Iran-Israel Conflict: Trump's Ceasefire News Boosts Stock Futures

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Iran-Israel Conflict: Trump's Ceasefire Announcement Briefly Boosts Stock Futures

Tensions ease, but uncertainty remains in volatile markets.

The escalating conflict between Iran and Israel sent shockwaves through global markets earlier this week. However, a surprise announcement by former President Donald Trump suggesting a potential ceasefire briefly ignited a rally in stock futures. While the market's response was short-lived, the event highlights the significant impact geopolitical events have on investor sentiment and the delicate balance of global financial stability.

The initial escalation, marked by [insert specific event, e.g., Iranian missile strikes or Israeli retaliatory actions], triggered fears of a wider conflict, leading to a sharp downturn in several key indices. Oil prices, particularly sensitive to Middle Eastern instability, surged, reflecting concerns about potential disruptions to global energy supplies. This uncertainty fueled anxieties among investors, causing a sell-off across various asset classes.

Trump's Intervention and Market Reaction:

Former President Trump's unexpected intervention, suggesting a potential path towards a ceasefire between Iran and Israel, provided a temporary reprieve. His statement [insert specifics of Trump's statement, including source if possible], albeit lacking concrete details, injected a dose of optimism into the market. This led to a noticeable, albeit fleeting, rebound in stock futures. However, analysts caution against reading too much into this temporary surge.

Why the Rally Was Short-Lived:

The limited and uncertain nature of Trump's announcement quickly dampened the initial optimism. The lack of official confirmation from either Iran or Israel, coupled with the ongoing geopolitical complexities, prevented a sustained rally. Furthermore, the underlying concerns about the broader implications of the conflict remained.

- Uncertainty about the future: The fragile nature of any potential ceasefire means markets remain on edge. Any escalation could trigger another round of volatility.

- Economic repercussions: The conflict's impact on oil prices and global trade remains a significant concern for investors.

- Geopolitical risks: The situation in the Middle East is notoriously complex, and unpredictable events can quickly shift the balance.

What Investors Should Watch:

Investors should carefully monitor the following developments:

- Official statements from Iran and Israel: Concrete confirmation of a ceasefire from both sides is crucial for market stability.

- Oil price movements: Any significant changes in oil prices will reflect the evolving situation and impact investor sentiment.

- US government response: The Biden administration's response to the situation will likely play a critical role in determining the trajectory of the conflict.

Long-Term Implications:

The long-term implications of the Iran-Israel conflict on the global economy are still unfolding. The potential for disruptions to energy supplies, increased geopolitical uncertainty, and the impact on international trade are all factors that investors need to consider. It's a complex situation requiring ongoing monitoring and careful analysis.

Conclusion:

While Trump's statement provided a brief respite, the Iran-Israel conflict continues to pose significant risks to global markets. Investors should adopt a cautious approach and carefully assess the evolving situation before making any significant investment decisions. The situation remains volatile, and further developments could impact markets significantly. Staying informed through reputable news sources and consulting with financial advisors is crucial during this period of heightened uncertainty. [Consider adding a link to a relevant financial news site here].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Iran-Israel Conflict: Trump's Ceasefire News Boosts Stock Futures. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

