Is 2025 Intel's Year? Evaluating The Investment Risks And Rewards

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is 2025 Intel's Year? Evaluating the Investment Risks and Rewards

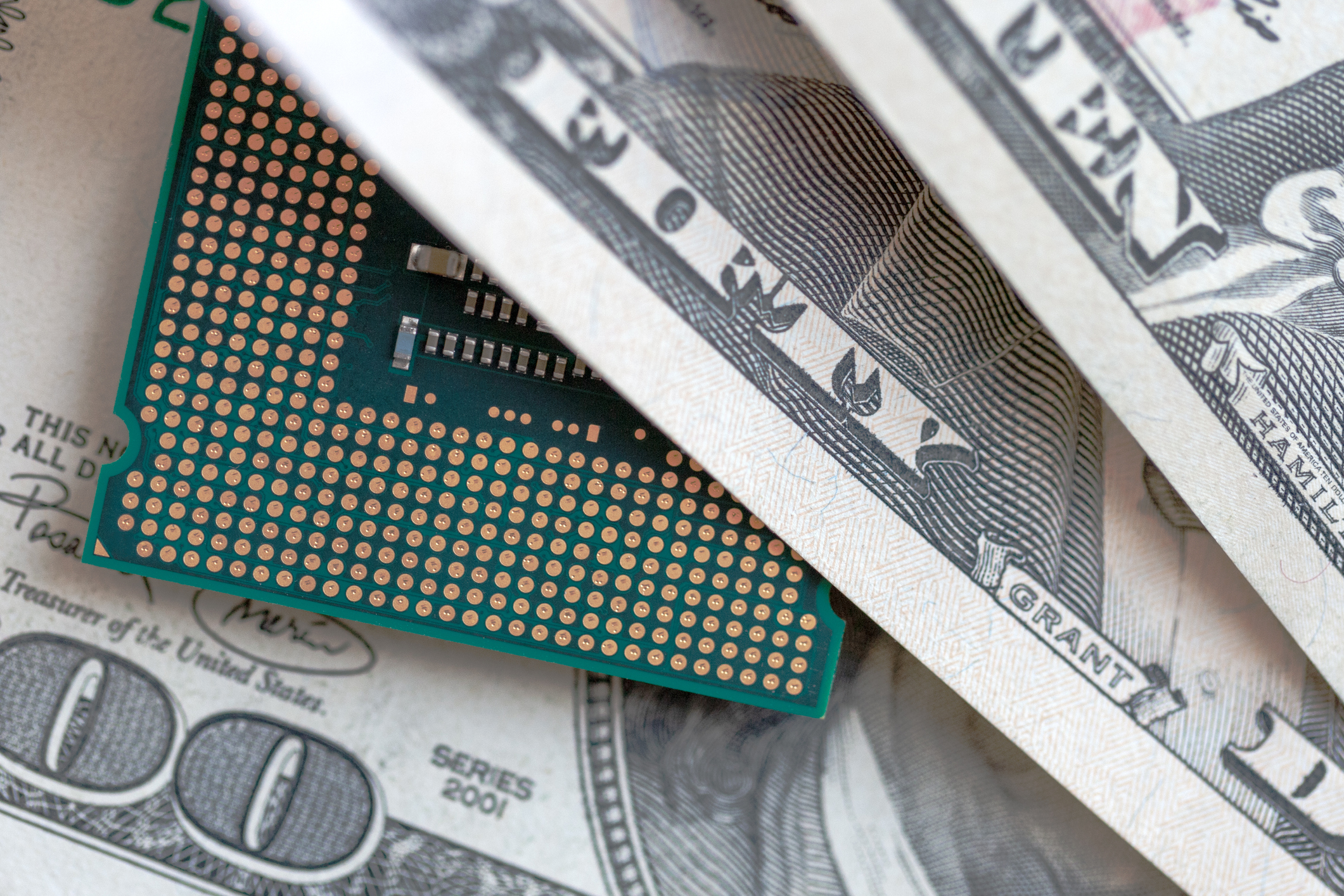

Intel. The name evokes a legacy of innovation in the semiconductor industry. But recent years have seen the tech giant facing stiff competition, struggling to regain its market share dominance. Now, with a renewed focus on advanced manufacturing and a flurry of new product announcements, many investors are wondering: is 2025 Intel's year for a significant comeback? This article delves into the potential risks and rewards of investing in Intel in the coming year, offering a balanced perspective for informed decision-making.

Intel's Renewed Focus: A Gamble on Manufacturing

Intel's strategy hinges heavily on its ambitious investment in advanced manufacturing processes. The company is pouring billions into expanding its fabrication plants (fabs) and developing leading-edge chip technologies, aiming to reclaim its position as a manufacturing leader. This represents a significant risk. Building and operating fabs is incredibly expensive, and delays or unforeseen technical challenges could severely impact profitability. However, if successful, this investment could yield enormous returns, giving Intel a competitive edge in supplying cutting-edge chips for PCs, data centers, and other crucial markets.

The Competition Remains Fierce: AMD and TSMC Loom Large

Intel faces relentless competition from AMD, which has steadily gained market share in CPUs, and TSMC, the world's leading independent semiconductor foundry. Both companies boast advanced manufacturing capabilities and strong product portfolios. Intel's success in 2025 will depend not only on its own technological advancements but also on its ability to effectively compete against these formidable rivals. This competitive landscape introduces considerable uncertainty for investors.

Key Factors to Consider for Intel Investment in 2025:

- Manufacturing Yield: The success of Intel's new fabs hinges on achieving high manufacturing yields – the percentage of chips produced without defects. Low yields translate to higher costs and lower profits.

