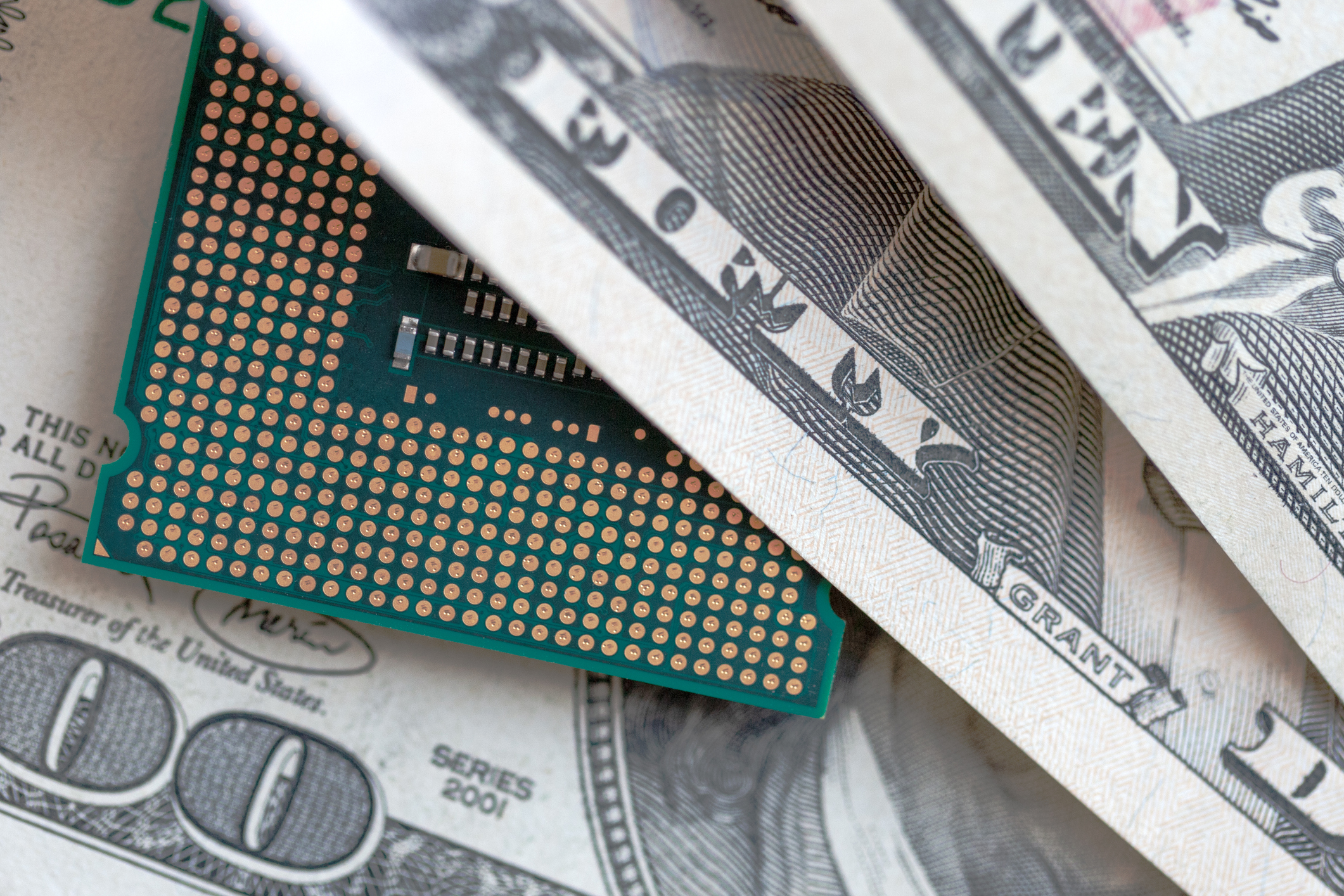

Is Intel's 2025 Turnaround A Risky Investment?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is Intel's 2025 Turnaround a Risky Investment?

