Jamie Dimon: The US Economy's Biggest Threat Is Internal

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Jamie Dimon Warns: The Biggest Threat to the US Economy Isn't External, It's Internal

JPMorgan Chase CEO Jamie Dimon's recent comments have sent shockwaves through the financial world, issuing a stark warning: the greatest threat to the US economy isn't geopolitical instability or global recession, but rather internal factors. Dimon, known for his candid assessments of the economic landscape, highlighted several key areas of concern during a recent earnings call, leaving investors and economists pondering the implications.

This isn't the first time Dimon has sounded the alarm. His consistent warnings underscore the gravity of the situation and demand our attention. Let's delve into the specific internal threats Dimon identified and explore their potential impact.

The Looming Debt Ceiling Crisis: A Ticking Time Bomb

One of Dimon's primary concerns revolves around the ongoing political stalemate surrounding the US debt ceiling. The potential for a default, he argues, poses an existential threat to the nation's financial stability. A failure to raise the debt ceiling could trigger a cascading effect, impacting everything from government spending and social security payments to the global financial markets. The uncertainty alone is enough to spook investors and hinder economic growth. This uncertainty is exactly what Dimon is highlighting as a significant internal risk.

[Link to relevant article on the debt ceiling crisis]

Inflation and Interest Rates: A Double-Edged Sword

The persistent inflationary pressures and the Federal Reserve's aggressive interest rate hikes are another major source of concern. While intended to curb inflation, these measures risk triggering a recession. Dimon acknowledged the Fed's difficult balancing act, emphasizing the potential for unintended consequences. The delicate interplay between inflation, interest rates, and economic growth creates a precarious situation, particularly for vulnerable sectors of the economy.

Political Polarization and Gridlock: Stifling Economic Progress

Dimon also pointed towards the increasing political polarization and legislative gridlock as significant obstacles to economic progress. The inability to enact meaningful reforms and address pressing economic issues undermines investor confidence and slows down economic growth. This internal dysfunction, he argues, hampers the nation's ability to compete effectively on the global stage.

The Geopolitical Landscape: A Complicating Factor, Not the Primary Threat

While acknowledging the complexities of the global geopolitical landscape, including the war in Ukraine and rising tensions with China, Dimon emphasized that these external factors are secondary compared to the internal challenges facing the US economy. These external issues certainly add to the overall complexity, but the core problems, he insists, lie within the United States itself.

What Does This Mean for the Future?

Dimon's warning serves as a critical wake-up call. Addressing these internal vulnerabilities requires decisive action from policymakers, businesses, and citizens alike. Finding common ground, prioritizing fiscal responsibility, and fostering a more collaborative political environment are crucial steps towards ensuring the long-term health and stability of the US economy.

The future of the US economy hangs in the balance. What are your thoughts on Dimon's assessment? Share your opinions in the comments below.

[Link to relevant article discussing economic forecasts]

Keywords: Jamie Dimon, US Economy, Economic Threat, Debt Ceiling, Inflation, Interest Rates, Political Polarization, Recession, JPMorgan Chase, Economic Forecast, Financial Crisis, Internal Risks, External Risks, Geopolitical Risks.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Jamie Dimon: The US Economy's Biggest Threat Is Internal. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Al Rokers Weight Loss Strategies For Long Term Success After 100 Pound Loss

Jun 03, 2025

Al Rokers Weight Loss Strategies For Long Term Success After 100 Pound Loss

Jun 03, 2025 -

Michigan Families Face Potential Bankruptcy From Dte Rate Hikes

Jun 03, 2025

Michigan Families Face Potential Bankruptcy From Dte Rate Hikes

Jun 03, 2025 -

The 2 C Threshold A Business Guide To Climate Change Adaptation

Jun 03, 2025

The 2 C Threshold A Business Guide To Climate Change Adaptation

Jun 03, 2025 -

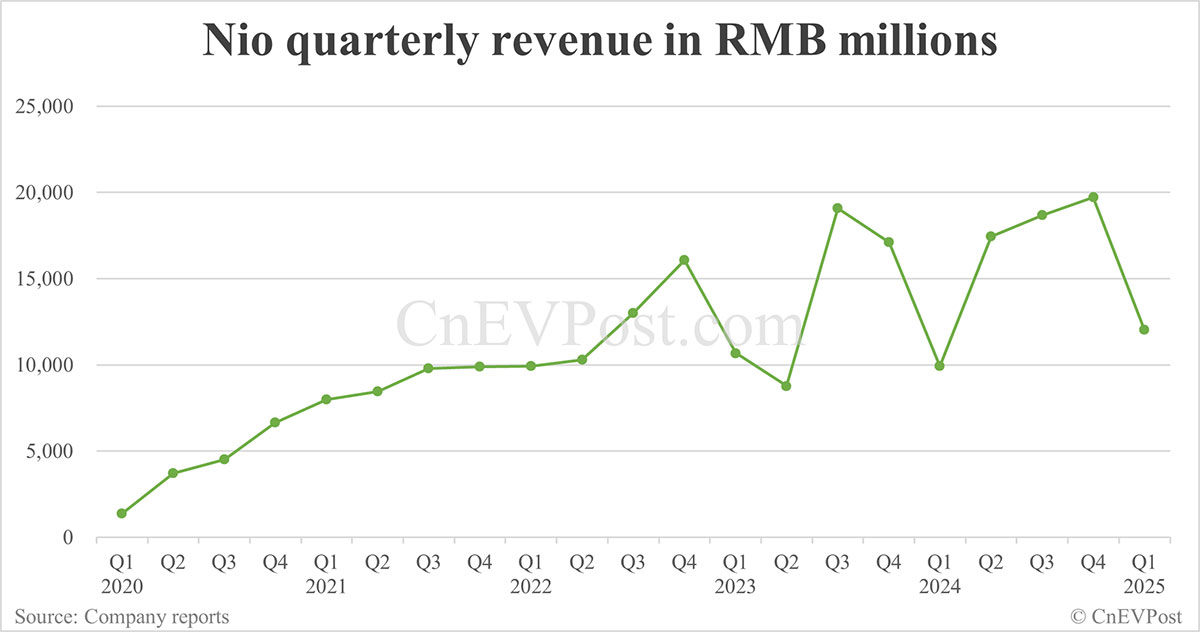

Strong Q1 For Nio Revenue Up 21 Year On Year

Jun 03, 2025

Strong Q1 For Nio Revenue Up 21 Year On Year

Jun 03, 2025 -

Sheinelle Jones Family Takes Center Stage After Husbands Unexpected Passing

Jun 03, 2025

Sheinelle Jones Family Takes Center Stage After Husbands Unexpected Passing

Jun 03, 2025