- Product Portfolio: The launch and market acceptance of Intel's new CPUs, GPUs, and other products will be crucial. Positive reviews and strong demand are vital for driving revenue growth.

- Pricing Strategies: Intel's pricing strategy will play a critical role in its competitiveness. Aggressive pricing could boost market share but might squeeze profit margins.

- Global Economic Conditions: The overall economic climate will significantly impact demand for semiconductors. A global recession could dampen sales and negatively affect Intel's performance.

Potential Rewards of Investing in Intel:

- Market Share Recovery: A successful execution of Intel's strategy could lead to significant market share gains, boosting revenue and profitability.

- Technological Leadership: Establishing itself as a leader in advanced manufacturing could position Intel for long-term growth and dominance in the semiconductor industry.

- Dividend Payments: Intel has a history of paying dividends to shareholders, providing a steady stream of income even during periods of slower growth.

Potential Risks of Investing in Intel:

- Manufacturing Delays and Cost Overruns: Significant delays or cost overruns in fab construction could severely impact profitability and investor confidence.

- Intense Competition: The competitive landscape remains highly challenging, and Intel's market share gains are not guaranteed.

- Geopolitical Uncertainty: Global political instability and trade tensions could disrupt supply chains and impact Intel's operations.

Conclusion: A High-Risk, High-Reward Proposition

Investing in Intel in 2025 presents a classic high-risk, high-reward scenario. The company's ambitious manufacturing investments could pay off handsomely, leading to a significant resurgence. However, the challenges are considerable, with stiff competition and the inherent risks associated with advanced chip manufacturing. Investors should carefully weigh these risks and rewards, conducting thorough due diligence before making any investment decisions. Staying updated on Intel's progress and market dynamics throughout the year is crucial for informed decision-making. Consider consulting with a financial advisor for personalized guidance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is 2025 Intel's Year? Evaluating The Investment Risks And Rewards. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

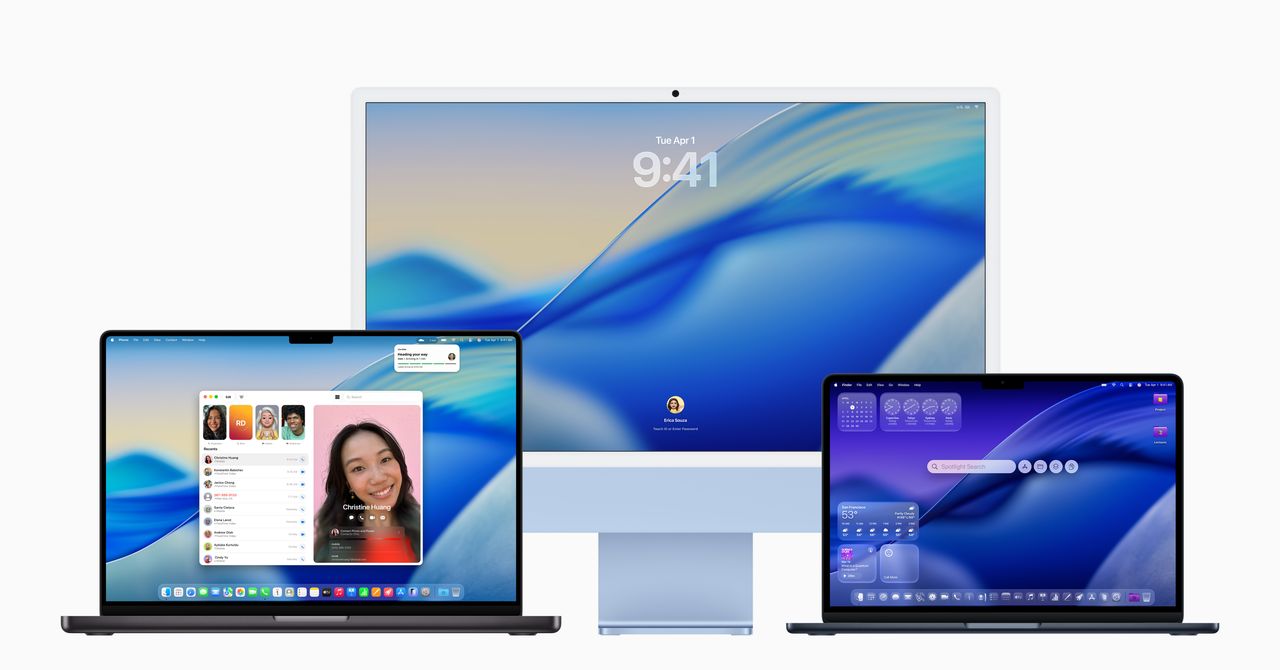

Intels Departure From Apple Macs Impact And Future Implications

Jun 11, 2025

Intels Departure From Apple Macs Impact And Future Implications

Jun 11, 2025 -

Lamar University Campus In Beaumont Evacuate Now Emergency Alert

Jun 11, 2025

Lamar University Campus In Beaumont Evacuate Now Emergency Alert

Jun 11, 2025 -

Turnstile Us Tour 2024 Where To Catch The Show

Jun 11, 2025

Turnstile Us Tour 2024 Where To Catch The Show

Jun 11, 2025 -

Us Tennis Player Apologizes After Queens Club Victories

Jun 11, 2025

Us Tennis Player Apologizes After Queens Club Victories

Jun 11, 2025 -

The Last Intel Mac A Retrospective And Look Ahead

Jun 11, 2025

The Last Intel Mac A Retrospective And Look Ahead

Jun 11, 2025