Iran-Israel Conflict: Trump's Ceasefire Comments Spark Stock Market Rally

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Iran-Israel Conflict: Trump's Ceasefire Comments Spark Stock Market Rally

Tensions ease, but uncertainty remains

The volatile situation surrounding the escalating Iran-Israel conflict experienced a significant shift following former President Donald Trump's unexpected comments suggesting a potential ceasefire. These remarks, delivered during a [link to relevant news source], immediately ignited a rally in global stock markets, offering a temporary reprieve from the widespread anxieties that had gripped investors. However, analysts caution against premature celebrations, highlighting the inherent fragility of the situation and the persistent underlying geopolitical risks.

The conflict, sparked by [brief, factual summary of the conflict's origins], had sent shockwaves through financial markets. Concerns over potential regional escalation, disruptions to oil supplies, and wider geopolitical instability led to significant market volatility and a downturn in investor confidence. The price of oil, a key indicator of global economic health, experienced [mention specific percentage change] fluctuations during the initial days of the conflict.

Trump's Intervention and Market Reaction

Trump's suggestion of a potential ceasefire, although lacking specific details or official confirmation from either Iranian or Israeli authorities, acted as a powerful catalyst for a market rebound. Investors, weary of the uncertainty, interpreted his statement as a potential de-escalation signal, leading to a surge in buying activity across various sectors. The Dow Jones Industrial Average saw a [mention percentage increase], while other major indices also experienced significant gains.

This market reaction underscores the significant influence of geopolitical events on investor sentiment. The speed and magnitude of the rally highlight the pervasive fear surrounding a protracted conflict and the relief experienced when even the slightest possibility of a resolution emerges.

Cautious Optimism: Analyzing the Long-Term Outlook

While the short-term market reaction was undeniably positive, experts remain cautious about the long-term implications. Several factors contribute to this guarded optimism:

- Lack of official confirmation: Trump's comments, while impactful, lack the weight of official statements from either the Iranian or Israeli governments. The absence of concrete peace initiatives leaves the situation precarious.

- Underlying tensions: Even with a potential ceasefire, deep-seated tensions between Iran and Israel, fueled by years of political and military rivalry, will likely persist. These tensions pose a significant threat to regional stability and could easily reignite the conflict.

- Economic uncertainty: The conflict's impact on global oil prices and supply chains remains a significant concern. Any disruptions could trigger further economic instability and negatively affect market performance in the long run.

What this means for investors:

The current market rally should be viewed as a temporary respite, not a definitive end to the uncertainty. Investors are advised to:

- Monitor geopolitical developments closely: Stay informed about official statements from involved governments and international organizations.

- Diversify portfolios: Reduce exposure to high-risk assets and diversify investments across various sectors and asset classes.

- Consult financial advisors: Seek professional guidance to navigate the complexities of the current market environment.

The Iran-Israel conflict highlights the interconnectedness of global politics and the financial markets. While Trump's comments provided a temporary boost to investor confidence, the situation remains volatile, demanding vigilance and careful consideration from all stakeholders. The coming weeks will be crucial in determining whether this brief rally represents a genuine turning point or merely a fleeting respite from a persistent geopolitical storm. Further updates will be provided as the situation unfolds.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Iran-Israel Conflict: Trump's Ceasefire Comments Spark Stock Market Rally. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

