Is NIO Stock's Pre-Earnings Dip A Buying Opportunity?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is NIO Stock's Pre-Earnings Dip a Buying Opportunity?

NIO, the Chinese electric vehicle (EV) maker, has seen its stock price fluctuate significantly in recent months. A common question on investors' minds before the release of NIO's latest earnings report is: should the pre-earnings dip be viewed as a buying opportunity? The answer, as with most investment decisions, is complex and depends on several factors. Let's delve into the current market sentiment and analyze whether now is the right time to invest in NIO.

NIO's Recent Performance and Market Challenges:

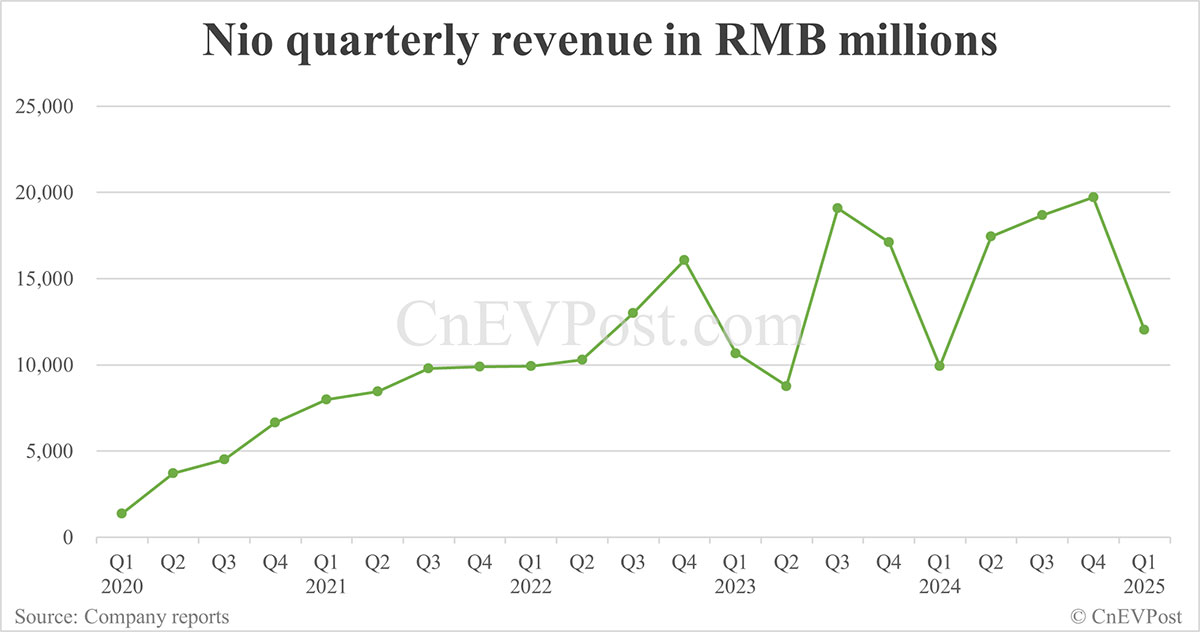

NIO, like many other EV companies, has faced headwinds in the current market. Increased competition, macroeconomic uncertainties, and supply chain disruptions have all contributed to the stock's volatility. While NIO has consistently delivered strong vehicle deliveries, surpassing expectations in some quarters, the overall market sentiment towards Chinese stocks has been cautious. This has led to significant price swings, creating both opportunities and risks for investors.

Analyzing the Pre-Earnings Dip:

The pre-earnings dip is a common phenomenon. Investors often sell shares before earnings announcements to lock in profits or mitigate potential losses if the results disappoint. This creates a temporary downward pressure on the stock price. However, if the earnings report surpasses expectations, the stock price can rebound sharply, making the pre-earnings dip a lucrative entry point for savvy investors.

Factors to Consider Before Investing:

Before deciding whether to buy NIO stock during a pre-earnings dip, consider these key factors:

- Earnings Expectations: Analyze analyst predictions and compare them to NIO's historical performance. A significant positive surprise could trigger a strong price rally.

- Market Sentiment: Consider the overall market conditions and the specific sentiment towards Chinese stocks. Geopolitical factors can significantly impact the stock price.

- NIO's Growth Trajectory: Assess NIO's long-term growth prospects. Factors like new model launches, expansion plans, and technological advancements will play a crucial role in future performance.

- Competition: Evaluate NIO's competitive landscape, considering the aggressive strategies of other major EV players both in China and globally. [Link to a relevant article about the Chinese EV market].

- Financial Health: Review NIO's financial statements, including revenue, profitability, and debt levels. A strong financial position reduces investment risk.

The Potential Upside:

Despite the challenges, NIO possesses several attractive qualities that could drive future growth:

- Strong Brand Recognition: NIO has established a strong brand presence in the Chinese EV market, known for its innovative technology and premium offerings.

- Expanding Product Lineup: NIO continues to expand its vehicle lineup, catering to a broader range of customer needs and preferences.

- Battery Swap Technology: NIO's unique battery swap technology offers a significant advantage over competitors, addressing range anxiety and accelerating charging times.

- Growing Charging Infrastructure: NIO is actively expanding its charging infrastructure, providing convenience for its customers.

Conclusion: Weighing the Risks and Rewards:

The pre-earnings dip in NIO stock presents a potential buying opportunity, but it's not without risk. Thoroughly research the company's financials, understand the market dynamics, and consider your own risk tolerance before making any investment decisions. Consult with a financial advisor if necessary. The information provided here is for educational purposes and should not be considered financial advice.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is NIO Stock's Pre-Earnings Dip A Buying Opportunity?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Abas Role Curtailed In Trump Judicial Nominee Review Process Under Bondi

Jun 03, 2025

Abas Role Curtailed In Trump Judicial Nominee Review Process Under Bondi

Jun 03, 2025 -

Nio Q1 Earnings Looming Stock Dip Presents Investment Opportunity

Jun 03, 2025

Nio Q1 Earnings Looming Stock Dip Presents Investment Opportunity

Jun 03, 2025 -

Cross State Manhunt Concludes With Murder Suspects Arrest

Jun 03, 2025

Cross State Manhunt Concludes With Murder Suspects Arrest

Jun 03, 2025 -

Crimean Bridge Attack Analysis Of The Incident And Potential Consequences

Jun 03, 2025

Crimean Bridge Attack Analysis Of The Incident And Potential Consequences

Jun 03, 2025 -

Analysis Of Nios 21 Year On Year Revenue Growth In Q1

Jun 03, 2025

Analysis Of Nios 21 Year On Year Revenue Growth In Q1

Jun 03, 2025