Is Uber Stock A Buy, Sell, Or Hold? Evaluating The Investment

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is Uber Stock a Buy, Sell, or Hold? Evaluating the Investment

Uber's meteoric rise from a disruptive startup to a global transportation giant has captivated investors. But with fluctuating market conditions and ongoing challenges, the question remains: is Uber stock (UBER) a buy, a sell, or a hold? This in-depth analysis examines the company's performance, future prospects, and potential risks to help you make an informed investment decision.

Uber's Current Market Position: A Mixed Bag

Uber dominates ride-sharing, but faces intense competition. Its core ride-hailing business, while still substantial, is facing pressure from competitors like Lyft and regional players. However, Uber's diversification into food delivery (Uber Eats) and freight transportation offers significant growth potential. The success of these ventures is crucial to the company's long-term viability.

Key Factors Influencing Uber Stock:

-

Profitability: Uber's journey to profitability has been a long and winding road. While the company is showing signs of improved financial performance, achieving consistent and substantial profits remains a key challenge. Investors need to carefully assess the sustainability of its current earnings trajectory. [Link to Uber's most recent financial reports]

-

Regulatory Landscape: The regulatory environment surrounding ride-sharing and delivery services varies significantly across different regions. Navigating these regulations and securing necessary permits and licenses can be costly and time-consuming, impacting Uber's operational efficiency and profitability.

-

Technological Innovation: Uber's continued investment in technology is crucial for maintaining its competitive edge. Developing new features, improving its app, and exploring autonomous vehicle technology are essential for attracting and retaining both riders and drivers. [Link to an article about Uber's technological advancements]

-

Driver Relations: Maintaining positive relationships with its driver network is paramount for Uber's success. Issues related to driver compensation, benefits, and working conditions can significantly impact operational costs and public perception.

-

Competition: The ride-sharing and food delivery markets are incredibly competitive. The constant battle for market share requires significant investment in marketing, promotions, and technological innovation, impacting profitability.

Analyzing the Risks:

Investing in Uber stock carries inherent risks. These include:

-

Market Volatility: The tech sector is known for its volatility, and Uber stock is no exception. External factors like economic downturns or changes in investor sentiment can significantly impact its share price.

-

Dependence on the Gig Economy: Uber's business model relies heavily on the gig economy. Changes in labor laws, worker classification disputes, and potential unionization efforts could significantly affect its operational costs and profitability.

Should You Buy, Sell, or Hold?

The decision to buy, sell, or hold Uber stock depends on your individual risk tolerance and investment goals. While Uber's diversification strategy and growth potential are attractive, the company still faces significant challenges. Before making any investment decision, it's crucial to conduct thorough research, consult with a financial advisor, and carefully consider your own investment risk profile.

Long-Term Outlook:

The long-term outlook for Uber is arguably positive, given its established brand recognition, expanding services, and potential for future growth in autonomous vehicles and other emerging technologies. However, consistent profitability and navigating regulatory hurdles remain key hurdles.

Call to Action: Stay informed about Uber's financial performance, industry developments, and regulatory changes. Regularly review your investment portfolio and adjust your strategy as needed. Remember, this analysis is for informational purposes only and should not be considered financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is Uber Stock A Buy, Sell, Or Hold? Evaluating The Investment. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

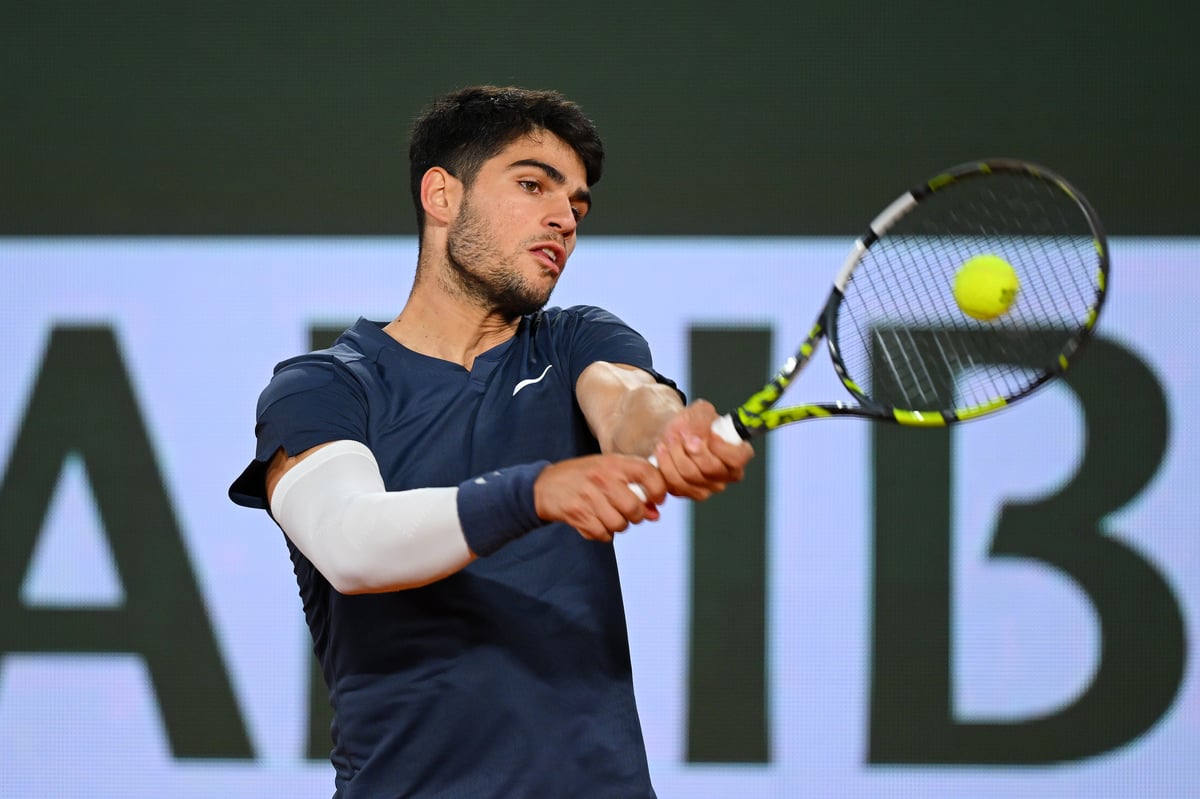

French Open Day 2 2025 Live Scores Results And Match Updates

May 27, 2025

French Open Day 2 2025 Live Scores Results And Match Updates

May 27, 2025 -

Watch The French Open 2025 On Tv And Online A Uk Viewers Guide

May 27, 2025

Watch The French Open 2025 On Tv And Online A Uk Viewers Guide

May 27, 2025 -

Follow Emma Navarros French Open 2025 Journey Daily Schedule And Live Updates

May 27, 2025

Follow Emma Navarros French Open 2025 Journey Daily Schedule And Live Updates

May 27, 2025 -

Nyse Oklo Soars Smr Nne Technology Drives Breakout Potential

May 27, 2025

Nyse Oklo Soars Smr Nne Technology Drives Breakout Potential

May 27, 2025 -

167 Million Powerball Jackpot Check The May 24 Winning Numbers

May 27, 2025

167 Million Powerball Jackpot Check The May 24 Winning Numbers

May 27, 2025