Investors Respond: Lincoln Financial's Tender Offer Reaches $812 Million

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investors Respond: Lincoln Financial's Tender Offer Reaches $812 Million

Lincoln Financial Group (LNC) announced today that its tender offer for its 7.25% Senior Notes due 2025 has successfully concluded, reaching a staggering $812 million. This significant response from investors highlights confidence in Lincoln Financial's financial health and strategic direction, despite ongoing economic uncertainty. The successful tender offer allows Lincoln Financial to proactively manage its debt profile and optimize its capital structure.

A Strategic Move for Financial Strength

The tender offer, launched earlier this year, allowed holders of the 7.25% Senior Notes to exchange their existing notes for newly issued notes with a lower interest rate. This strategic maneuver is a common tactic used by companies to reduce their interest expense and improve their overall financial flexibility. By lowering its debt burden, Lincoln Financial strengthens its position to navigate potential economic headwinds and pursue future growth opportunities. The company's proactive approach demonstrates a commitment to long-term financial stability.

Market Reaction and Investor Sentiment

The overwhelming response to the tender offer signals positive investor sentiment towards Lincoln Financial. The high participation rate suggests confidence in the company's future prospects and its ability to manage its debt responsibly. While the broader market faces challenges, Lincoln Financial's successful debt restructuring demonstrates resilience and a prudent approach to financial management. This move could potentially boost investor confidence and lead to a more positive market perception of the company.

What this Means for Lincoln Financial's Future

This successful tender offer represents a significant milestone for Lincoln Financial. The reduction in debt service costs will free up capital for strategic investments, potentially accelerating growth in key business areas. This could involve expanding product offerings, enhancing technological capabilities, or pursuing acquisitions to further strengthen its market position.

- Reduced Interest Expense: A key benefit is the significant reduction in future interest expenses, bolstering profitability and improving the company's bottom line.

- Enhanced Financial Flexibility: The freed-up capital provides greater financial flexibility to pursue growth initiatives and weather potential economic downturns.

- Improved Credit Rating: The successful debt reduction could positively impact Lincoln Financial's credit rating, further enhancing its borrowing capacity and reducing its cost of capital.

Looking Ahead: Potential Implications for Investors

While the immediate impact is positive, investors should continue to monitor Lincoln Financial's performance and financial statements. Analyzing future earnings reports and strategic announcements will provide further insight into the long-term implications of this successful tender offer. Understanding the company's future investment strategy and its impact on shareholder value remains crucial for investors. For detailed financial information and investor resources, visit the Lincoln Financial Investor Relations website: [Insert Link to Lincoln Financial Investor Relations Website Here].

Conclusion: A Positive Sign in Uncertain Times

In a period of economic uncertainty, Lincoln Financial's successful tender offer demonstrates proactive financial management and inspires confidence among investors. The significant response to the offer underscores the market's faith in the company's future, highlighting its resilience and strategic planning. This achievement positions Lincoln Financial for future growth and strengthens its long-term financial health. The company's proactive debt management strategy sets a positive precedent for other financial institutions navigating similar market conditions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investors Respond: Lincoln Financial's Tender Offer Reaches $812 Million. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Powerball Lottery Results May 24th Drawing And 167 Million Jackpot

May 28, 2025

Powerball Lottery Results May 24th Drawing And 167 Million Jackpot

May 28, 2025 -

May 24 2025 Powerball Results Did Anyone Claim The Jackpot

May 28, 2025

May 24 2025 Powerball Results Did Anyone Claim The Jackpot

May 28, 2025 -

Houston Electricity Outages Current Status And Restoration Times

May 28, 2025

Houston Electricity Outages Current Status And Restoration Times

May 28, 2025 -

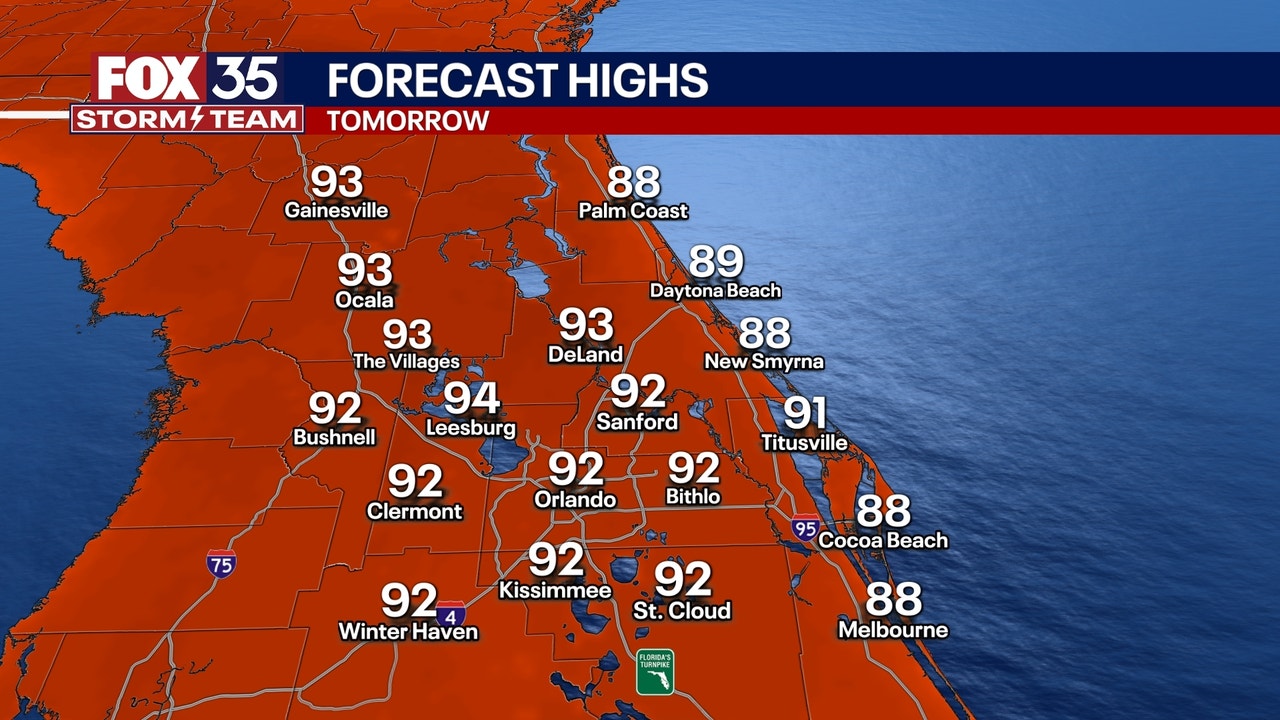

Orlando Weather Forecast Heat Humidity And Increased Storm Chances

May 28, 2025

Orlando Weather Forecast Heat Humidity And Increased Storm Chances

May 28, 2025 -

Mike North Defends Joe Burrows Concerns Over Repeated Primetime Games In Baltimore

May 28, 2025

Mike North Defends Joe Burrows Concerns Over Repeated Primetime Games In Baltimore

May 28, 2025