Jamie Dimon: The US Economy's Greatest Threat Is Internal

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Jamie Dimon Warns: Internal Factors Pose Greatest Threat to US Economy

JPMorgan Chase CEO Jamie Dimon's latest warning about the US economy has sent shockwaves through financial markets. Instead of focusing on external threats like inflation or geopolitical instability, Dimon pinpoints internal factors as the most significant danger to the nation's economic health. This stark assessment, delivered during a recent earnings call, highlights a growing concern among economists and investors about the fragility of the US economic landscape.

Dimon, known for his frank assessments and insightful market predictions, didn't mince words. He emphasized that while external pressures exist, the greatest risk stems from within the US itself. This statement demands a closer look at the specific internal threats he alluded to and their potential impact on the American economy.

Identifying the Internal Threats: Dimon's Key Concerns

Dimon's concerns aren't vague; they point to specific areas demanding immediate attention:

-

Government Spending and Debt: The spiraling national debt and ongoing debates surrounding government spending are major sources of instability. Uncontrolled spending, coupled with a growing debt burden, could lead to higher interest rates, reduced investment, and ultimately, slower economic growth. This is a recurring theme in economic discussions, and Dimon's emphasis underscores its severity. [Link to relevant article on US national debt]

-

Political Polarization and Uncertainty: The deeply divided political climate creates uncertainty for businesses and investors. Policy changes, regulatory hurdles, and the constant threat of legislative gridlock hinder long-term planning and investment, stifling economic expansion. This political uncertainty is a significant drag on economic confidence, impacting both consumer and investor behavior.

-

Geopolitical Tensions (Internal): While Dimon acknowledged external geopolitical risks, he also highlighted internal political divisions that mirror global conflicts, creating an environment of domestic instability. This internal friction can manifest in social unrest, impacting productivity and business operations.

-

The Regulatory Landscape: While regulation is essential, an overly complex and unpredictable regulatory environment can hinder innovation and investment. This can particularly impact smaller businesses, which are crucial drivers of job creation and economic growth. [Link to article about business regulation]

The Ripple Effect: How Internal Threats Impact the Economy

These internal threats are interconnected. For instance, political gridlock can prevent the necessary fiscal reforms to address the growing national debt, exacerbating the problem. This, in turn, can lead to higher interest rates, impacting borrowing costs for businesses and consumers, slowing down economic activity.

The resulting uncertainty can also diminish consumer confidence, leading to reduced spending and further economic slowdown. This creates a vicious cycle where internal weaknesses amplify each other, posing a significant threat to overall economic stability.

Looking Ahead: Mitigating the Risks

Dimon's warning serves as a call to action. Addressing these internal challenges requires a bipartisan effort focused on fiscal responsibility, promoting political stability, streamlining regulations, and fostering a more unified national vision. Ignoring these issues could have severe consequences, jeopardizing the long-term prosperity of the US economy. The need for proactive and collaborative solutions is paramount to avert a potential economic crisis.

What are your thoughts on Jamie Dimon's assessment? Share your opinions in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Jamie Dimon: The US Economy's Greatest Threat Is Internal. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Chicago Fire Stadium A 650 Million Development At The 78

Jun 03, 2025

Chicago Fire Stadium A 650 Million Development At The 78

Jun 03, 2025 -

Economic Growth In Brazil Harnessing The Potential Of Climate Action

Jun 03, 2025

Economic Growth In Brazil Harnessing The Potential Of Climate Action

Jun 03, 2025 -

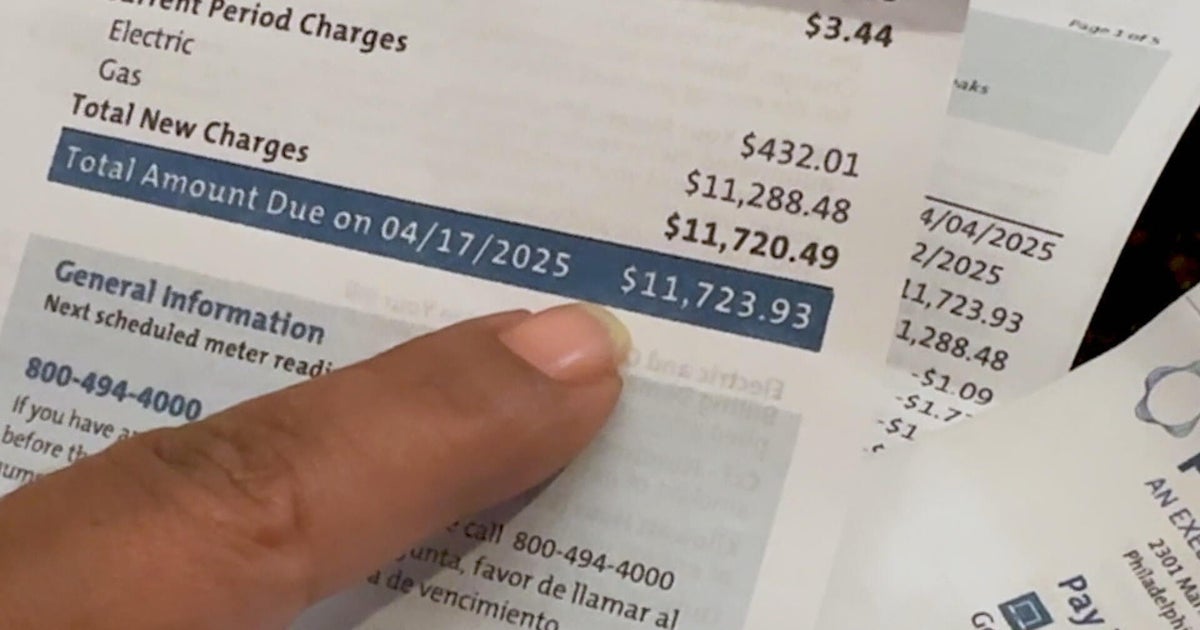

Pecos Billing System Under Scrutiny After Customer Hit With 12 000 Bill

Jun 03, 2025

Pecos Billing System Under Scrutiny After Customer Hit With 12 000 Bill

Jun 03, 2025 -

Actor Tray Chaney Seeks Support After Sons Tornado Injury In Georgia

Jun 03, 2025

Actor Tray Chaney Seeks Support After Sons Tornado Injury In Georgia

Jun 03, 2025 -

Crimean Bridge Targeted Again Ukraine Claims Underwater Sabotage

Jun 03, 2025

Crimean Bridge Targeted Again Ukraine Claims Underwater Sabotage

Jun 03, 2025