Investors Respond To Lincoln Financial's Boosted Tender Offer

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investors Respond to Lincoln Financial's Boosted Tender Offer: A Cautious Optimism?

Lincoln Financial Group's (LNC) decision to sweeten its tender offer for its outstanding 7.000% Subordinated Debentures due 2047 has sent ripples through the investment community. While the increased offer price signals a proactive approach to managing its debt profile, investor response has been somewhat muted, reflecting a complex interplay of market conditions and perceived risks.

The initial offer, announced [Insert Date of Initial Offer], fell short of expectations for many bondholders. This prompted Lincoln Financial to raise the price, aiming to garner higher participation in the buyback. The revised offer, details of which can be found on the company's investor relations website [Insert Link to Investor Relations Website], presents a more attractive proposition, but concerns remain.

What Drove the Increased Offer?

Several factors likely contributed to Lincoln Financial's decision to boost its tender offer. These include:

- Interest Rate Environment: The prevailing high-interest-rate environment makes refinancing existing debt more expensive. A tender offer allows the company to proactively reduce its debt burden at a potentially more favorable rate than future refinancing options.

- Improved Credit Rating Outlook: While not explicitly stated, an improved credit rating may have played a role. Reducing debt through a successful tender offer could further strengthen Lincoln Financial's financial position and potentially lead to an upgrade.

- Strategic Restructuring: The buyback may be part of a broader strategic restructuring initiative designed to optimize the company's capital allocation and enhance shareholder value.

Investor Reactions: A Mixed Bag

While the increased offer price is undoubtedly positive, investor response hasn't been universally enthusiastic. Some analysts remain cautious, pointing to:

- Lingering Market Uncertainty: The current economic climate presents significant challenges, creating uncertainty about future market performance and the ability of companies to service their debt.

- Potential for Future Debt Issues: While the tender offer addresses immediate concerns, investors are wary of the potential for future debt-related issues. A comprehensive analysis of Lincoln Financial's long-term debt management strategy is crucial.

- Alternative Investment Opportunities: With interest rates at elevated levels, investors have a broader range of high-yield investment opportunities, potentially reducing the appeal of the Lincoln Financial tender offer, even with the price increase.

Looking Ahead: What to Watch For

The success of Lincoln Financial's boosted tender offer will depend on several factors, including the final participation rate and the overall market sentiment. Key aspects to monitor include:

- Participation Rate: A high participation rate would indicate investor confidence in the company's strategy and financial health. A low participation rate, however, would raise concerns.

- Impact on Credit Ratings: Rating agencies will closely monitor the outcome of the tender offer and assess its impact on Lincoln Financial's creditworthiness.

- Future Debt Management Strategies: Investors will be keen to understand Lincoln Financial's long-term debt management plans and its commitment to maintaining a healthy financial position.

Conclusion:

Lincoln Financial's revised tender offer represents a significant move in managing its debt profile. While the increased offer price offers a more compelling proposition for investors, concerns remain about the broader market environment and long-term financial outlook. The coming weeks will be crucial in determining the success of the offer and gauging the true extent of investor confidence in the company's strategic direction. It's a situation worth monitoring closely for anyone interested in the financial services sector and corporate debt management strategies.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investors Respond To Lincoln Financial's Boosted Tender Offer. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

International Relations Assessing The Responses Of China North Korea And Russia To Trumps Proposal

May 29, 2025

International Relations Assessing The Responses Of China North Korea And Russia To Trumps Proposal

