Is Intel A Buy In 2025? Assessing The Turnaround Potential

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is Intel a Buy in 2025? Assessing the Turnaround Potential

Intel. The name conjures images of technological innovation, but recent years have seen the chip giant struggle to maintain its dominance. So, is Intel a buy in 2025? The answer isn't a simple yes or no, and requires a deep dive into the company's turnaround strategy and the evolving semiconductor landscape.

Intel's recent struggles stem from a confluence of factors. The rise of competitors like TSMC and Samsung in advanced manufacturing processes, coupled with internal execution challenges, led to a significant loss of market share in the high-performance computing (HPC) space. However, the company is actively working to reverse this trend, investing heavily in its manufacturing capabilities and launching new product lines.

Intel's Turnaround Strategy: A Multi-Pronged Approach

Intel's CEO, Pat Gelsinger, has spearheaded a significant restructuring, focusing on several key areas:

- Investing in Manufacturing: Intel is aggressively expanding its manufacturing capacity with its IDM 2.0 strategy. This involves significant capital expenditures in building new fabs (fabrication plants) and mastering advanced process nodes (like 3nm and beyond). This is crucial for regaining competitiveness in producing cutting-edge chips.

- New Product Lines: Intel is pushing into new markets, beyond its traditional stronghold in CPUs. This includes expansion into discrete GPUs (graphics processing units), a market currently dominated by Nvidia and AMD. Success here would significantly diversify their revenue streams.

- Focusing on Innovation: Intel is emphasizing innovation in chip architecture and design, aiming to regain its technological edge. This involves developing new chip designs optimized for specific applications, such as artificial intelligence and high-performance computing.

- Strategic Partnerships: Intel is forging strategic partnerships, acknowledging the complexities of the semiconductor industry. This collaborative approach aims to leverage external expertise and accelerate its progress in certain areas.

Challenges Remain: Navigating a Competitive Landscape

Despite Intel's ambitious turnaround plan, significant challenges persist:

- Catch-Up in Manufacturing: Intel is playing catch-up to its competitors in advanced node technology. Overcoming this gap requires substantial investment and flawless execution.

- Competition: The semiconductor industry is fiercely competitive. Maintaining market share against established players like TSMC, Samsung, and Nvidia will be a continuous uphill battle.

- Economic Uncertainty: The global economic climate plays a significant role. Demand fluctuations and potential economic downturns could impact Intel's growth trajectory.

Is Intel a Buy in 2025? A Cautious Outlook

Predicting the future is always risky, particularly in the volatile tech sector. While Intel's turnaround strategy shows promise, success is not guaranteed. The company faces significant hurdles, and investors need to carefully weigh the potential rewards against the considerable risks.

Factors to Consider Before Investing:

- Intel's Financial Performance: Closely monitor Intel's quarterly earnings reports and financial statements to gauge the effectiveness of their turnaround efforts.

- Technological Advancements: Keep abreast of Intel's progress in developing and manufacturing advanced chip technologies.

- Market Conditions: Pay attention to overall market trends in the semiconductor industry, including demand, pricing, and competition.

Conclusion:

Intel's future is far from certain. While the company is taking decisive action to revitalize its business, the path to recovery is long and challenging. Investing in Intel in 2025 requires a long-term perspective and a tolerance for risk. Conduct thorough due diligence and consider consulting with a financial advisor before making any investment decisions. The potential for significant returns exists, but so does the risk of further losses. Only time will tell if Intel's ambitious plan will yield the desired results. Stay informed and stay tuned for further updates.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is Intel A Buy In 2025? Assessing The Turnaround Potential. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

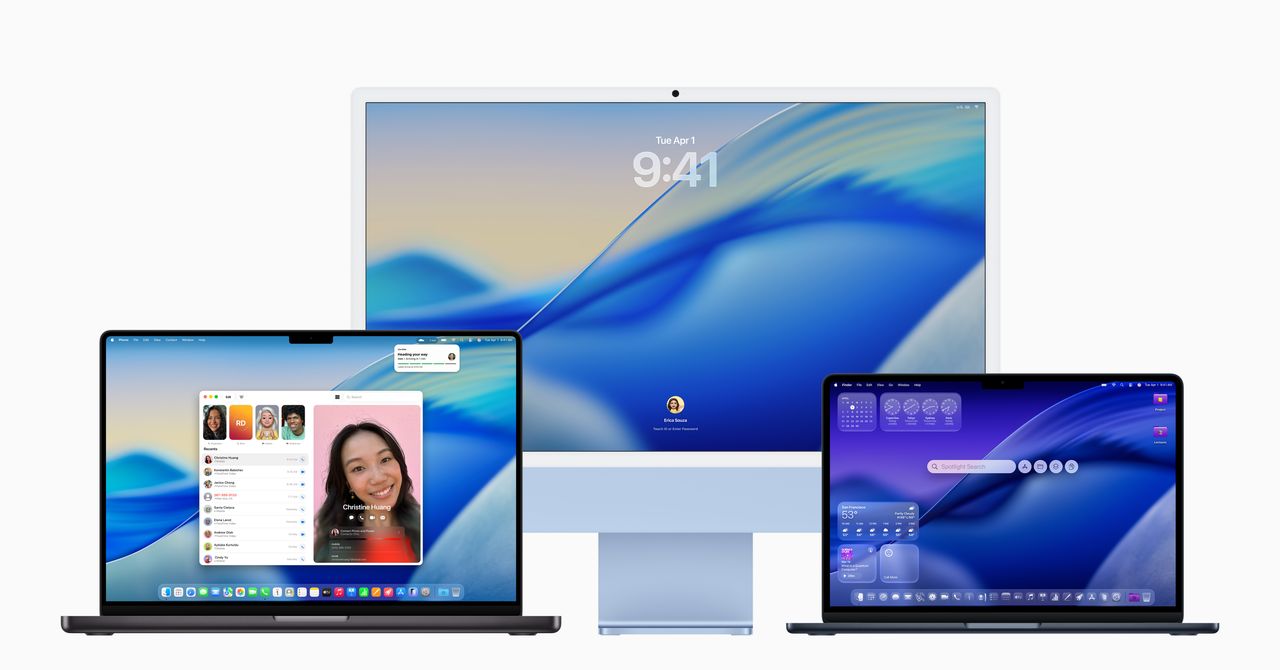

The Last Intel Mac A Retrospective And Look Ahead

Jun 11, 2025

The Last Intel Mac A Retrospective And Look Ahead

Jun 11, 2025 -

Queens Club Championship Live Scores And Keys Zakharova Match Highlights

Jun 11, 2025

Queens Club Championship Live Scores And Keys Zakharova Match Highlights

Jun 11, 2025 -

Latest Nba Mock Draft A Head To Head Analysis Of Team Needs And Best Value Picks

Jun 11, 2025

Latest Nba Mock Draft A Head To Head Analysis Of Team Needs And Best Value Picks

Jun 11, 2025 -

Intel Stock Intc Plummets A Deep Dive Into The 35 Decline And Investment Strategy

Jun 11, 2025

Intel Stock Intc Plummets A Deep Dive Into The 35 Decline And Investment Strategy

Jun 11, 2025 -

Boost Your Macs Performance With Mac Os Tahoe 26

Jun 11, 2025

Boost Your Macs Performance With Mac Os Tahoe 26

Jun 11, 2025