Is Hims & Hers (HIMS) Stock Overvalued? A Risk Assessment.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is Hims & Hers (HIMS) Stock Overvalued? A Risk Assessment

Hims & Hers Health, Inc. (HIMS), the telehealth company disrupting the men's and women's health market, has seen its stock price fluctuate significantly since its IPO. This raises a crucial question for potential investors: is HIMS stock currently overvalued, and what are the inherent risks? This in-depth analysis explores the company's performance, market position, and future prospects to help you assess the risk.

Hims & Hers: A Disruptive Force in Telehealth

Hims & Hers has carved a niche for itself by offering convenient and affordable access to healthcare services, primarily focusing on dermatology, sexual health, and mental wellness. Their direct-to-consumer model, utilizing a user-friendly app and online platform, has attracted a large and growing customer base. This accessibility is a major draw, particularly for individuals who may find traditional healthcare options cumbersome or expensive.

However, this convenient approach isn't without its challenges. The company faces intense competition from established players and emerging startups in the rapidly evolving telehealth landscape. Maintaining a competitive edge requires constant innovation and substantial marketing investment.

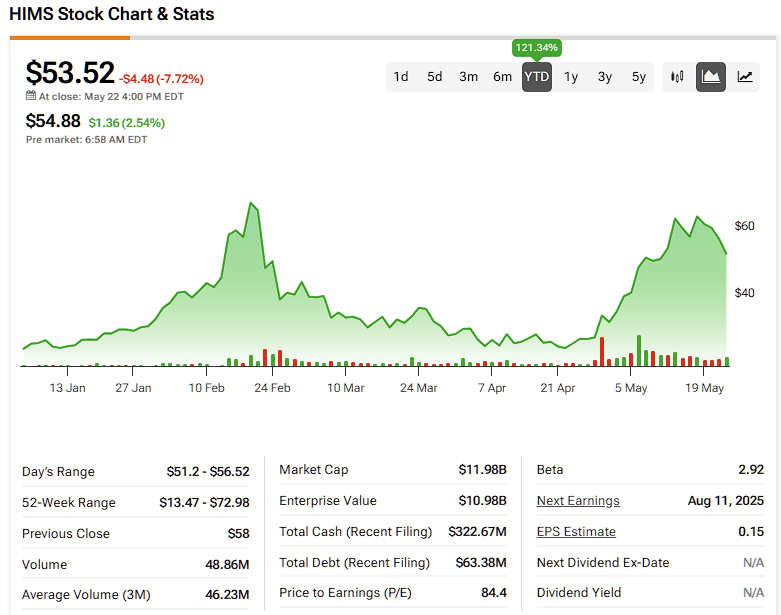

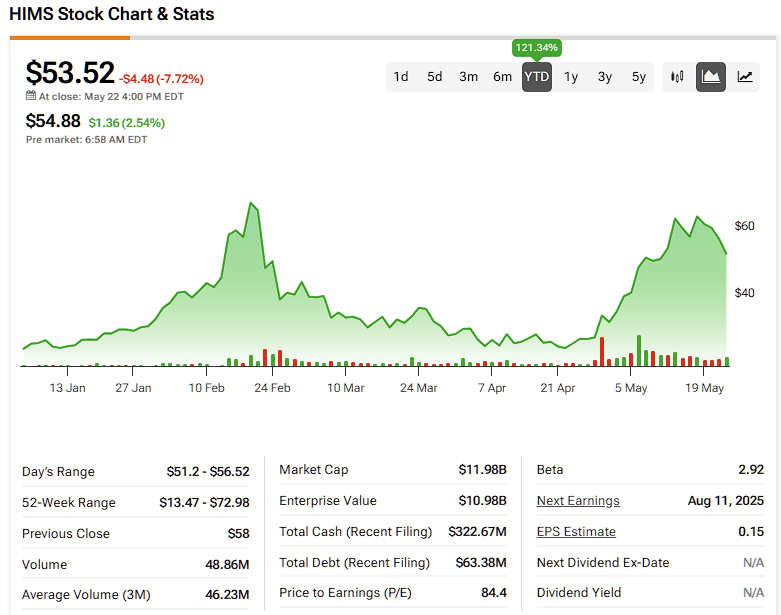

Financial Performance and Valuation Metrics

Analyzing HIMS's financial statements is crucial to assessing its valuation. Key metrics to consider include:

- Revenue Growth: Examining the year-over-year revenue growth reveals the company's ability to expand its market share and attract new customers. While HIMS has shown growth, its sustainability needs further scrutiny.

- Profitability: HIMS is currently operating at a loss. Assessing the path to profitability is critical. Investors need to understand the company's strategy for achieving sustainable positive cash flow.

- Debt Levels: High debt can significantly impact a company's financial stability and future growth potential. Analyzing HIMS's debt-to-equity ratio provides insights into its financial risk profile.

- Price-to-Sales Ratio (P/S): Compared to industry peers, the P/S ratio can indicate whether HIMS is overvalued or undervalued. A high P/S ratio may suggest the market is pricing in significant future growth, which may or may not materialize.

Key Risks Associated with Investing in HIMS Stock

Investing in HIMS stock comes with several risks:

- Competition: The telehealth market is highly competitive. Existing healthcare providers and new entrants are constantly vying for market share. HIMS's ability to maintain its competitive advantage is paramount.

- Regulatory Uncertainty: The healthcare industry is subject to significant regulation. Changes in regulations could negatively impact HIMS's operations and profitability.

- Dependence on Marketing: HIMS relies heavily on marketing to attract new customers. Reduced marketing effectiveness could hurt its growth trajectory.

- Customer Acquisition Costs: Acquiring new customers can be expensive. If customer acquisition costs outpace revenue growth, profitability will be negatively affected.

- Data Privacy and Security: As a telehealth company, HIMS handles sensitive patient data. Data breaches could severely damage its reputation and lead to significant legal and financial liabilities.

Conclusion: A Cautious Approach

While Hims & Hers presents a compelling investment opportunity due to its innovative business model and market potential, the risks are significant. The high valuation, coupled with the intense competition and ongoing losses, warrants a cautious approach. Before investing, conduct thorough due diligence, paying close attention to the company's financial performance, competitive landscape, and regulatory environment. Consider consulting a financial advisor to assess your risk tolerance and determine if HIMS aligns with your investment strategy. Further research into quarterly earnings reports and SEC filings is strongly recommended.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money. Always conduct your own research before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is Hims & Hers (HIMS) Stock Overvalued? A Risk Assessment.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ukraine Accuses Russia Underwater Drone Attack On Crimean Bridge

Jun 04, 2025

Ukraine Accuses Russia Underwater Drone Attack On Crimean Bridge

Jun 04, 2025 -

Scott Walkers Failed Attempt To Impress Donald Trump

Jun 04, 2025

Scott Walkers Failed Attempt To Impress Donald Trump

Jun 04, 2025 -

Three Actors Join Cast Of Snowfall Spinoff Pilot

Jun 04, 2025

Three Actors Join Cast Of Snowfall Spinoff Pilot

Jun 04, 2025 -

Roseanne Barr Recovers Embraces Texas Ranching After Accident

Jun 04, 2025

Roseanne Barr Recovers Embraces Texas Ranching After Accident

Jun 04, 2025 -

Trumps Big Beautiful Bill Republican Divisions And Public Backlash

Jun 04, 2025

Trumps Big Beautiful Bill Republican Divisions And Public Backlash

Jun 04, 2025