Is 180 Life Sciences' (ATNF) Crypto Move A Smart Strategy? Stock Performance Examined

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is 180 Life Sciences' (ATNF) Crypto Move a Smart Strategy? Stock Performance Examined

180 Life Sciences (NASDAQ: ATNF), a clinical-stage biotechnology company focused on developing therapies for inflammatory diseases, recently made headlines with its foray into the cryptocurrency market. This strategic decision, while bold, has raised eyebrows among investors, prompting questions about its long-term viability and impact on the company's stock performance. This article delves into 180 Life Sciences' crypto move, analyzing its potential benefits and risks, and examining the subsequent impact on ATNF stock.

The Crypto Diversification Play: A Risky Gamble or Calculated Move?

180 Life Sciences' announcement regarding its crypto investments sent ripples through the financial community. While the exact details of their involvement remain somewhat opaque, the move is generally interpreted as a diversification strategy, aiming to potentially offset risks associated with the volatile biotech sector. The company may be seeking to capitalize on the potential for high returns in the cryptocurrency market, albeit with significantly higher risk.

However, this strategy is not without its critics. Investing in cryptocurrencies presents considerable volatility and regulatory uncertainty. The price of Bitcoin and other cryptocurrencies can fluctuate wildly, posing significant risks to the company's balance sheet. Furthermore, the regulatory landscape surrounding crypto is constantly evolving, potentially leading to unforeseen challenges and losses.

Examining ATNF Stock Performance Post-Crypto Announcement

The impact of 180 Life Sciences' crypto move on ATNF stock performance is a key area of analysis. While correlation doesn't equal causation, it's crucial to examine the stock's trajectory following the announcement. Has the move boosted investor confidence, leading to a price increase? Or has it introduced further uncertainty, resulting in decreased market value? Analyzing trading volume and price charts in the period surrounding the announcement will provide valuable insights. (Note: Detailed stock performance analysis requires access to real-time financial data and is beyond the scope of this news article. Investors should consult reputable financial resources for up-to-date information.)

Potential Benefits and Drawbacks:

-

Potential Benefits:

- Diversification: Reducing reliance on the biotech sector's inherent volatility.

- High-Growth Potential: Cryptocurrencies have historically shown significant growth potential, although this is accompanied by significant risk.

- Enhanced Investor Appeal: Some investors might view the crypto strategy as innovative and forward-thinking.

-

Potential Drawbacks:

- Volatility: Crypto markets are notoriously volatile, posing significant risk to the company's investments.

- Regulatory Uncertainty: The evolving regulatory landscape for cryptocurrencies adds another layer of uncertainty.

- Distraction from Core Business: Focusing on crypto investments might divert resources and attention from the company's core drug development activities.

Conclusion: A Calculated Risk?

180 Life Sciences' foray into the cryptocurrency market is a bold move that presents both potential benefits and significant risks. Whether this strategy ultimately proves successful will depend on several factors, including the future performance of the crypto market, the company's risk management capabilities, and the overall performance of its core biotech operations. Investors need to carefully consider the implications of this decision before making any investment choices. Conducting thorough due diligence and seeking advice from qualified financial professionals is crucial before making any investment decisions related to ATNF or any other cryptocurrency-related investment.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research and consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is 180 Life Sciences' (ATNF) Crypto Move A Smart Strategy? Stock Performance Examined. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

