Is Hims & Hers (HIMS) Stock A Buy Or Sell? A Deep Dive

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is Hims & Hers (HIMS) Stock a Buy or Sell? A Deep Dive

Hims & Hers Health (HIMS), a telehealth company disrupting the men's and women's health market, has seen its stock price fluctuate significantly. This leaves many investors wondering: is HIMS stock a buy or a sell? This deep dive will explore the company's financials, market position, and future prospects to help you make an informed decision.

Hims & Hers: A Telehealth Pioneer

Hims & Hers offers convenient, affordable access to healthcare services through its telehealth platform. They specialize in treating conditions like hair loss, sexual health concerns, and skincare issues, catering to a broad demographic. This business model has proven popular, attracting a substantial user base and generating considerable revenue. However, the company also faces significant challenges.

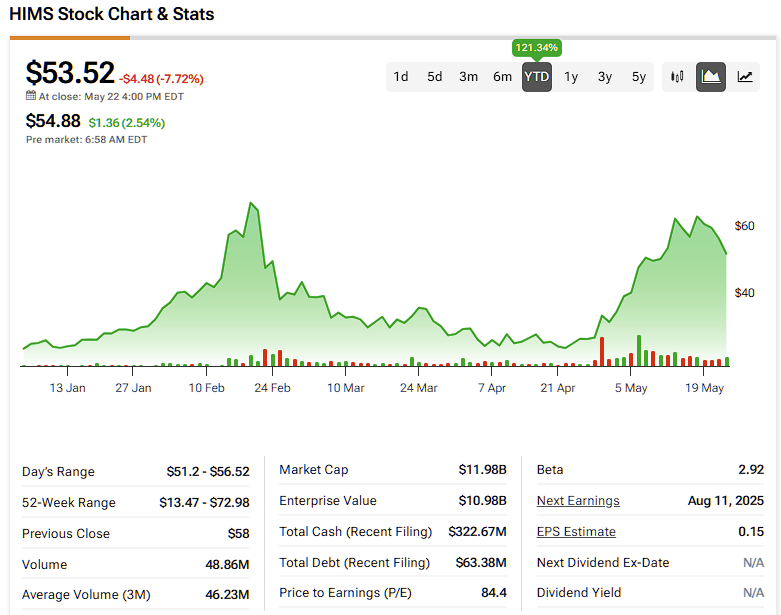

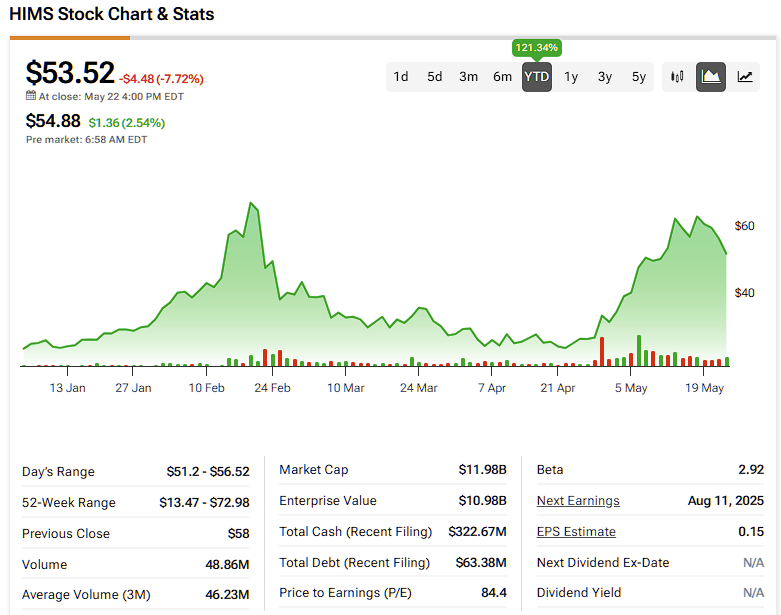

Analyzing HIMS Stock Performance:

HIMS's stock performance has been a rollercoaster ride. While early investor enthusiasm propelled the stock price upward, recent performance has been more volatile. Several factors contribute to this volatility, including:

- Increased Competition: The telehealth market is becoming increasingly crowded, with established players and new entrants vying for market share. This competitive landscape puts pressure on HIMS's pricing and profitability.

- Regulatory Scrutiny: The healthcare industry is heavily regulated, and telehealth companies are subject to various compliance requirements. Changes in regulations could impact HIMS's operations and profitability.

- Economic Uncertainty: Macroeconomic factors, such as inflation and recessionary fears, can significantly affect consumer spending and investment decisions. These broader economic forces invariably impact HIMS's stock price.

Financial Health and Growth Potential:

While HIMS demonstrates impressive revenue growth, profitability remains a challenge. Investors should carefully examine the company's financial statements, including revenue streams, operating expenses, and net income, to assess its long-term viability. Key metrics to consider include:

- Revenue Growth: Analyze the year-over-year revenue growth to understand the company's expansion rate.

- Profit Margins: Examine the gross and operating profit margins to assess the company's profitability and efficiency.

- Debt Levels: Evaluate the company's debt-to-equity ratio to gauge its financial leverage and risk.

Accessing HIMS's financial statements directly through the company's investor relations website and through reputable financial news sources like the is crucial for a complete picture.

HIMS Stock Valuation:

Determining whether HIMS stock is undervalued or overvalued requires a thorough valuation analysis. Several valuation methods exist, including discounted cash flow (DCF) analysis and comparable company analysis. Comparing HIMS's valuation metrics (like Price-to-Earnings ratio or P/E) to those of its competitors can provide valuable insights. However, relying solely on one metric is insufficient; a comprehensive approach is necessary.

Is HIMS Stock a Buy or Sell? The Verdict:

The decision of whether to buy or sell HIMS stock is complex and depends heavily on individual investment goals and risk tolerance. While the company has significant growth potential in the rapidly expanding telehealth market, it also faces considerable challenges. Investors should carefully consider the following:

- Your Risk Tolerance: HIMS stock is inherently risky due to its volatility and the competitive nature of the industry.

- Long-Term Perspective: Investing in HIMS requires a long-term perspective, as significant returns may not be realized immediately.

- Diversification: As with any investment, diversifying your portfolio to mitigate risk is crucial.

Before making any investment decisions, consult with a qualified financial advisor to discuss your individual circumstances and receive personalized advice. This article serves as informational analysis and does not constitute financial advice. Conduct your own thorough research before investing in HIMS or any other stock.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is Hims & Hers (HIMS) Stock A Buy Or Sell? A Deep Dive. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Crimea Bridge Explosion Damage Assessment And Casualties

Jun 03, 2025

Crimea Bridge Explosion Damage Assessment And Casualties

Jun 03, 2025 -

Crimea Bridge Hit Latest Updates On The Incident And Casualties

Jun 03, 2025

Crimea Bridge Hit Latest Updates On The Incident And Casualties

Jun 03, 2025 -

After Backlash Patti Lu Pone Offers Apology For Broadway Statements

Jun 03, 2025

After Backlash Patti Lu Pone Offers Apology For Broadway Statements

Jun 03, 2025 -

Actors Son Critically Injured In Henry County Tornado Road To Recovery

Jun 03, 2025

Actors Son Critically Injured In Henry County Tornado Road To Recovery

Jun 03, 2025 -

Economic Fallout Trump Justifies Steep Increase In Metal Tariffs

Jun 03, 2025

Economic Fallout Trump Justifies Steep Increase In Metal Tariffs

Jun 03, 2025