Is Hims & Hers (HIMS) Stock Overvalued? A Detailed Analysis.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is Hims & Hers (HIMS) Stock Overvalued? A Detailed Analysis

Hims & Hers Health, Inc. (HIMS), the telehealth company disrupting the direct-to-consumer healthcare market, has seen its stock price fluctuate significantly since its initial public offering (IPO). This raises a crucial question for potential investors: Is HIMS stock overvalued? This detailed analysis explores the company's performance, market position, and future prospects to help answer this question.

Hims & Hers: A Disruptive Force in Telehealth

Hims & Hers offers a convenient and accessible platform for consumers seeking treatment for various health concerns, including hair loss, sexual health, and skincare. Their direct-to-consumer model, coupled with telehealth services, has resonated with a significant portion of the market. This business model eliminates the need for traditional doctor visits, offering convenience and often lower costs. However, this convenience comes with its own set of challenges and potential risks.

Factors Suggesting Overvaluation:

-

High Valuation Relative to Earnings: One of the primary concerns surrounding HIMS stock is its relatively high price-to-earnings (P/E) ratio compared to established players in the healthcare sector. While high growth potential justifies a higher P/E ratio, HIMS's current valuation may be exceeding sustainable levels based on current earnings. Investors should carefully analyze the company's financial statements and projections before investing.

-

Increased Competition: The telehealth market is becoming increasingly crowded. Established healthcare providers and new entrants are aggressively competing for market share, putting pressure on HIMS's pricing and profitability. This competitive landscape poses a significant challenge to HIMS's long-term growth trajectory.

-

Regulatory Uncertainty: The telehealth industry is subject to evolving regulations. Changes in healthcare policies could impact HIMS's operations and profitability, creating uncertainty for investors. Staying informed about regulatory developments is crucial for anyone considering investing in HIMS.

Factors Suggesting Undervaluation:

-

Significant Market Opportunity: The market for telehealth services is substantial and continues to grow rapidly. HIMS is well-positioned to capitalize on this growth, particularly as consumer preference for convenient healthcare options increases.

-

Strong Brand Recognition: Hims & Hers have built a strong brand identity and considerable customer loyalty. Their marketing strategies have successfully targeted a specific demographic, fostering brand recognition and driving repeat business.

-

Potential for Expansion: HIMS has opportunities to expand its product offerings and target new demographics. Diversification into new healthcare areas could further drive revenue growth and enhance its long-term value.

Conclusion: A Balanced Perspective

Determining whether HIMS stock is overvalued requires a thorough evaluation of both its strengths and weaknesses. While the company operates in a rapidly expanding market with significant growth potential and strong brand recognition, concerns remain regarding its high valuation relative to earnings and the increasing competitive pressure.

What to Consider Before Investing:

- Thoroughly review HIMS's financial statements and SEC filings. Understand the company's revenue streams, profitability, and debt levels.

- Analyze the competitive landscape. Identify key competitors and assess their market share and strategies.

- Stay informed about regulatory changes in the telehealth industry. Changes in regulations could significantly impact HIMS's business.

- Consider your own risk tolerance. Investing in growth stocks like HIMS carries inherent risks.

Ultimately, the decision of whether or not to invest in HIMS stock is a personal one based on your individual investment goals and risk tolerance. This analysis provides a framework for informed decision-making, but it's crucial to conduct your own due diligence before making any investment choices. Remember to consult with a qualified financial advisor before making any investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is Hims & Hers (HIMS) Stock Overvalued? A Detailed Analysis.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

