Jamie Dimon's Blunt Assessment: The Impact Of China Tariffs On The US Economy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Jamie Dimon's Blunt Assessment: The Impact of China Tariffs on the US Economy

Introduction: JPMorgan Chase CEO Jamie Dimon recently delivered a stark warning about the lingering effects of US-China tariffs on the American economy. His blunt assessment, delivered during a crucial earnings call, highlights the continued complexities and unforeseen consequences of the trade war. This article delves into Dimon's concerns, examining the specific impacts he highlighted and exploring the broader economic implications.

Dimon's Key Concerns: Dimon didn't mince words, stating that the tariffs imposed during the Trump administration continue to negatively affect the US economy. He didn't solely focus on immediate impacts but also highlighted the long-term ramifications, emphasizing the ripple effects across various sectors. His concerns weren't merely theoretical; he tied them directly to JPMorgan Chase's observations and experiences working with businesses across different industries.

Inflationary Pressures and Supply Chain Disruptions: One of Dimon's central arguments revolved around the persistent inflationary pressures stemming from the tariffs. The increased costs associated with imported goods, directly resulting from these tariffs, have contributed significantly to inflation, impacting consumer spending and overall economic growth. This is further exacerbated by ongoing supply chain disruptions, some of which can be directly traced back to the trade war's impact on global trade relationships.

Impact on Specific Sectors: Dimon's assessment wasn't a generalized concern; he pointed to specific sectors disproportionately affected by the tariffs. While he didn't name specific companies, his commentary hinted at the struggles faced by businesses heavily reliant on imported goods from China. This includes numerous manufacturing sectors, impacting job creation and competitiveness in the global marketplace. The agricultural sector, previously a major point of contention in the trade war, continues to feel the long-term effects, affecting farmers and related businesses.

Long-Term Economic Implications: The most alarming aspect of Dimon's statement was his emphasis on the long-term damage. The uncertainty created by the trade war, even after some tariffs were reduced or removed, continues to impact investment decisions. Businesses hesitate to commit to long-term projects due to the unpredictable nature of future trade policies. This hesitancy acts as a significant brake on economic growth, hindering innovation and expansion.

Geopolitical Considerations: It's important to understand that Dimon's assessment isn't solely about economics. The ongoing tensions between the US and China have geopolitical ramifications that extend beyond tariffs. The complex relationship between the two superpowers significantly impacts global stability and investor confidence, further complicating the economic outlook.

Looking Ahead: While some tariffs have been reduced, the lingering effects underscore the need for a more stable and predictable trade relationship between the US and China. Dimon's remarks serve as a powerful reminder of the long-term consequences of trade wars and the importance of fostering collaborative international trade policies. The future economic stability of the United States might very well hinge on a resolution to these trade tensions.

Call to Action: Staying informed about the evolving economic landscape is crucial for businesses and consumers alike. Follow reputable financial news sources and engage in informed discussions to better understand the impact of these global events. Understanding the complexity of these issues is vital for navigating the current economic climate effectively.

Keywords: Jamie Dimon, China Tariffs, US Economy, Inflation, Supply Chain, Trade War, JPMorgan Chase, Economic Impact, Geopolitics, Global Trade, Economic Growth, Investment, Consumer Spending.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Jamie Dimon's Blunt Assessment: The Impact Of China Tariffs On The US Economy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

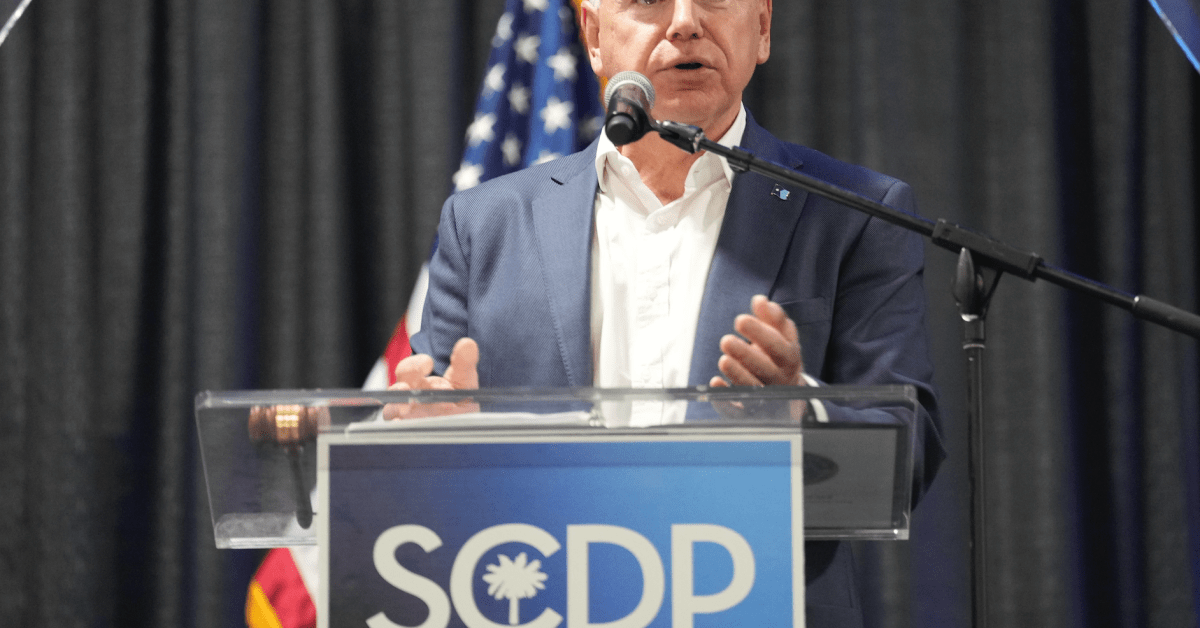

Walz Calls For More Aggressive Democratic Strategy Condemns Trump As Cruel

Jun 02, 2025

Walz Calls For More Aggressive Democratic Strategy Condemns Trump As Cruel

Jun 02, 2025 -

Tornado Throws The Wire Actors Son 300 Feet Familys Account Of Henry County Storm

Jun 02, 2025

Tornado Throws The Wire Actors Son 300 Feet Familys Account Of Henry County Storm

Jun 02, 2025 -

Be A Little Meaner Walz Challenges Democrats Amidst Trump Criticism

Jun 02, 2025

Be A Little Meaner Walz Challenges Democrats Amidst Trump Criticism

Jun 02, 2025 -

Cruise Lines Invest In Major Revitalizations Amidst Industry Growth

Jun 02, 2025

Cruise Lines Invest In Major Revitalizations Amidst Industry Growth

Jun 02, 2025 -

Ou Regarder Les Huitiemes De Finale Du 1er Juin En Direct

Jun 02, 2025

Ou Regarder Les Huitiemes De Finale Du 1er Juin En Direct

Jun 02, 2025