Is NIO Stock's Dip Before Q1 Results A Buying Signal?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is NIO Stock's Dip Before Q1 Results a Buying Signal?

NIO, the Chinese electric vehicle (EV) maker, has seen its stock price fluctuate recently, prompting investors to question whether the current dip before the release of Q1 2024 results represents a buying opportunity. The market's reaction to NIO's performance has been volatile, making it crucial for investors to carefully consider the factors influencing the stock's price before making any decisions. This analysis delves into the potential implications of the recent dip and explores whether it signals a promising entry point for shrewd investors.

Understanding NIO's Recent Performance

NIO's stock price has experienced significant swings in recent months, reflecting the broader uncertainties within the Chinese EV market and the global economic landscape. Increased competition, supply chain challenges, and fluctuating raw material costs have all contributed to this volatility. The upcoming Q1 2024 earnings report is highly anticipated, as it will provide crucial insights into the company's financial health and future growth prospects. Many analysts believe that the current dip may be a result of pre-earnings jitters, with investors taking a cautious stance before the release of the official figures.

Key Factors Influencing NIO Stock

Several factors are currently influencing investor sentiment towards NIO stock:

- Q1 2024 Earnings Expectations: Analysts' forecasts for Q1 2024 vary, creating uncertainty among investors. Positive surprises could lead to a significant price surge, while disappointing results might exacerbate the current downturn. Keep an eye on key metrics like vehicle deliveries, revenue growth, and profitability margins.

- Competition in the Chinese EV Market: The Chinese EV market is incredibly competitive, with established players like BYD and new entrants constantly vying for market share. NIO's ability to differentiate itself through innovation, brand building, and strategic partnerships will be crucial for its long-term success.

- Government Policies and Regulations: Changes in government policies and regulations related to the EV industry in China can significantly impact NIO's operations and profitability. Investors need to monitor these developments closely.

- Global Economic Conditions: Global macroeconomic factors, such as inflation and interest rate hikes, also play a role in influencing investor confidence and NIO's stock price.

Is the Dip a Buying Opportunity?

Whether the current dip in NIO stock is a buying signal depends on individual investor risk tolerance and long-term outlook. While the uncertainty surrounding the Q1 2024 results is a valid concern, the potential for significant upside following positive earnings could outweigh the risk for some investors.

Arguments for Buying:

- Potential for Growth: NIO operates in a rapidly growing market with significant long-term potential. The company's innovative technology and expanding product lineup could drive future growth.

- Undervalued Stock: Some analysts believe that the current stock price undervalues NIO's long-term potential, making it an attractive investment opportunity for long-term investors.

- Strategic Partnerships: NIO's strategic partnerships and collaborations could provide access to new markets and technologies, further boosting its growth prospects.

Arguments Against Buying:

- Market Volatility: The Chinese EV market remains volatile, and unexpected events could negatively impact NIO's performance.

- Competition: Intense competition could put pressure on NIO's profitability margins.

- Geopolitical Risks: Geopolitical risks related to China could also affect investor sentiment and NIO's stock price.

Conclusion: Proceed with Caution

The decision to buy NIO stock before the Q1 2024 results is a complex one, requiring careful consideration of the various factors discussed above. Investors should conduct thorough due diligence, analyze the Q1 results meticulously upon release, and assess their own risk tolerance before making any investment decisions. While the dip may present an opportunity, it’s crucial to approach it cautiously and with a long-term perspective. Remember to consult with a qualified financial advisor before making any investment choices.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is NIO Stock's Dip Before Q1 Results A Buying Signal?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Al Rokers Lasting Weight Loss Maintaining A Healthy Lifestyle

Jun 03, 2025

Al Rokers Lasting Weight Loss Maintaining A Healthy Lifestyle

Jun 03, 2025 -

Joe Roots 166 Leads England To Narrow Win Against West Indies In Cardiff

Jun 03, 2025

Joe Roots 166 Leads England To Narrow Win Against West Indies In Cardiff

Jun 03, 2025 -

England Vs West Indies Cardiff Test Sees Roots Unbeaten Century Secure Victory

Jun 03, 2025

England Vs West Indies Cardiff Test Sees Roots Unbeaten Century Secure Victory

Jun 03, 2025 -

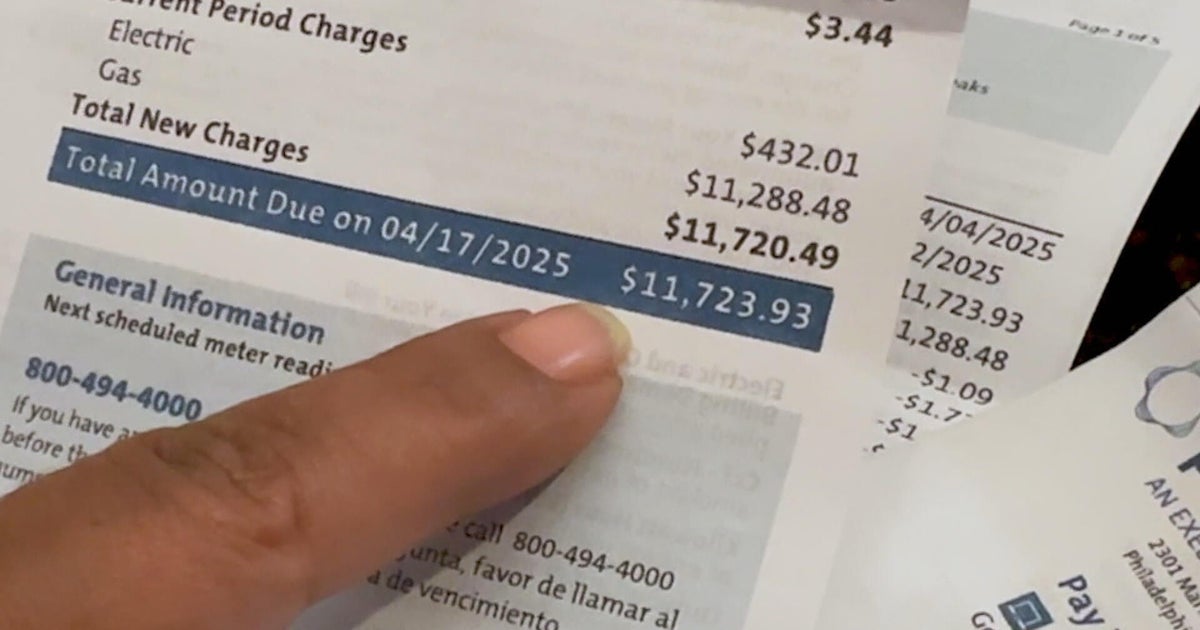

12 000 Peco Bill One Customers Shock Others Face Months Without Bills

Jun 03, 2025

12 000 Peco Bill One Customers Shock Others Face Months Without Bills

Jun 03, 2025 -

Economic Calendar What To Expect In Asia On Monday June 2nd 2025

Jun 03, 2025

Economic Calendar What To Expect In Asia On Monday June 2nd 2025

Jun 03, 2025