Investment Outlook: 3 AI Stocks With Palantir-Level Potential

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investment Outlook: 3 AI Stocks with Palantir-Level Potential

The artificial intelligence (AI) revolution is reshaping industries, and savvy investors are looking for the next big winners. While Palantir Technologies (PLTR) has captured significant attention for its data analytics prowess, the AI landscape is vast and ripe with untapped potential. This article explores three AI stocks poised for substantial growth, offering a compelling investment outlook for those seeking Palantir-level returns, but with potentially less volatility. We'll delve into their unique strengths and market positioning, providing you with the insights needed to make informed investment decisions.

Understanding the Palantir Phenomenon:

Before diving into our top three picks, it's crucial to understand why Palantir has become such a prominent player. Its groundbreaking data integration and analytics platforms serve government and commercial clients, offering crucial insights from complex datasets. This success stems from a combination of factors: a strong technology foundation, a focus on high-value contracts, and a first-mover advantage in certain niche markets. However, Palantir’s stock price has been subject to significant fluctuations, highlighting the inherent risks in investing in high-growth AI companies.

3 AI Stocks to Watch:

Our selection criteria focus on companies demonstrating strong AI capabilities, significant growth potential, and a compelling market position. Remember that investing in the stock market always carries risk, and these are just potential opportunities, not guarantees of success. Conduct thorough due diligence before making any investment decisions.

1. C3.ai (AI): The Enterprise AI Powerhouse

C3.ai provides an enterprise-grade AI platform enabling businesses to build and deploy AI applications across various sectors. This company offers a comprehensive suite of tools and pre-built applications, making AI adoption more accessible. Their focus on enterprise clients positions them for long-term growth, driven by increasing demand for AI solutions within established industries.

- Strengths: Robust platform, strong enterprise partnerships, expanding market share.

- Potential Risks: Competition from larger tech companies, reliance on enterprise adoption rates.

- Investment Outlook: C3.ai presents a strong potential for long-term growth, mirroring Palantir’s success in providing crucial AI-powered solutions to large organizations.

2. Microsoft (MSFT): The AI Giant

While not solely an AI company, Microsoft's significant investments in AI, particularly through its integration with Azure cloud services and its partnership with OpenAI, position it for substantial growth in the AI sector. Microsoft’s broad reach and established infrastructure provide a strong foundation for leveraging AI across various products and services.

- Strengths: Massive market capitalization, diverse product portfolio, strong brand recognition, leading cloud infrastructure.

- Potential Risks: Competition in the cloud computing market, regulatory scrutiny.

- Investment Outlook: Microsoft offers a more diversified, potentially less volatile, investment option with considerable AI exposure. Their strategic partnerships and integrations signal a long-term commitment to the AI space.

3. Nvidia (NVDA): The AI Hardware Leader

Nvidia’s dominance in the GPU market makes it a crucial player in the AI revolution. Its GPUs are essential for training and deploying many AI models, creating a significant competitive advantage. The increasing demand for high-performance computing power for AI applications strengthens Nvidia’s position.

- Strengths: Market leader in GPU technology, essential for AI development, strong growth prospects.

- Potential Risks: Dependence on the semiconductor industry, potential supply chain disruptions.

- Investment Outlook: Nvidia presents a compelling investment opportunity, capitalizing on the foundational hardware requirements of the booming AI sector. Their position as a key enabler of AI development offers significant long-term growth potential.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Call to Action: What are your thoughts on these AI stocks? Share your insights and investment strategies in the comments below!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investment Outlook: 3 AI Stocks With Palantir-Level Potential. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Cincinnati Bengals Road To The Playoffs Examining The 2025 Nfl Schedule

May 28, 2025

Cincinnati Bengals Road To The Playoffs Examining The 2025 Nfl Schedule

May 28, 2025 -

Medjedovics Roland Garros Run Continues Second Round Reached

May 28, 2025

Medjedovics Roland Garros Run Continues Second Round Reached

May 28, 2025 -

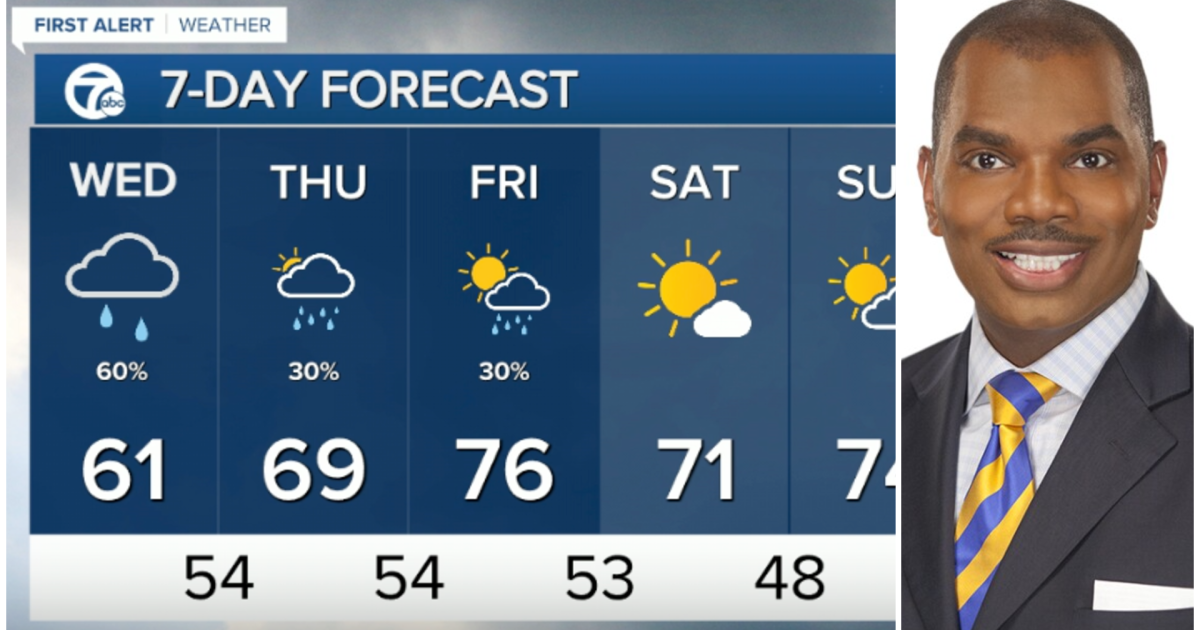

Metro Detroit To See Increased Rain Probability Wednesday

May 28, 2025

Metro Detroit To See Increased Rain Probability Wednesday

May 28, 2025 -

Roland Garros 2025 American Seeds Fritz And Navarro Suffer Early Exits

May 28, 2025

Roland Garros 2025 American Seeds Fritz And Navarro Suffer Early Exits

May 28, 2025 -

Cincinatti Bengals 2025 Nfl Schedule Primetime Games And Playoff Contention

May 28, 2025

Cincinatti Bengals 2025 Nfl Schedule Primetime Games And Playoff Contention

May 28, 2025