Is Spirit Airlines Headed For Bankruptcy? Stock Takes A Nosedive

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is Spirit Airlines Headed for Bankruptcy? Stock Takes a Nosedive

Spirit Airlines, the ultra-low-cost carrier known for its bare-bones fares and often-criticized fees, is facing turbulent times. Recent stock plunges have fueled speculation: is bankruptcy on the horizon for this controversial airline? The answer, while not definitively yes, is complex and warrants a closer look at the factors contributing to the current crisis.

A Dramatic Stock Drop: The Catalyst for Concern

Spirit Airlines' stock price recently experienced a significant downturn, triggering widespread concern among investors and passengers alike. This dramatic fall reflects underlying financial instability and a confluence of negative factors impacting the airline's profitability and overall outlook. While a single stock drop doesn't automatically signal bankruptcy, it serves as a potent indicator of serious underlying problems.

Factors Fueling the Fears:

Several key factors contribute to the growing anxieties surrounding Spirit Airlines' financial health:

-

High Fuel Costs: The airline industry is heavily reliant on fuel, and the recent surge in global oil prices has significantly impacted Spirit's operating costs. This increased expense, coupled with their already thin profit margins, creates a precarious situation. [Link to article about rising fuel costs in the airline industry]

-

Increased Competition: The ultra-low-cost carrier (ULCC) market is fiercely competitive. Spirit faces stiff competition from established players like Ryanair and easyJet, as well as newer entrants constantly vying for market share. This intense competition often leads to price wars, further squeezing profit margins.

-

Labor Relations: Tensions between Spirit Airlines and its employees, including pilots and flight attendants, have occasionally led to disruptions and increased operational costs. Resolving these labor disputes requires significant financial investment and can further strain already limited resources. [Link to news article about recent labor disputes in the airline industry]

-

Economic Uncertainty: The current global economic climate adds another layer of complexity. Recessions and economic downturns often lead to decreased consumer spending, impacting demand for air travel and potentially reducing Spirit's revenue streams.

Is Bankruptcy Inevitable? Analyzing the Outlook:

While the situation is undoubtedly concerning, declaring Spirit Airlines bankrupt prematurely would be an oversimplification. The airline has taken steps to address its challenges, including cost-cutting measures and efforts to improve operational efficiency. However, the effectiveness of these measures remains to be seen.

Several factors need to be considered before reaching a conclusion:

-

Debt Levels: A thorough examination of Spirit's debt load is crucial. High levels of debt can significantly increase the risk of bankruptcy, particularly when combined with reduced revenue and increased operating costs.

-

Cash Reserves: The airline's current cash reserves and access to further funding will play a vital role in determining its ability to weather the storm. A strong cash position offers a buffer against short-term challenges.

-

Management Response: The effectiveness of Spirit Airlines' management team in addressing the challenges and implementing corrective strategies will be a key determinant of the airline's future.

What's Next for Spirit Airlines?

The coming months will be critical for Spirit Airlines. Investors and passengers alike will be closely watching the airline's performance, its ability to manage costs, and its response to the challenges it faces. While bankruptcy isn't guaranteed, the current situation demands careful observation and analysis. The airline's ability to adapt to the changing market landscape and improve its financial performance will ultimately dictate its long-term survival.

Disclaimer: This article provides information based on publicly available data and analysis. It should not be considered financial advice. Always conduct your own research before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is Spirit Airlines Headed For Bankruptcy? Stock Takes A Nosedive. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Cd Projekt Red Delays Cyberpunk 2077s 2 3 Update What We Know