Intel, a once-dominant force in the chip industry, has faced significant challenges in recent years, losing ground to rivals like AMD and TSMC. However, the company has outlined an ambitious plan for a turnaround by 2025, promising a resurgence in market share and profitability. But is this ambitious goal a sound investment opportunity, or a risky gamble? Let's delve into the details.

Intel's Ambitious Roadmap: A Gamble on Innovation?

Intel's strategy hinges on several key pillars: a renewed focus on process technology (with its upcoming 20A and 18A nodes), significant investments in manufacturing capacity (including new fabs in Arizona and Ohio), and a diversification strategy expanding beyond CPUs into other high-growth markets like GPUs and specialized AI accelerators. This ambitious plan requires billions of dollars in investment and relies heavily on successfully delivering on its technological promises. Failure to meet these ambitious targets could result in further market share erosion and significant financial losses.

The Risks Involved: More Than Just a Chip Shortage

While Intel’s challenges are partly industry-wide (such as the global chip shortage), the company faces unique hurdles. These include:

- Competition: AMD has consistently gained market share in CPUs, while TSMC dominates the foundry business. Intel needs to recapture lost ground against strong, well-established competitors.

- Technological Execution: Intel has faced delays in its process node advancements in recent years. Successfully delivering on its 20A and 18A node promises is crucial for its turnaround strategy. Any further delays could be catastrophic.

- Market Volatility: The semiconductor industry is notoriously cyclical. Unexpected downturns in demand could severely impact Intel's profitability and investment returns.

- High Capital Expenditure: The massive investments required for new fabs carry significant risk. If demand doesn't meet projections, these investments could become a major drag on profitability.

Potential Rewards: A Giant Awakens?

Despite the considerable risks, a successful turnaround could yield significant rewards for investors. If Intel can successfully execute its plan, the potential payoffs are substantial:

- Market Share Recovery: Reclaiming significant market share in CPUs and expanding into new markets could lead to substantial revenue growth.

- Improved Profit Margins: Technological advancements and increased manufacturing efficiency could boost profit margins.

- Innovation Leadership: Successfully delivering leading-edge process technologies could solidify Intel's position as a technology innovator.

Is it Worth the Risk? A Balanced Perspective

The question of whether investing in Intel's turnaround is worthwhile depends heavily on your risk tolerance. It's undeniably a high-risk, high-reward proposition. The company's success hinges on the successful execution of its ambitious roadmap, which faces significant headwinds.

For conservative investors, the risks might outweigh the potential rewards. However, more aggressive investors who are comfortable with substantial risk might see the potential for significant returns if Intel can successfully navigate its challenges and deliver on its promises. Thorough due diligence, including independent research and analysis, is essential before making any investment decisions.

Further Research: For a more in-depth understanding, consider consulting financial news sources like the Wall Street Journal and Bloomberg, as well as Intel's investor relations website for detailed financial reports and strategic updates. Remember to consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is Intel's 2025 Turnaround A Risky Investment?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Is This The End Apples Classic Mac Book Pro May Be Discontinued Soon

Jun 10, 2025

Is This The End Apples Classic Mac Book Pro May Be Discontinued Soon

Jun 10, 2025 -

Carlos Alcarazs Epic Roland Garros Recovery Sports Moment Of The Year

Jun 10, 2025

Carlos Alcarazs Epic Roland Garros Recovery Sports Moment Of The Year

Jun 10, 2025 -

Green Bays Receiving Corps Can A Position Change Save A Players Career

Jun 10, 2025

Green Bays Receiving Corps Can A Position Change Save A Players Career

Jun 10, 2025 -

Social Media Scrutiny Musks Trump Accusation Mysteriously Disappears

Jun 10, 2025

Social Media Scrutiny Musks Trump Accusation Mysteriously Disappears

Jun 10, 2025 -

Fake News Whoopi Goldberg Challenges Elon Musk Trump Breakup Narrative On The View

Jun 10, 2025

Fake News Whoopi Goldberg Challenges Elon Musk Trump Breakup Narrative On The View

Jun 10, 2025