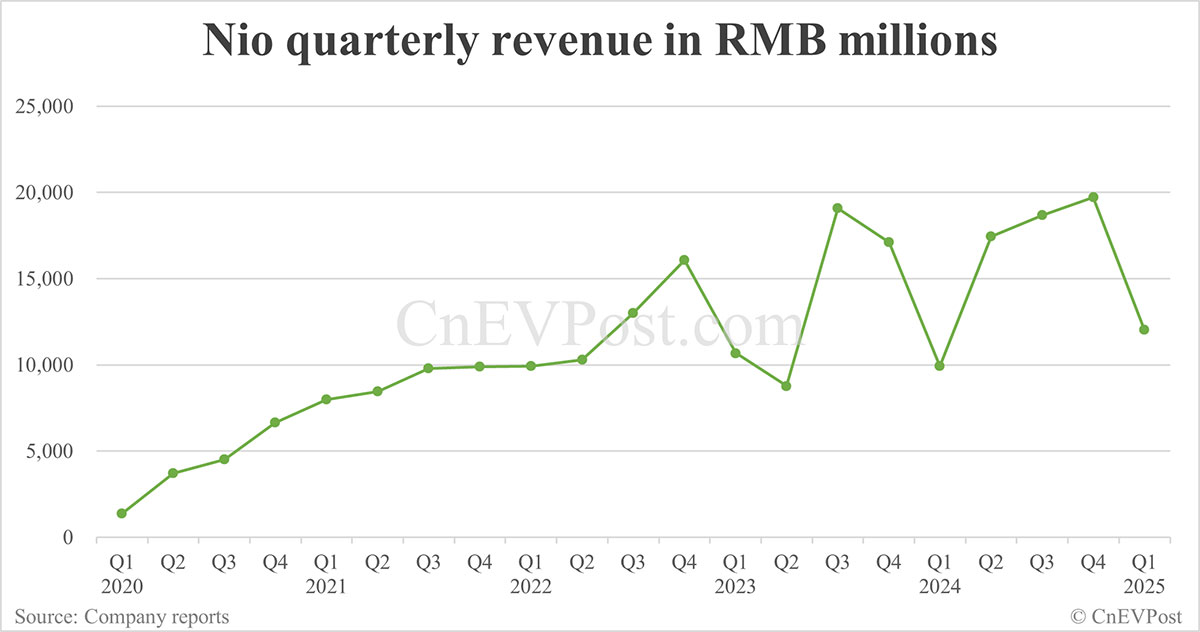

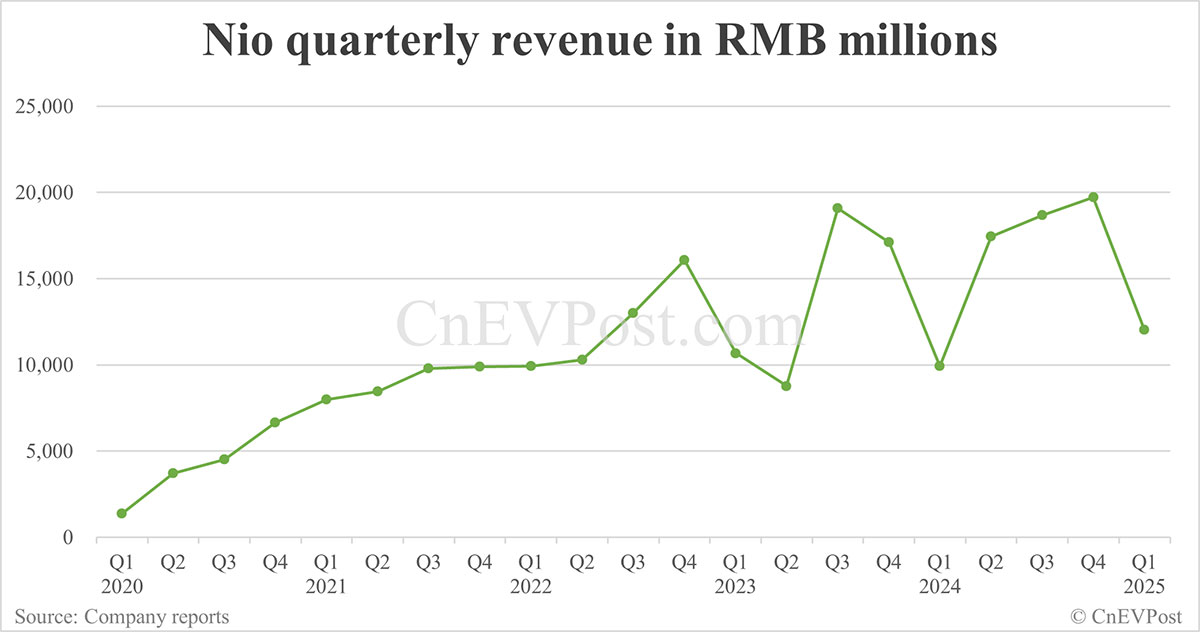

Nios Q1 2024 Financial Report Shows 21 Revenue Increase

Jun 04, 2025

Nios Q1 2024 Financial Report Shows 21 Revenue Increase

Jun 04, 2025 -

Snowfall Spinoff Pilot Cast Announced Asante Blackk Peyton Alex Smith And Simmie Sims Iii To Star

Jun 04, 2025

Snowfall Spinoff Pilot Cast Announced Asante Blackk Peyton Alex Smith And Simmie Sims Iii To Star

Jun 04, 2025 -

Nio Reports Strong Q1 2024 Results 21 Revenue Increase

Jun 04, 2025

Nio Reports Strong Q1 2024 Results 21 Revenue Increase

Jun 04, 2025 -

Accusations Of Racism Lu Pone Under Fire From Over 500 Broadway Colleagues

Jun 04, 2025

Accusations Of Racism Lu Pone Under Fire From Over 500 Broadway Colleagues

Jun 04, 2025 -

Nio Stock Analyzing The Q1 Earnings Impact On Share Price

Jun 04, 2025

Nio Stock Analyzing The Q1 Earnings Impact On Share Price

Jun 04, 2025