Jamie Dimon's Blunt Assessment: The Impact Of US China Tariffs

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Jamie Dimon's Blunt Assessment: Navigating the Choppy Waters of US-China Tariffs

Introduction: JPMorgan Chase CEO Jamie Dimon rarely minces words, and his recent comments on the lingering impact of US-China tariffs haven't been an exception. His blunt assessment paints a complex picture of the ongoing economic fallout, affecting everything from inflation to global supply chains. This article delves into Dimon's key concerns and analyzes their broader implications for businesses and consumers alike.

Dimon's Concerns: More Than Just Trade Wars

Dimon's criticisms extend beyond the immediate financial consequences of tariffs. While he acknowledges the initial aim of protecting American industries, he highlights the unintended and far-reaching consequences. He points to the significant contribution of tariffs to persistent inflation, arguing they've increased the cost of goods for consumers and hampered business growth. This isn't simply about trade; it's about the ripple effect on the entire US economy.

The Inflationary Spiral: A Key Consequence

One of Dimon's central arguments is the inflationary pressure exerted by tariffs. By increasing the cost of imported goods, tariffs directly contribute to higher prices for consumers. This, coupled with other economic factors, fuels an inflationary spiral that erodes purchasing power and stifles economic growth. This isn't just a theory; it's reflected in the persistent inflation rates the US has experienced in recent years. [Link to a relevant article on US inflation statistics]

Supply Chain Disruptions: A Global Headache

The impact extends far beyond price increases. Dimon also stresses the significant disruption to global supply chains caused by the tariffs. Uncertainty surrounding trade policies has forced businesses to re-evaluate their strategies, leading to delays, increased costs, and a general lack of stability. This instability has a knock-on effect, impacting everything from manufacturing to consumer goods availability. The complexity of global trade means that disruptions in one area quickly ripple outwards, creating significant challenges for businesses worldwide.

Geopolitical Implications: Beyond Economics

The US-China trade relationship goes far beyond simple economics. Dimon's comments indirectly touch upon the broader geopolitical implications of the tariffs. The ongoing tension between the two superpowers casts a shadow over global stability, creating uncertainty for businesses and investors alike. This uncertainty is a significant deterrent to investment and economic growth, further compounding the problems created by the tariffs themselves. [Link to an article discussing US-China geopolitical relations]

Looking Ahead: Mitigation Strategies and Policy Recommendations

While Dimon expresses concern, he doesn't offer specific policy solutions. However, his comments highlight the need for a more nuanced approach to trade policy, one that considers the long-term consequences alongside short-term gains. Experts suggest that focusing on targeted interventions rather than broad tariffs, and fostering greater transparency and predictability in trade relations, could help mitigate the negative impacts.

Conclusion: A Call for Careful Consideration

Jamie Dimon's outspoken criticism of the lasting effects of US-China tariffs serves as a stark reminder of the complex and far-reaching consequences of trade policy decisions. His assessment highlights the need for careful consideration of the inflationary pressures, supply chain disruptions, and geopolitical ramifications before implementing such significant measures. The ongoing challenge lies in finding a balance between protecting domestic industries and fostering a stable and prosperous global economy. The debate continues, and the long-term effects remain to be seen.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Jamie Dimon's Blunt Assessment: The Impact Of US China Tariffs. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Analyzing Nios Q1 2024 Earnings A Deep Dive Into Delivery Figures And Tariff Effects

Jun 03, 2025

Analyzing Nios Q1 2024 Earnings A Deep Dive Into Delivery Figures And Tariff Effects

Jun 03, 2025 -

Rising Dte Energy Costs A Financial Crisis Looms For Michigan Families

Jun 03, 2025

Rising Dte Energy Costs A Financial Crisis Looms For Michigan Families

Jun 03, 2025 -

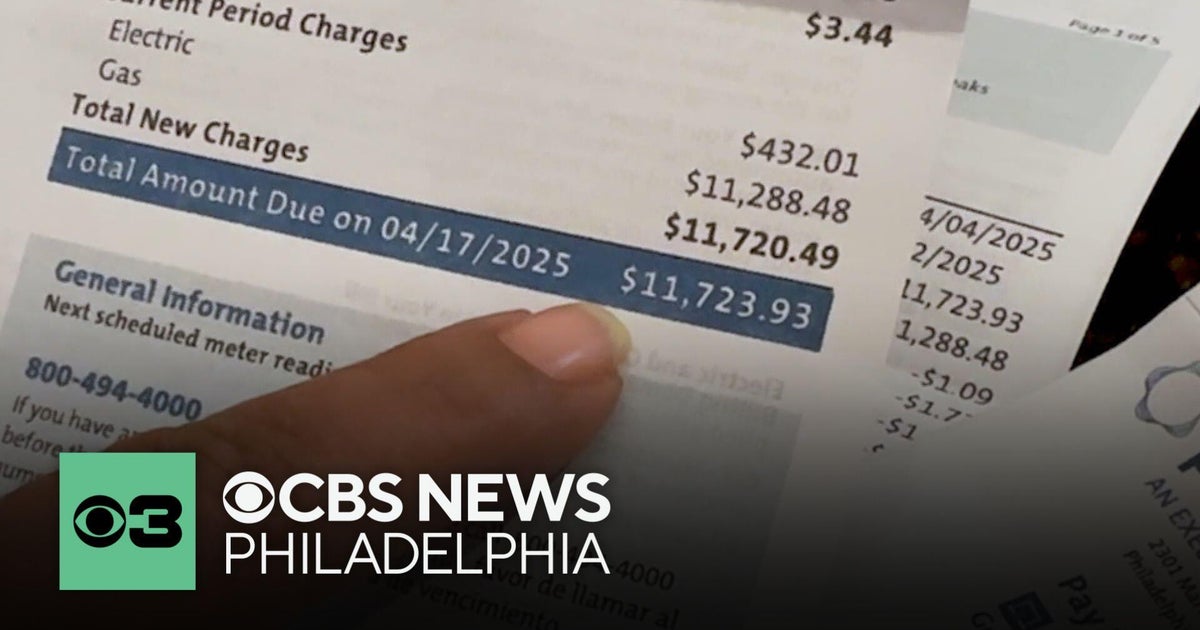

Peco Billing Error 12 000 Bill After Months Without Statements

Jun 03, 2025

Peco Billing Error 12 000 Bill After Months Without Statements

Jun 03, 2025 -

The 2 C Threshold A Companys Action Plan For A Changing Climate

Jun 03, 2025

The 2 C Threshold A Companys Action Plan For A Changing Climate

Jun 03, 2025 -

Crimean Bridge Targeted Analysis Of The Blast And Its Implications

Jun 03, 2025

Crimean Bridge Targeted Analysis Of The Blast And Its Implications

Jun 03, 2025