Is Intel (INTC) A Buy After A 35% Drop?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is Intel (INTC) a Buy After a 35% Drop? A Deep Dive into the Chip Giant's Future

Intel (INTC) has experienced a significant downturn, plummeting over 35% in value. This dramatic fall has left many investors wondering: is now the time to buy? The answer, as with most investment questions, is complex and depends heavily on individual risk tolerance and investment strategy. This article delves into the factors contributing to Intel's decline and explores whether the current price presents a compelling buying opportunity.

The Fall from Grace: Understanding Intel's Recent Struggles

Intel's recent struggles are multifaceted, stemming from several key areas:

-

Increased Competition: The semiconductor industry is fiercely competitive. AMD's (AMD) resurgence in CPUs and the rise of NVIDIA (NVDA) in GPUs have significantly impacted Intel's market share. This intensified competition has squeezed profit margins and slowed growth.

-

Manufacturing Delays and Technological Challenges: Intel has faced setbacks in its manufacturing process, falling behind rivals in the race to produce smaller, more efficient chips. This has impacted their ability to deliver cutting-edge processors, a critical factor in maintaining competitiveness. Read more about the complexities of semiconductor manufacturing . (This is a placeholder link; replace with a relevant article)

-

Economic Headwinds: The global economic slowdown has impacted demand for semiconductors, affecting Intel's sales and revenue. The decrease in consumer spending and business investment has further exacerbated the company's challenges.

-

CEO Transition and Strategic Shifts: The recent change in leadership at Intel and the subsequent strategic shifts require time to bear fruit. The effectiveness of these changes remains to be seen.

Is the Dip a Buying Opportunity? A Cautious Optimism

While the situation looks challenging, there are arguments to be made for considering Intel at its current price:

-

Undervalued Assets: Some analysts believe Intel's stock price significantly undervalues its substantial assets and intellectual property. A turnaround could lead to significant gains.

-

Potential for Growth: Intel is investing heavily in new technologies and manufacturing processes. Successful implementation of these initiatives could reverse the current trend and reignite growth. Their focus on advanced packaging technologies could prove particularly significant.

-

Dividend Yield: Intel offers a relatively high dividend yield, providing a source of income even if the stock price remains stagnant. This makes it attractive to income-focused investors.

Risks Remain: Proceed with Caution

Despite the potential upside, it's crucial to acknowledge the significant risks involved:

-

Continued Competition: The competitive landscape remains intense, and there's no guarantee Intel can regain lost market share.

-

Execution Risk: The success of Intel's strategic initiatives depends on effective execution, which is not guaranteed.

-

Economic Uncertainty: Global economic conditions remain unpredictable, potentially further impacting demand for semiconductors.

The Verdict: A Long-Term Perspective

Intel's 35% drop presents a complex investment scenario. The company faces significant challenges but also possesses considerable assets and potential for future growth. For long-term investors with a high risk tolerance, the current price might offer a compelling entry point, particularly if they believe in the company's long-term strategic vision. However, it's vital to conduct thorough due diligence and consult with a financial advisor before making any investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is Intel (INTC) A Buy After A 35% Drop?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Heated White House Exchange Elon Musks Physical Interaction With Treasury Secretary Bessent

Jun 11, 2025

Heated White House Exchange Elon Musks Physical Interaction With Treasury Secretary Bessent

Jun 11, 2025 -

Karoline Leavitts Statement On Elon Musk And Treasury Secretary Scott Bessents Interaction

Jun 11, 2025

Karoline Leavitts Statement On Elon Musk And Treasury Secretary Scott Bessents Interaction

Jun 11, 2025 -

Dissecting The 2024 Nba Draft Where Team Needs Meet Best Available Talent

Jun 11, 2025

Dissecting The 2024 Nba Draft Where Team Needs Meet Best Available Talent

Jun 11, 2025 -

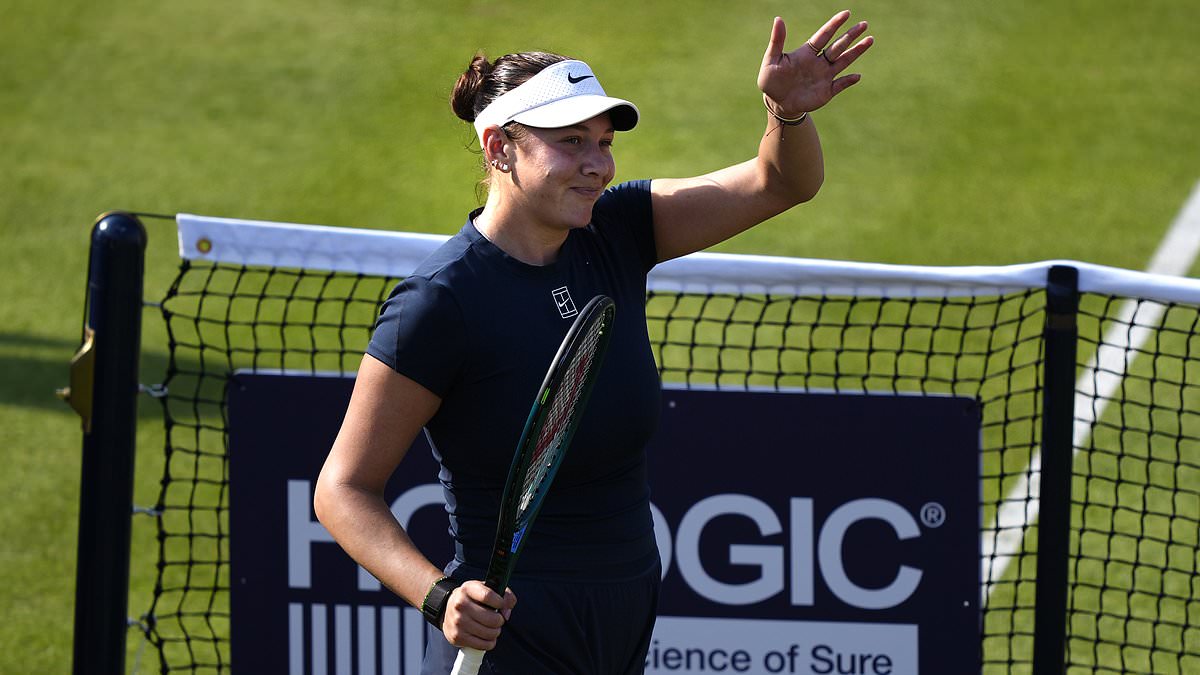

Controversy At Queen S American Player Apologizes To British Fans

Jun 11, 2025

Controversy At Queen S American Player Apologizes To British Fans

Jun 11, 2025 -

White House Witness Account Elon Musks Rugby Style Confrontation With Bessent

Jun 11, 2025

White House Witness Account Elon Musks Rugby Style Confrontation With Bessent

Jun 11, 2025