From Peacemaker To War Trumps Middle East Legacy In Question

Jun 24, 2025

From Peacemaker To War Trumps Middle East Legacy In Question

Jun 24, 2025 -

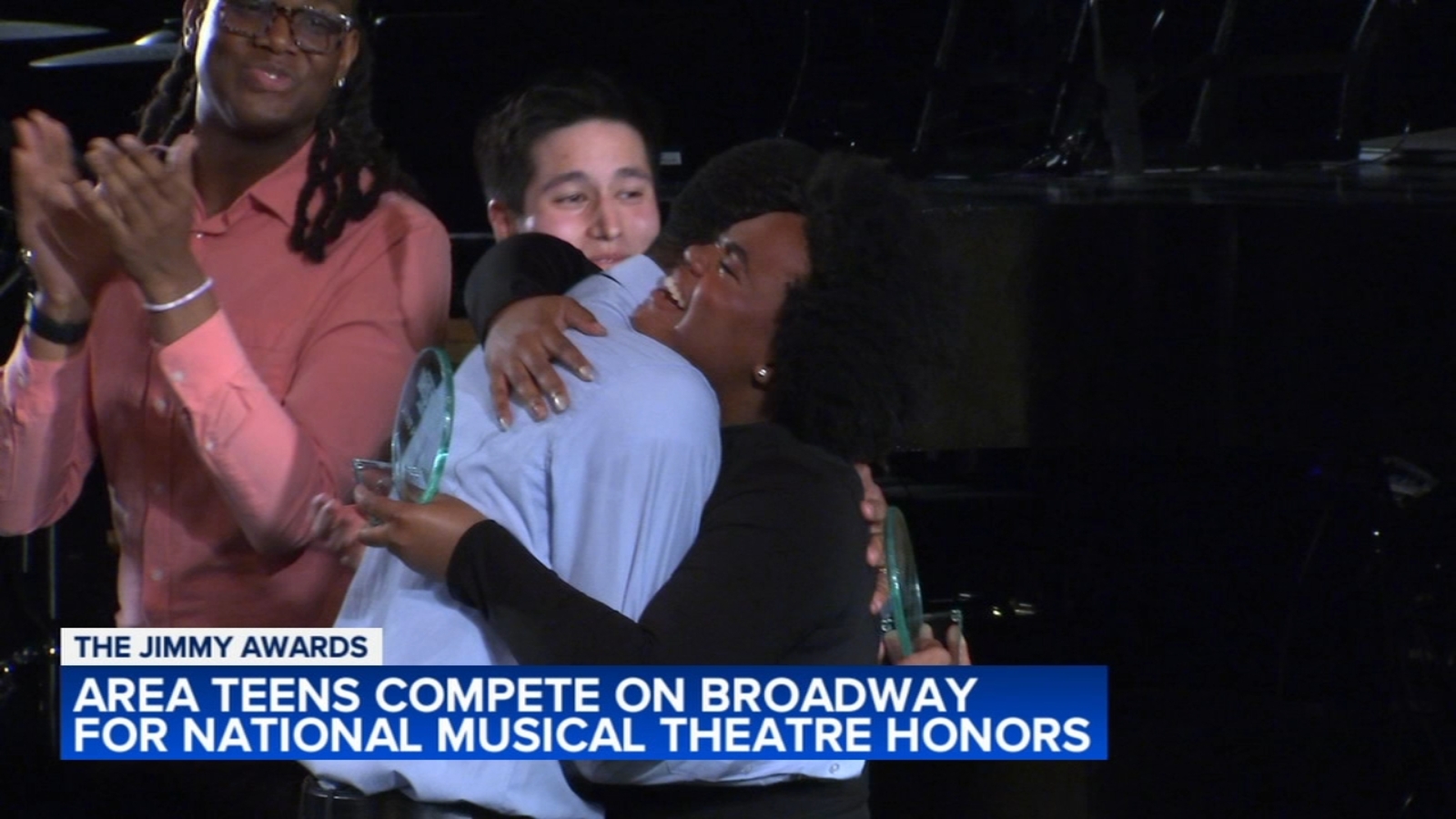

Illinois Jimmy Award Nominees Chicago And Frankfort Teens Shine

Jun 24, 2025

Illinois Jimmy Award Nominees Chicago And Frankfort Teens Shine

Jun 24, 2025 -

Trump Orders Wider Ice Deportation Crackdown In Democratic Areas

Jun 24, 2025

Trump Orders Wider Ice Deportation Crackdown In Democratic Areas

Jun 24, 2025 -

The Summer Of Discontent Trumps War On Climate Science And Its Consequences

Jun 24, 2025

The Summer Of Discontent Trumps War On Climate Science And Its Consequences

Jun 24, 2025 -

Predicting The Mets Vs Braves Series What To Watch For June 23 26

Jun 24, 2025

Predicting The Mets Vs Braves Series What To Watch For June 23 26

Jun 24, 2025