Aug 15, 2025

Cd Projekt Red Delays Cyberpunk 2077s 2 3 Update What We Know

Aug 15, 2025 -

Netflix Unveils Trailer For Steve Starring Cillian Murphy

Aug 15, 2025

Netflix Unveils Trailer For Steve Starring Cillian Murphy

Aug 15, 2025 -

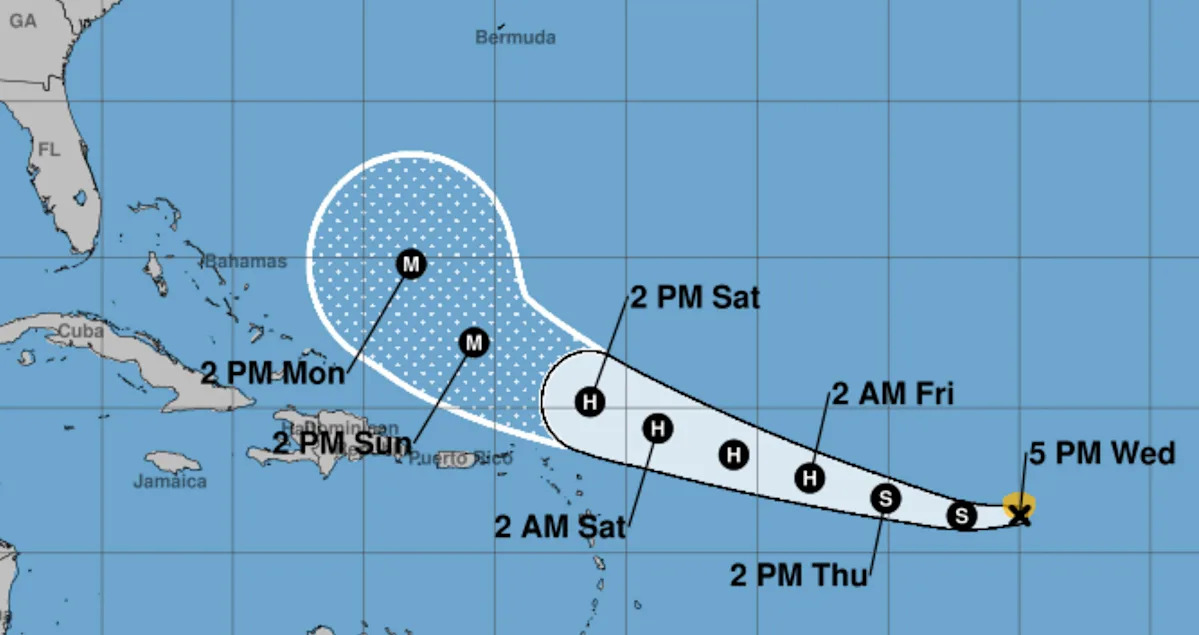

2025 Atlantic Hurricane Season Tracking Tropical Storm Erins Development

Aug 15, 2025

2025 Atlantic Hurricane Season Tracking Tropical Storm Erins Development

Aug 15, 2025 -

Cd Projekt Red Delays Cyberpunk 2077s 2 3 Patch What We Know

Aug 15, 2025

Cd Projekt Red Delays Cyberpunk 2077s 2 3 Patch What We Know

Aug 15, 2025 -

2025 Fantasy Football Wide Receiver Preview Deepest Draft Pool Yet

Aug 15, 2025

2025 Fantasy Football Wide Receiver Preview Deepest Draft Pool Yet

Aug 15, 2025

Latest Posts

-

Trump And Putins Summit A Deep Dive Into The Secret White House Diplomacy

Aug 15, 2025

Trump And Putins Summit A Deep Dive Into The Secret White House Diplomacy

Aug 15, 2025 -

Memphis Community Pushes Back Against Elon Musks X Ai Expansion

Aug 15, 2025

Memphis Community Pushes Back Against Elon Musks X Ai Expansion

Aug 15, 2025 -

Fortnite Servers Down Login Issues Resolved Official Statement Released

Aug 15, 2025

Fortnite Servers Down Login Issues Resolved Official Statement Released

Aug 15, 2025 -

Robinhoods U Turn On Remote Work Ceos Admission And New Policy

Aug 15, 2025

Robinhoods U Turn On Remote Work Ceos Admission And New Policy

Aug 15, 2025 -

No Diablo 4 Livestream Blizzard Responds To Fan Feedback Retools Broadcast

Aug 15, 2025

No Diablo 4 Livestream Blizzard Responds To Fan Feedback Retools Broadcast

Aug 15, 2025