Iran-Israel Conflict: Trump's Ceasefire Remarks Spark Stock Market Uptick

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Iran-Israel Conflict: Trump's Ceasefire Remarks Spark Stock Market Uptick

Tensions ease, but uncertainty remains: Former President Donald Trump's recent comments suggesting a potential ceasefire between Iran and Israel sent ripples through global financial markets, resulting in a noticeable uptick in stock prices. The statement, made during a [link to source of Trump's statement], offered a glimmer of hope amidst escalating regional tensions, calming investor fears of a wider conflict that could severely disrupt oil supplies and global trade. However, analysts warn against premature celebrations, citing the inherent volatility of the situation and the need for concrete diplomatic action.

The escalating conflict between Iran and Israel, marked by recent missile strikes and retaliatory actions, had already begun to impact global markets. Concerns about the potential for a major escalation, mirroring the 2006 Lebanon War or even broader regional conflict, fueled uncertainty and prompted investors to move towards safer assets. The price of oil, a key commodity sensitive to geopolitical instability, experienced a significant surge. This instability directly impacts various sectors, including energy, transportation, and international trade, leading to widespread economic anxiety.

Trump's words offer temporary reprieve

Trump's remarks, while not officially endorsed by either the US government or either party in the conflict, offered a temporary respite. The market reacted positively, interpreting the statement as a potential pathway towards de-escalation, even if a long-term solution remains elusive. The Dow Jones Industrial Average saw a notable increase, while other major indices also experienced gains. This positive market reaction highlights the significant influence of political events on investor sentiment and underscores the interconnectedness of global finance and geopolitical stability.

Understanding the Market Reaction

The stock market’s response is complex, reflecting several factors:

- Reduced risk premium: The perceived reduction in the likelihood of a major conflict led to a decrease in the risk premium – the extra return investors demand for holding riskier assets during uncertain times.

- Oil price stabilization: The potential for a ceasefire could ease concerns about oil supply disruptions, leading to a slight decrease in oil prices and reducing inflationary pressures.

- Investor sentiment: The news provided a much-needed boost to investor confidence, which had been significantly dampened by the escalating conflict.

Challenges and Uncertainties Remain

While the market celebrated Trump's remarks, it's crucial to acknowledge the remaining challenges:

- Lack of official confirmation: Trump's statement lacks official backing, leaving the path to a ceasefire uncertain and subject to change.

- Underlying tensions: The fundamental issues driving the conflict remain unresolved, raising concerns about the sustainability of any potential ceasefire.

- Geopolitical complexity: The region's complex geopolitical landscape involves multiple actors, making any lasting resolution difficult to achieve.

What to watch for in the coming days

Analysts will be closely monitoring developments in the region for any signs of escalation or de-escalation. Further statements from official government channels will be crucial in guiding investor sentiment. The price of oil and the performance of related sectors will serve as key indicators of the market's reaction to ongoing events.

In conclusion, while Trump's comments provided a short-term boost to the stock market, investors should remain cautious. The Iran-Israel conflict remains a volatile situation, and the path to lasting peace remains uncertain. Continued monitoring of the situation and careful analysis of official statements are crucial for navigating the market's response to this evolving geopolitical landscape. Consult with a financial advisor before making any investment decisions based on geopolitical events.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Iran-Israel Conflict: Trump's Ceasefire Remarks Spark Stock Market Uptick. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

