Is Affordable Housing The Next Big Profit Driver For Real Estate?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is Affordable Housing the Next Big Profit Driver for Real Estate?

The real estate market, known for its volatility and high-profit potential, is increasingly turning its gaze towards a sector often overlooked: affordable housing. While traditionally seen as a social responsibility rather than a lucrative investment, a confluence of factors suggests that affordable housing could be the next big profit driver for savvy real estate developers and investors. But is this a realistic expectation, or just another market trend destined to fade?

The Shifting Landscape of Housing Demand:

The current housing crisis highlights a significant gap between supply and demand, particularly within the affordable housing segment. Millennials and Gen Z, burdened by student debt and stagnant wages, are increasingly priced out of the traditional housing market. This demographic shift, coupled with rising inflation and interest rates, has created a massive underserved population desperately seeking affordable rental and ownership options. This pent-up demand represents a potentially enormous untapped market.

Government Incentives and Policy Changes:

Recognizing the critical need for affordable housing, governments at both the national and local levels are implementing various incentives and policies to encourage investment in this sector. Tax breaks, grants, and expedited permitting processes are becoming increasingly common, making affordable housing projects more financially attractive for developers. These government initiatives are injecting significant capital into the market, fostering growth and reducing financial risk for investors.

The Rise of ESG Investing:

Environmental, Social, and Governance (ESG) investing is gaining significant traction, and affordable housing aligns perfectly with its core principles. Investors are increasingly seeking projects that generate positive social impact alongside financial returns. Investing in affordable housing allows investors to align their portfolios with their values while capitalizing on a growing market segment. This growing interest in ESG-compliant investments is driving further capital into the affordable housing sector.

Challenges and Considerations:

While the potential for profit is undeniable, several challenges remain. Developing affordable housing often involves navigating complex regulatory hurdles, securing land at reasonable prices, and managing potentially higher construction and maintenance costs. Furthermore, successful affordable housing projects require a long-term perspective, as returns may not be as immediate as in other real estate sectors.

Innovative Solutions and Future Outlook:

To address these challenges, innovative solutions are emerging, including modular construction techniques, the utilization of sustainable materials, and the implementation of technology to streamline the development process. These innovations are helping to reduce costs, improve efficiency, and enhance the overall sustainability of affordable housing projects.

The Verdict:

The future of affordable housing in the real estate market looks promising. The convergence of unmet demand, supportive government policies, and the increasing popularity of ESG investing creates a compelling case for its potential as a significant profit driver. While challenges remain, developers and investors who are willing to navigate the complexities and adopt innovative strategies are well-positioned to capitalize on this growing market segment. The key lies in understanding the unique needs of this sector and developing projects that are both financially viable and socially responsible. Are you ready to invest in the future of housing?

Keywords: Affordable Housing, Real Estate Investment, Profitable Real Estate, ESG Investing, Housing Crisis, Government Incentives, Sustainable Housing, Modular Construction, Rental Housing, Homeownership, Real Estate Market Trends, Investment Opportunities.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is Affordable Housing The Next Big Profit Driver For Real Estate?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nintendo Reverses Mario Kart Worlds Open World Driving Change

Jul 31, 2025

Nintendo Reverses Mario Kart Worlds Open World Driving Change

Jul 31, 2025 -

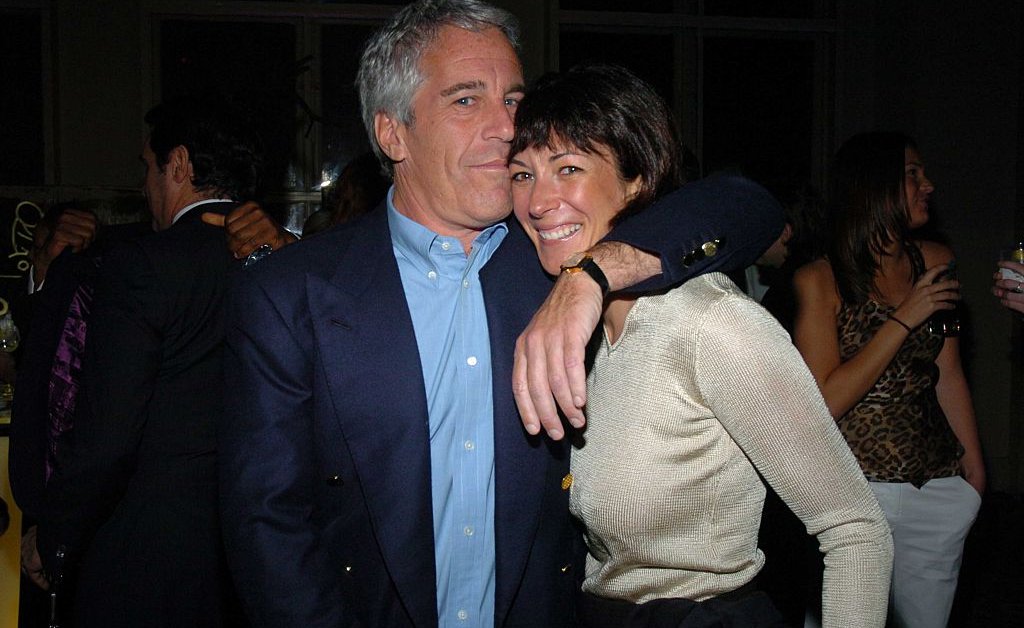

Ghislaine Maxwells Connection To Jeffrey Epstein A Timeline Of Events

Jul 31, 2025

Ghislaine Maxwells Connection To Jeffrey Epstein A Timeline Of Events

Jul 31, 2025 -

The Potential For Real Estate Growth Following Trumps Economic Plan

Jul 31, 2025

The Potential For Real Estate Growth Following Trumps Economic Plan

Jul 31, 2025 -

Senate Confirms First Ever Cdc Director A Historic Appointment

Jul 31, 2025

Senate Confirms First Ever Cdc Director A Historic Appointment

Jul 31, 2025 -

Tsunami Warning Liverpool Match To Go Ahead As Planned

Jul 31, 2025

Tsunami Warning Liverpool Match To Go Ahead As Planned

Jul 31, 2025