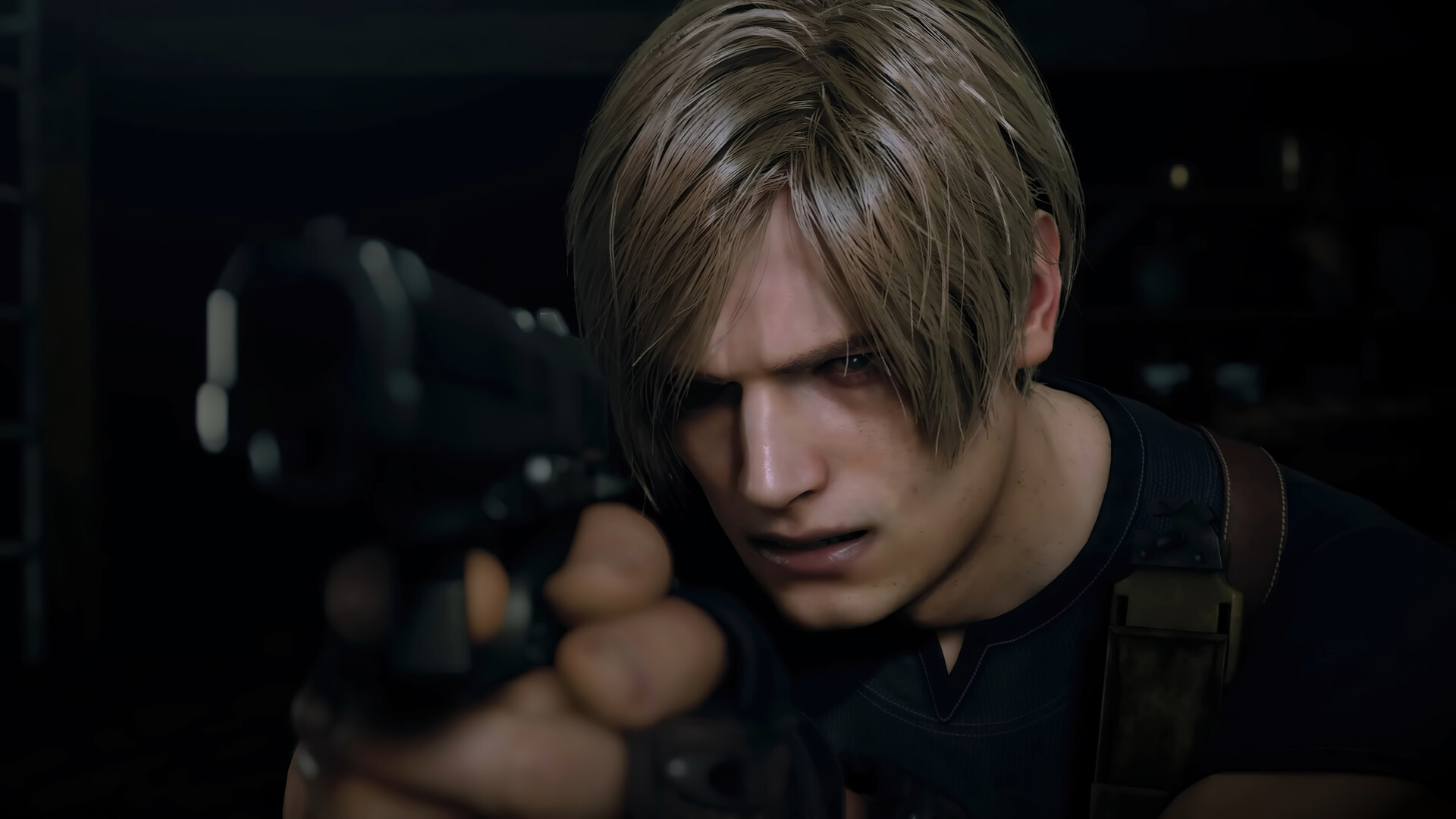

Resident Evil Insider Reveals Shocking News Leon Kennedys Era Ends After Part 9

Aug 13, 2025

Resident Evil Insider Reveals Shocking News Leon Kennedys Era Ends After Part 9

Aug 13, 2025 -

Stream Hbo Max And Viu Content Together New Bundle Launches In 5 Asian Countries

Aug 13, 2025

Stream Hbo Max And Viu Content Together New Bundle Launches In 5 Asian Countries

Aug 13, 2025 -

O Rourke Faces Jail Time Paxtons Lawsuit Over Democratic Walkout Fundraising

Aug 13, 2025

O Rourke Faces Jail Time Paxtons Lawsuit Over Democratic Walkout Fundraising

Aug 13, 2025 -

The Impact Of Trumps Unconventional Use Of Us Troops On American Soil

Aug 13, 2025

The Impact Of Trumps Unconventional Use Of Us Troops On American Soil

Aug 13, 2025 -

Peacemaker Rumor Explains Justice League Cameos Absence In Dc Universe

Aug 13, 2025

Peacemaker Rumor Explains Justice League Cameos Absence In Dc Universe

Aug 13, 2025

Latest Posts

-

California Redistricting Battle Newsom Demands Trump Withdraw Plan

Aug 14, 2025

California Redistricting Battle Newsom Demands Trump Withdraw Plan

Aug 14, 2025 -

Navigating Workers Comp In Charlotte Your Vocational Rehab Attorneys Role

Aug 14, 2025

Navigating Workers Comp In Charlotte Your Vocational Rehab Attorneys Role

Aug 14, 2025 -

Money Isnt Solving Ices Agent Recruitment Problem A Hiring Crisis

Aug 14, 2025

Money Isnt Solving Ices Agent Recruitment Problem A Hiring Crisis

Aug 14, 2025 -

Fantasy Football Value Picks Affordable Wide Receivers Guaranteed To Score

Aug 14, 2025

Fantasy Football Value Picks Affordable Wide Receivers Guaranteed To Score

Aug 14, 2025 -

Steve At Tiff Cillian Murphy On Characters Anxiety And The Art Of Compelling Storytelling

Aug 14, 2025

Steve At Tiff Cillian Murphy On Characters Anxiety And The Art Of Compelling Storytelling

Aug 14, 2025