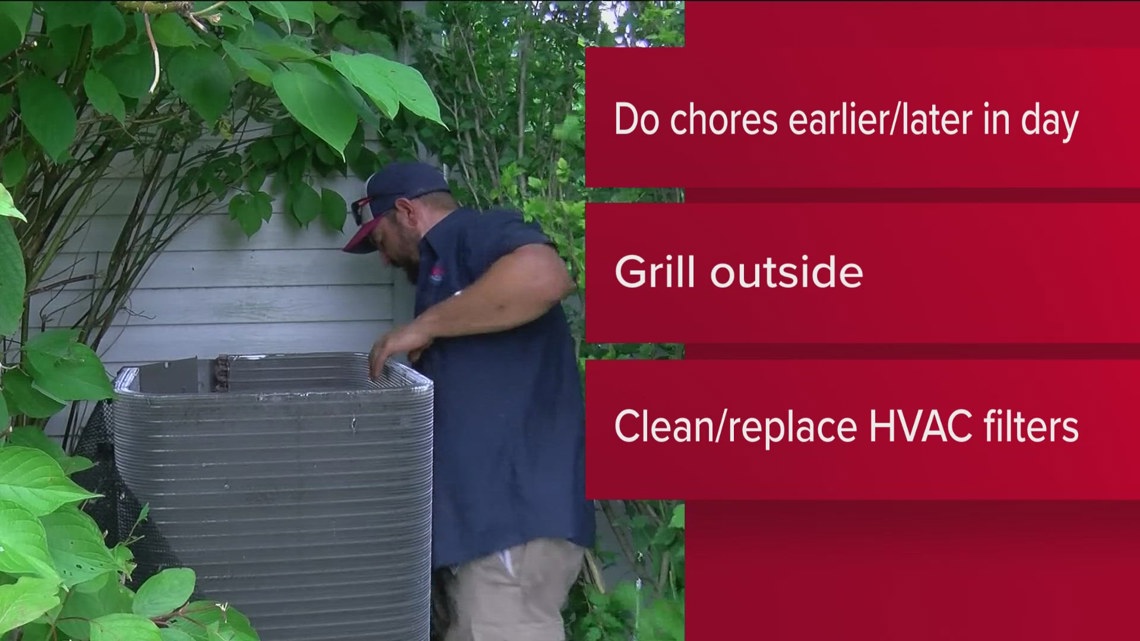

Heat Wave Survival Guide Save Money Safely During Extreme Temperatures

Jun 24, 2025

Heat Wave Survival Guide Save Money Safely During Extreme Temperatures

Jun 24, 2025 -

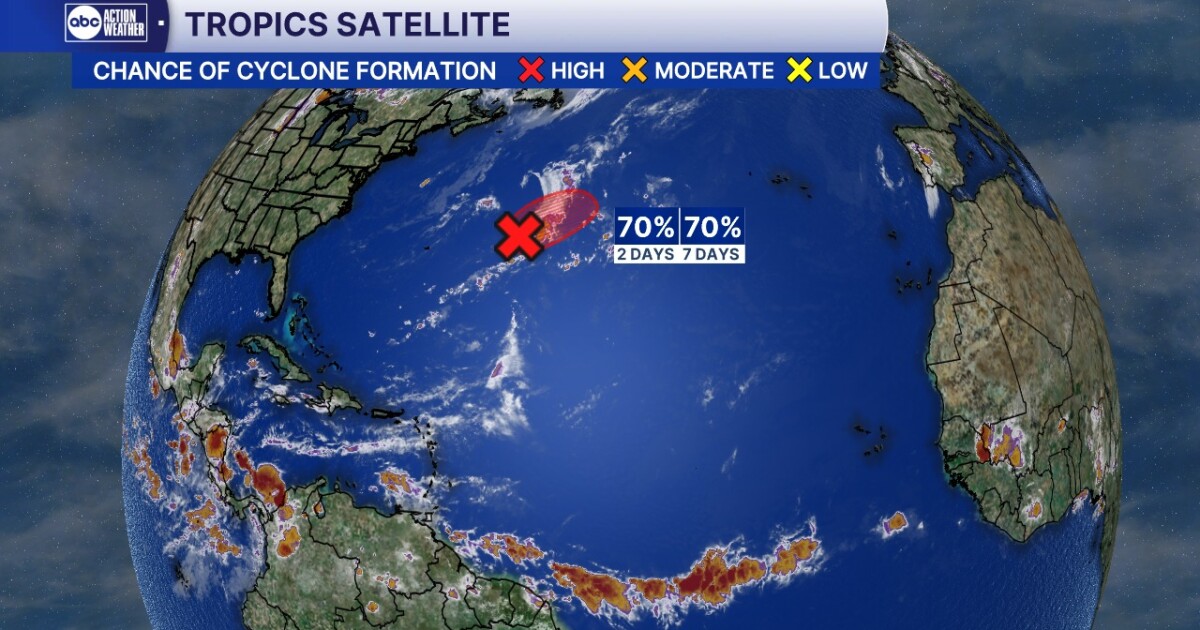

Tropical Storm Andrea Watch Potential First Hurricane Of 2025 Season

Jun 24, 2025

Tropical Storm Andrea Watch Potential First Hurricane Of 2025 Season

Jun 24, 2025 -

The Jimmy Awards A Celebration Of 110 Talented High School Students

Jun 24, 2025

The Jimmy Awards A Celebration Of 110 Talented High School Students

Jun 24, 2025 -

Jimmy Awards Celebrating Excellence In High School Theater Tonight

Jun 24, 2025

Jimmy Awards Celebrating Excellence In High School Theater Tonight

Jun 24, 2025 -

Mlb News Orioles Sign Catcher Chadwick Tromp

Jun 24, 2025

Mlb News Orioles Sign Catcher Chadwick Tromp

Jun 24, 2025