Is Uber Stock A Buy Or Sell? A Deep Dive Analysis.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is Uber Stock a Buy or Sell? A Deep Dive Analysis

Uber Technologies (UBER) has become a household name, revolutionizing transportation and delivery services. But for investors, the question remains: is Uber stock a buy or a sell? This in-depth analysis explores the company's performance, future prospects, and potential risks to help you make an informed decision.

The ride-sharing giant has experienced a rollercoaster ride since its IPO, fluctuating wildly due to factors ranging from pandemic-related disruptions to intense competition and regulatory hurdles. Understanding these factors is crucial before investing.

Uber's Current Financial Performance:

Uber's financial reports paint a complex picture. While revenue growth has been impressive, consistently surpassing expectations in recent quarters, profitability remains elusive. The company is heavily investing in expanding its services, including Uber Eats, freight transportation, and autonomous vehicle technology. This significant capital expenditure impacts its bottom line, leaving many investors questioning its long-term financial sustainability.

- Revenue Growth: Uber consistently reports strong revenue growth, fueled by increasing rider and delivery demand. This is a positive sign, indicating the company's market dominance and ability to attract and retain customers.

- Profitability Concerns: Despite the revenue growth, Uber's path to profitability is still uncertain. High operating expenses, including driver compensation and marketing costs, continue to pressure margins.

- Debt Levels: Uber carries significant debt, which adds to the financial risk for potential investors. This debt needs to be carefully considered alongside the company's growth trajectory.

Factors Influencing Uber Stock Price:

Several key factors influence the price of Uber stock:

- Competition: Uber faces fierce competition from rivals like Lyft, Didi Chuxing, and Bolt. Competition drives down prices, squeezing profit margins and impacting market share.

- Regulatory Changes: The regulatory landscape for ride-sharing services varies significantly across different regions. Changes in regulations, such as licensing requirements and fare caps, can impact Uber's operations and profitability.

- Economic Conditions: Macroeconomic factors, like inflation and recessionary fears, significantly influence consumer spending. A downturn in the economy can lead to decreased demand for ride-sharing and delivery services.

- Technological Advancements: Uber's investment in autonomous vehicle technology represents a high-risk, high-reward strategy. Success in this area could dramatically reshape the company's future, but failure could lead to significant losses.

Should You Buy or Sell Uber Stock?

The decision to buy or sell Uber stock depends heavily on your individual investment strategy and risk tolerance.

Arguments for Buying:

- Long-term Growth Potential: Uber operates in a rapidly growing market with significant potential for long-term expansion.

- Diversification of Services: Uber's diversification into food delivery and freight transportation reduces reliance on its core ride-sharing business, mitigating risk.

- Technological Innovation: The company's investment in cutting-edge technology, including autonomous vehicles, positions it for future growth and market leadership.

Arguments for Selling:

- Lack of Profitability: Uber's persistent losses raise concerns about its long-term financial viability.

- High Competition: The intense competition in the ride-sharing and delivery markets puts pressure on prices and profit margins.

- Regulatory Uncertainty: Changes in regulations could significantly impact Uber's operations and profitability.

Conclusion:

Determining whether Uber stock is a buy or a sell is not straightforward. It requires a careful consideration of the company's financial performance, the competitive landscape, and the broader economic environment. Investors should conduct thorough due diligence and assess their own risk tolerance before making any investment decisions. Consider consulting with a financial advisor for personalized advice. The information presented here is for informational purposes only and should not be construed as financial advice.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is Uber Stock A Buy Or Sell? A Deep Dive Analysis.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Mixed Messages Trump Honors Fallen Troops While Airing Political Complaints On Memorial Day

May 28, 2025

Mixed Messages Trump Honors Fallen Troops While Airing Political Complaints On Memorial Day

May 28, 2025 -

Planning A Date Three Day Weekends Offer More Time And Opportunity

May 28, 2025

Planning A Date Three Day Weekends Offer More Time And Opportunity

May 28, 2025 -

Daniel Altmaiers Roland Garros Shock Taylor Fritz Eliminated

May 28, 2025

Daniel Altmaiers Roland Garros Shock Taylor Fritz Eliminated

May 28, 2025 -

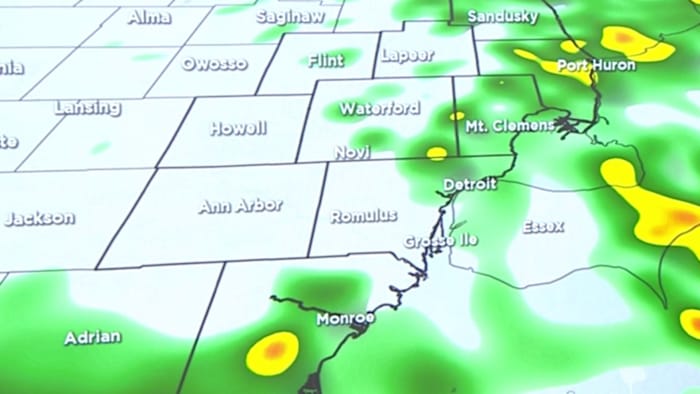

Rain Chances Increase Metro Detroit Weekly Weather Outlook

May 28, 2025

Rain Chances Increase Metro Detroit Weekly Weather Outlook

May 28, 2025 -

Investing In Ai This Stocks 150 Jump In Two Months Is Turning Heads

May 28, 2025

Investing In Ai This Stocks 150 Jump In Two Months Is Turning Heads

May 28, 2025