Is NIO Stock A Buy After Q1 Earnings Report?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is NIO Stock a Buy After Q1 Earnings Report? A Deep Dive into the Electric Vehicle Giant

NIO, a prominent player in the burgeoning electric vehicle (EV) market, recently released its Q1 2024 earnings report, sending ripples through the investment world. The report painted a mixed picture, leaving many investors wondering: is NIO stock a buy right now? This article delves into the key takeaways from the report, analyzing the company's performance and offering insights to help you make an informed investment decision.

NIO Q1 2024 Earnings: The Highlights

The Q1 report showcased both strengths and weaknesses for NIO. While the company delivered impressive vehicle deliveries, exceeding analyst expectations, certain financial metrics fell short. Let's break down the key aspects:

-

Strong Vehicle Deliveries: NIO reported a significant increase in vehicle deliveries compared to the same period last year, demonstrating continued growth in demand for its EVs. This positive trend is a crucial factor for evaluating the company's future prospects. This surge in deliveries underscores the growing appeal of NIO's vehicles, particularly in the competitive Chinese EV market.

-

Revenue Growth, But Margin Pressure: While revenue showed growth, it didn't quite match the pace of delivery increases. Profit margins faced pressure due to increased competition and price wars within the EV sector. This is a crucial area to consider when assessing the long-term viability of NIO's business model. Understanding the dynamics of pricing strategies and their impact on profitability is essential for any potential investor.

-

Future Outlook and Expansion Plans: NIO provided guidance for the upcoming quarters, hinting at continued investment in research and development (R&D), expansion into new markets, and the launch of new EV models. These expansion plans, while promising for long-term growth, also signify potential short-term financial strain. Investors need to weigh the risks and rewards associated with this growth strategy.

Analyzing the Investor Sentiment

Following the release of the Q1 earnings report, investor sentiment was mixed. Some analysts expressed concern over the margin pressure and the competitive landscape, while others remained optimistic about NIO's long-term growth potential. The stock price experienced some volatility in the days following the report, reflecting this uncertainty.

Factors to Consider Before Investing in NIO

Before deciding whether NIO stock is a buy for you, carefully consider these factors:

-

Market Competition: The EV market is incredibly competitive, with established players like Tesla and a growing number of Chinese rivals. NIO's ability to differentiate itself and maintain its market share is crucial for its success.

-

Government Regulations: Changes in government regulations, particularly in China, could significantly impact NIO's operations and profitability. Staying informed about the regulatory environment is essential.

-

Technological Innovation: Continuous technological advancements are vital for staying ahead in the EV race. NIO's investment in R&D and its ability to innovate will be key determinants of its future success.

-

Your Risk Tolerance: Investing in NIO carries inherent risks, given the volatility of the EV market and the company's growth stage. Only invest an amount you're comfortable potentially losing.

Conclusion: Is NIO a Buy?

The answer to whether NIO stock is a buy after its Q1 earnings report depends largely on your individual investment strategy and risk tolerance. While the strong delivery numbers are encouraging, the margin pressure and intense competition present significant challenges. Thorough research and careful consideration of the factors discussed above are essential before making any investment decisions. Consult with a qualified financial advisor before investing in any stock.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is NIO Stock A Buy After Q1 Earnings Report?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Snowfall Spinoff Asante Blackk Peyton Alex Smith And Simmie Sims Iii Lead The Pilot Cast

Jun 04, 2025

Snowfall Spinoff Asante Blackk Peyton Alex Smith And Simmie Sims Iii Lead The Pilot Cast

Jun 04, 2025 -

Sheinelle Joness Family A Source Speaks Out Following Loss

Jun 04, 2025

Sheinelle Joness Family A Source Speaks Out Following Loss

Jun 04, 2025 -

2 C World Urgent Action Needed For Business Preparedness

Jun 04, 2025

2 C World Urgent Action Needed For Business Preparedness

Jun 04, 2025 -

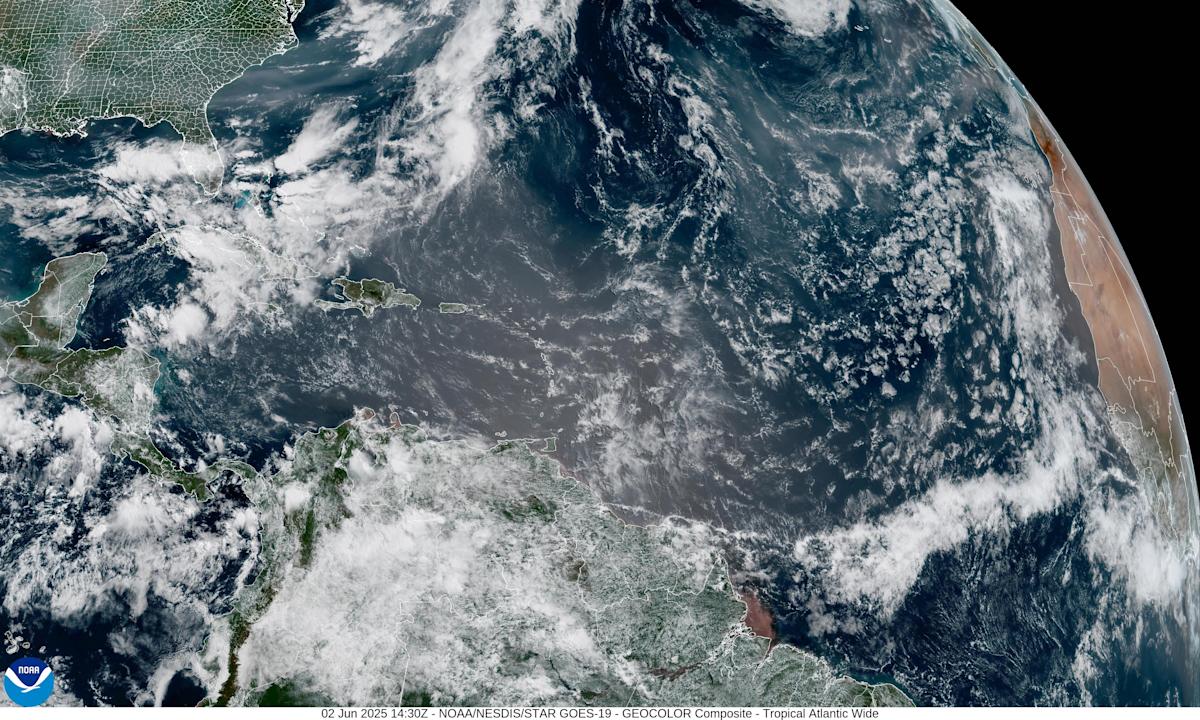

Wall Of Dust Examining The Effects Of Saharan Dust And Canadian Wildfire Smoke In Florida

Jun 04, 2025

Wall Of Dust Examining The Effects Of Saharan Dust And Canadian Wildfire Smoke In Florida

Jun 04, 2025 -

Analyzing Trumps Reaction To Scott Walkers Political Misstep

Jun 04, 2025

Analyzing Trumps Reaction To Scott Walkers Political Misstep

Jun 04, 2025