Is Hims & Hers (HIMS) Stock A Buy Or A Sell? A Market Analysis.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is Hims & Hers (HIMS) Stock a Buy or a Sell? A Market Analysis

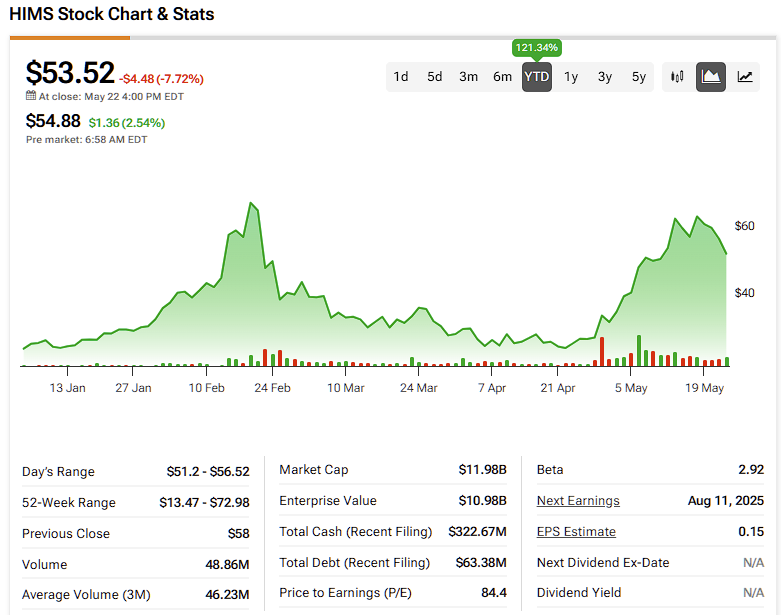

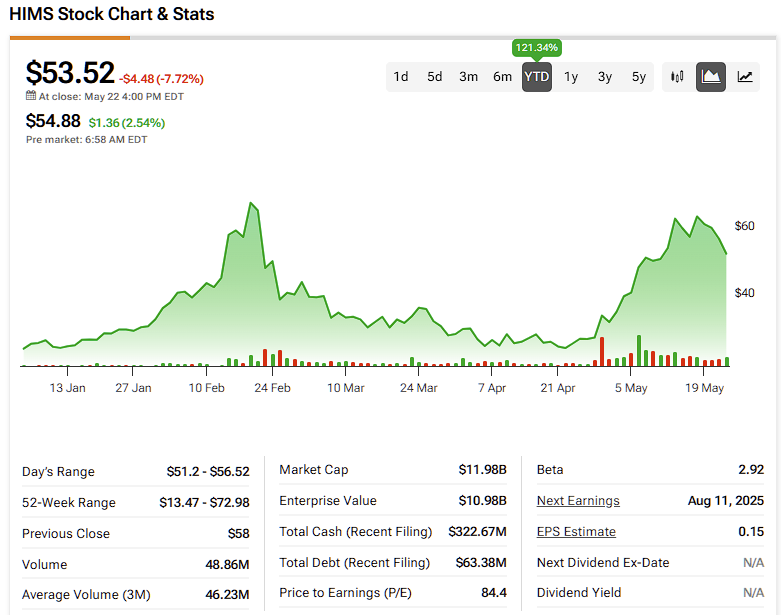

Hims & Hers (HIMS), the telehealth company disrupting the men's and women's health market, has seen its stock price fluctuate significantly since its IPO. For potential investors, the question remains: is HIMS stock a buy or a sell? This market analysis delves into the company's performance, future prospects, and the factors influencing its stock price to help you make an informed decision.

Hims & Hers: A Quick Overview

Hims & Hers offers convenient, affordable access to healthcare services, primarily focusing on dermatology, sexual health, and mental wellness. Their direct-to-consumer model, utilizing telehealth technology and a subscription-based approach, has attracted a large and growing customer base. This business model eliminates many of the traditional barriers to healthcare access, making it a disruptive force in the industry. However, the competitive landscape is intensifying, with established players and new entrants vying for market share.

