can boost confidence, a lack of clarity can sometimes create a "fear of missing out" (FOMO) effect, driving speculative investment. Recent regulatory moves, or the lack thereof, in various jurisdictions could be contributing to the current surge.

-

Macroeconomic Factors: Global macroeconomic instability, including inflation and geopolitical uncertainties, continues to drive investors towards alternative assets like Bitcoin. As traditional markets experience volatility, Bitcoin's perceived resilience as a decentralized asset becomes increasingly attractive. This flight to safety boosts demand and price.

-

Technological Advancements: The ongoing development and improvement of the Bitcoin network, including scaling solutions and layer-2 technologies, enhance its efficiency and usability. These advancements attract developers and users, further strengthening the ecosystem and boosting investor confidence.

Technical Analysis: Charting Bitcoin's Ascent

Technical analysis suggests a strong bullish sentiment. The break above the $102,000 resistance level signifies a significant psychological hurdle overcome. Increased trading volume accompanying the price surge confirms the strength of the move. However, it's crucial to remember that the crypto market is inherently volatile, and price corrections are always a possibility. [Link to reputable crypto charting website].

Looking Ahead: Sustaining the Momentum?

While the current rally is impressive, the sustainability of Bitcoin's price above $102,000 remains to be seen. Several factors could influence its future trajectory:

-

Regulatory Uncertainty: Unfavorable regulatory changes in major markets could trigger a price correction.

-

Market Sentiment: A shift in investor sentiment, perhaps due to unforeseen global events, could impact Bitcoin's price.

-

Competition from Altcoins: The emergence of competing cryptocurrencies could divert investment away from Bitcoin.

Conclusion: A Bullish Outlook, But Proceed with Caution

Bitcoin's surge past $102,000 marks a significant milestone. The confluence of institutional adoption, macroeconomic factors, and technological advancements appears to be driving this bullish momentum. However, investors should remain cautious and aware of the inherent volatility of the cryptocurrency market. Conduct thorough research and manage risk appropriately before investing in Bitcoin or any other cryptocurrency.

Keywords: Bitcoin, BTC, Cryptocurrency, Price Surge, $102,000, Institutional Adoption, Macroeconomic Factors, Regulatory Clarity, Volatility, Crypto Market, Investment, Technical Analysis, Bullish, Altcoins.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on January Highs Reclaimed: Bitcoin's Surge Past $102,000 Explained. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nyt Spelling Bee Answers And Clues For May 8th Puzzle 431

May 10, 2025

Nyt Spelling Bee Answers And Clues For May 8th Puzzle 431

May 10, 2025 -

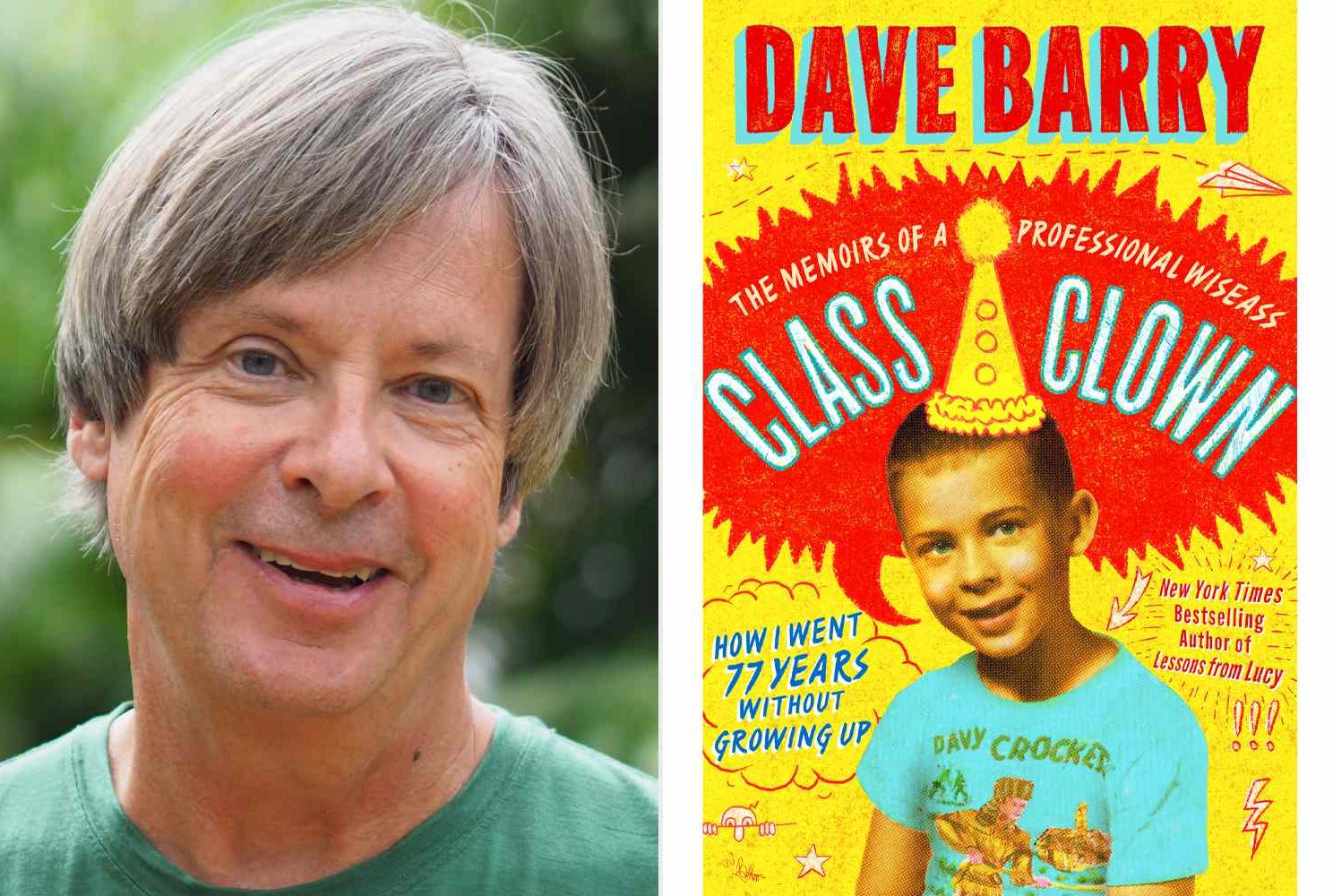

Keplers Presents An Evening With Dave Barry And Angie Corio May 12

May 10, 2025

Keplers Presents An Evening With Dave Barry And Angie Corio May 12

May 10, 2025 -

Grow A Garden Lunar Update Unveiling All Night Egg Pets

May 10, 2025

Grow A Garden Lunar Update Unveiling All Night Egg Pets

May 10, 2025 -

How To Stream Or Watch Emiliana Arango Vs Mirra Andreeva At The 2025 Internazionali Bnl D Italia

May 10, 2025

How To Stream Or Watch Emiliana Arango Vs Mirra Andreeva At The 2025 Internazionali Bnl D Italia

May 10, 2025 -

Conquering Nyt Spelling Bee Puzzle 431 May 8th Solutions

May 10, 2025

Conquering Nyt Spelling Bee Puzzle 431 May 8th Solutions

May 10, 2025