May 29, 2025 -

Animal Cruelty Charges R And B Singer Jaheims Legal Troubles In Fulton County

May 29, 2025

Animal Cruelty Charges R And B Singer Jaheims Legal Troubles In Fulton County

May 29, 2025 -

Cameron Brink Injury Update Video Fuels Speculation Of Sparks Return

May 29, 2025

Cameron Brink Injury Update Video Fuels Speculation Of Sparks Return

May 29, 2025 -

Wwes Stephanie Mc Mahon Shares Close Call With Regrettable Tattoo

May 29, 2025

Wwes Stephanie Mc Mahon Shares Close Call With Regrettable Tattoo

May 29, 2025 -

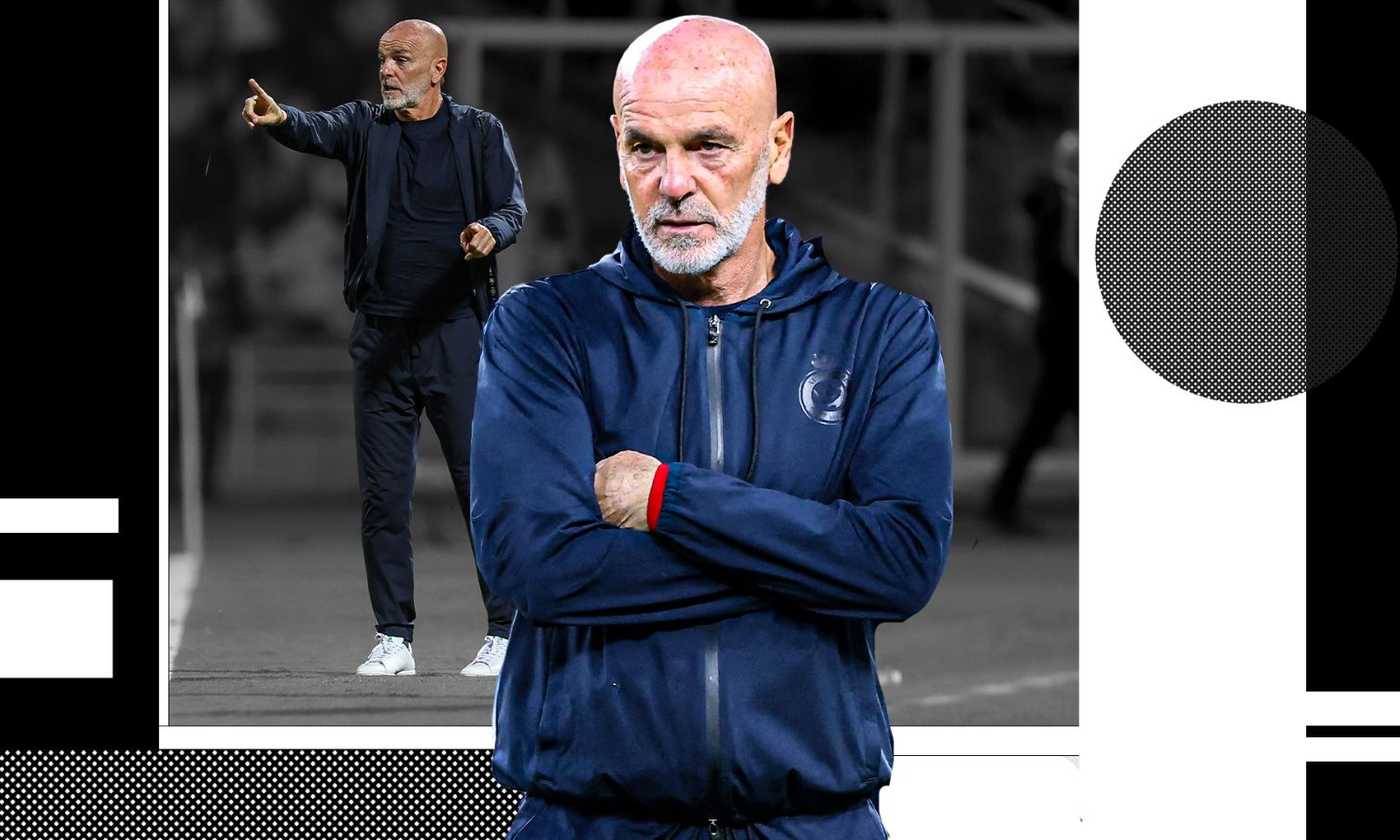

Atalanta Pioli Un Nome Caldo Per La Panchina L Analisi Della Situazione

May 29, 2025

Atalanta Pioli Un Nome Caldo Per La Panchina L Analisi Della Situazione

May 29, 2025