Factors Influencing HIMS Stock Price

Several factors contribute to the volatility of HIMS stock:

- Market Sentiment: The overall market sentiment significantly impacts HIMS, as it does with many growth stocks. Periods of economic uncertainty can lead to sell-offs, even if the company's fundamentals remain strong.

- Competition: The telehealth market is increasingly competitive. Established players and new entrants are constantly innovating and expanding their service offerings, putting pressure on HIMS's market share and profitability. Understanding the competitive landscape is crucial for evaluating HIMS's long-term prospects.

- Regulatory Landscape: Changes in healthcare regulations can significantly impact HIMS's operations and profitability. Keeping abreast of regulatory developments is essential for assessing potential risks and opportunities.

- Financial Performance: HIMS's financial performance, including revenue growth, profitability, and cash flow, is a key driver of its stock price. Analyzing these metrics provides valuable insights into the company's financial health and future prospects. Investors should carefully review their quarterly and annual reports. [Link to Hims & Hers investor relations page]

- Growth Potential: HIMS's ability to expand its customer base, penetrate new markets, and introduce new products and services will significantly influence its future growth and stock price. The company's strategic initiatives and expansion plans should be carefully considered.

Strengths and Weaknesses of HIMS

Strengths:

- Convenient and Accessible Healthcare: HIMS offers a convenient and accessible alternative to traditional healthcare, appealing to a broad customer base.

- Strong Brand Recognition: The company has built a strong brand presence and recognition within its target market.

- Subscription Model: The subscription-based model provides recurring revenue, enhancing predictability and stability.

Weaknesses:

- Dependence on Telehealth: HIMS's reliance on telehealth makes it vulnerable to changes in telehealth regulations and technological advancements.

- Competition: As mentioned earlier, intense competition poses a significant challenge to HIMS's market share and profitability.

- Profitability: HIMS is currently not yet highly profitable, and achieving sustained profitability remains a key challenge.

Is HIMS Stock a Buy or a Sell?

Determining whether HIMS stock is a buy or a sell depends largely on individual investment goals, risk tolerance, and market outlook. While the company exhibits significant growth potential in a burgeoning market, it also faces considerable challenges, including intense competition and the need to achieve sustained profitability.

For long-term investors with a high-risk tolerance, HIMS might be considered a speculative buy, betting on its long-term growth potential. However, risk-averse investors may find the volatility and uncertainty associated with HIMS stock too risky.

Before making any investment decision, it's crucial to conduct thorough due diligence, including reviewing financial statements, analyzing industry trends, and considering your own investment goals and risk tolerance. Consulting with a qualified financial advisor is always recommended.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves significant risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is Hims & Hers (HIMS) Stock A Buy Or A Sell? A Market Analysis.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Source Confirms Sheinelle Joness Family Focus Post Loss

Jun 04, 2025

Source Confirms Sheinelle Joness Family Focus Post Loss

Jun 04, 2025 -

Renewed Attacks Ukraine Claims New Underwater Bombing Near Crimean Bridge

Jun 04, 2025

Renewed Attacks Ukraine Claims New Underwater Bombing Near Crimean Bridge

Jun 04, 2025 -

Joe Root England Captain Brook Says Hes Improving With Age

Jun 04, 2025

Joe Root England Captain Brook Says Hes Improving With Age

Jun 04, 2025 -

Social Media Firestorm Wvu Players Pitt Logo Disrespect Ignites Twitter

Jun 04, 2025

Social Media Firestorm Wvu Players Pitt Logo Disrespect Ignites Twitter

Jun 04, 2025 -

Chicago Fire Soccer Stadium The 78 Developments 650 M Game Changer

Jun 04, 2025

Chicago Fire Soccer Stadium The 78 Developments 650 M Game Changer

Jun 04, 2025