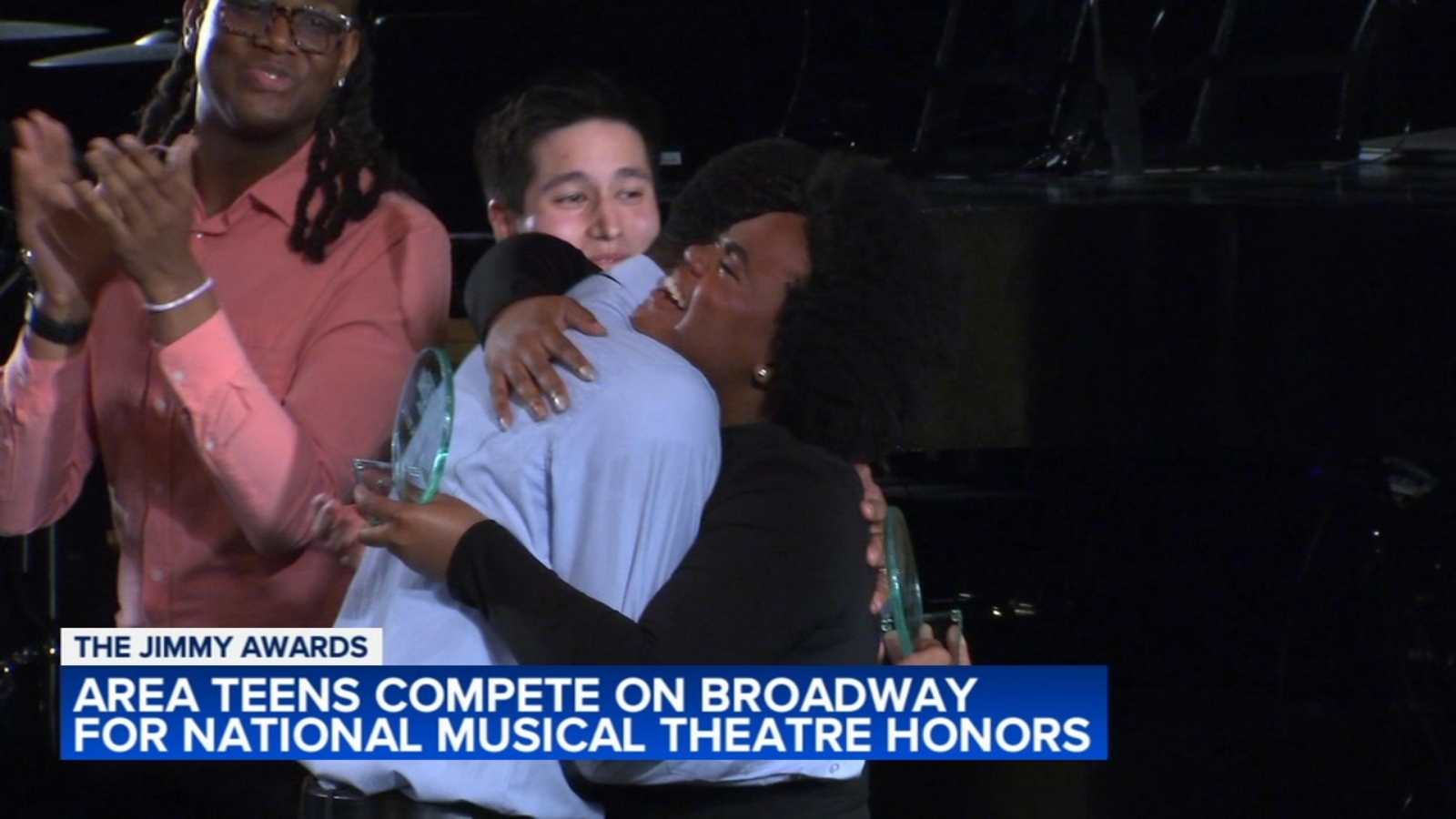

Frankfort And Chicago Teens To Represent Illinois At The 2025 Jimmy Awards

Jun 24, 2025

Frankfort And Chicago Teens To Represent Illinois At The 2025 Jimmy Awards

Jun 24, 2025 -

New Border Statistics Spark Concern Former Ice Director Weighs In

Jun 24, 2025

New Border Statistics Spark Concern Former Ice Director Weighs In

Jun 24, 2025 -

Handley To Concussion List Orioles Call Up Catcher For Roster Spot

Jun 24, 2025

Handley To Concussion List Orioles Call Up Catcher For Roster Spot

Jun 24, 2025 -

Former Ice Chief On Surging Border Numbers A Critical Analysis

Jun 24, 2025

Former Ice Chief On Surging Border Numbers A Critical Analysis

Jun 24, 2025 -

Alliant Energy Corporation Lnt Analysis Of Significant Institutional Ownership

Jun 24, 2025

Alliant Energy Corporation Lnt Analysis Of Significant Institutional Ownership

Jun 24, 2025