Investing In MSTR: Details On The New 9% Dividend Preferred Stock

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investing in MSTR: Details on the New 9% Dividend Preferred Stock – A Smart Move?

MicroStrategy (MSTR), the business intelligence company known for its significant Bitcoin holdings, has made headlines again, this time with the announcement of a new 9% dividend preferred stock offering. This move has sent ripples through the investment community, sparking questions about its implications and whether it's a smart investment strategy for individual investors. Let's delve into the details.

Understanding MicroStrategy's 9% Dividend Preferred Stock

The newly issued preferred stock, officially designated as Series A Mandatorily Convertible Preferred Stock, offers a compelling 9% annual dividend yield. This is significantly higher than the average dividend yield for many established companies. However, it's crucial to understand the nuances before jumping in. This isn't a typical preferred stock; it comes with a mandatory conversion feature. This means the shares will eventually be converted into common stock under specific circumstances, outlined in the offering documents.

Key Features to Consider:

- High Dividend Yield: The 9% annual dividend is a major draw for income-seeking investors. This attractive yield can significantly boost investment returns, particularly in a low-interest-rate environment.

- Mandatory Conversion: This is a key differentiating factor. While providing immediate income, the eventual conversion into common stock introduces an element of uncertainty regarding the future share price.

- Potential for Capital Appreciation: While the dividend is a key attraction, the conversion to common stock offers the potential for capital appreciation if MSTR's share price rises.

- Risk Assessment: Like any investment, there are risks involved. The success of this investment depends heavily on MicroStrategy's future performance and the overall market conditions.

Who Should Consider Investing in MSTR's Preferred Stock?

This preferred stock might be suitable for investors with a higher risk tolerance who are:

- Income-oriented: Those seeking a substantial dividend income stream will find the 9% yield particularly appealing.

- Long-term investors: The mandatory conversion feature requires a longer-term investment horizon. Short-term trading may not be ideal.

- Comfortable with volatility: MSTR's stock price can fluctuate significantly, making it crucial to have a long-term investment strategy and the ability to weather market downturns.

Potential Downsides:

- Conversion Uncertainty: The exact timing and terms of the conversion are subject to specific conditions, introducing an element of uncertainty.

- Dependence on MSTR's Performance: The success of the investment is directly linked to MicroStrategy's future financial performance and the overall market sentiment towards the company and its Bitcoin strategy.

- Dilution: The issuance of a large number of preferred shares could potentially dilute the value of existing common stock.

Analyzing the Bigger Picture: MSTR's Bitcoin Strategy

It's impossible to discuss MicroStrategy without mentioning its significant Bitcoin holdings. This bold strategy is a double-edged sword. While it has generated significant gains in the past (and losses at times!), it also introduces substantial volatility to the company's valuation. Investors should carefully consider the implications of this strategy when assessing the risk associated with the preferred stock offering. For more on MicroStrategy's Bitcoin strategy, you can read .

Conclusion: Proceed with Caution and Due Diligence

MicroStrategy's 9% dividend preferred stock offers an attractive yield, but investors must carefully weigh the risks and understand the implications of the mandatory conversion feature. Thorough research and a comprehensive understanding of the company's financial position and overall market conditions are crucial before making an investment decision. Consult with a qualified financial advisor to determine if this investment aligns with your individual risk tolerance and investment goals.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing involves risk, including the potential loss of principal. Always conduct your own thorough research and consult with a financial professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investing In MSTR: Details On The New 9% Dividend Preferred Stock. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Will Trumps Pro Vaccine Cdc Director Clash With Robert F Kennedy Jr

Jul 31, 2025

Will Trumps Pro Vaccine Cdc Director Clash With Robert F Kennedy Jr

Jul 31, 2025 -

First Look Ice Cube Fights Extraterrestrial Invaders In New Prime Video Film

Jul 31, 2025

First Look Ice Cube Fights Extraterrestrial Invaders In New Prime Video Film

Jul 31, 2025 -

Urgent Multiple Victims Reported In Manhattan Shooting Incident

Jul 31, 2025

Urgent Multiple Victims Reported In Manhattan Shooting Incident

Jul 31, 2025 -

Doncics Post Playoff Training Regime A Focused Approach To Improvement

Jul 31, 2025

Doncics Post Playoff Training Regime A Focused Approach To Improvement

Jul 31, 2025 -

Hedefinize Ulasin Yks Tercihlerinde Uzmanlarin Oenerecegi Stratejik Arastirma Yoentemleri

Jul 31, 2025

Hedefinize Ulasin Yks Tercihlerinde Uzmanlarin Oenerecegi Stratejik Arastirma Yoentemleri

Jul 31, 2025

Latest Posts

-

Interview Lindsay Lohan Discusses Motherhood And The Future Of Freaky Friday

Aug 01, 2025

Interview Lindsay Lohan Discusses Motherhood And The Future Of Freaky Friday

Aug 01, 2025 -

Reeleccion Indefinida Y Sexenios El Impacto De La Nueva Ley En El Salvador

Aug 01, 2025

Reeleccion Indefinida Y Sexenios El Impacto De La Nueva Ley En El Salvador

Aug 01, 2025 -

Yankees Cut Ties With Pitcher Marcus Stroman

Aug 01, 2025

Yankees Cut Ties With Pitcher Marcus Stroman

Aug 01, 2025 -

Dramatic Comeback Starodubtseva Overcomes Wang Yafan In Thrilling Montreal Match

Aug 01, 2025

Dramatic Comeback Starodubtseva Overcomes Wang Yafan In Thrilling Montreal Match

Aug 01, 2025 -

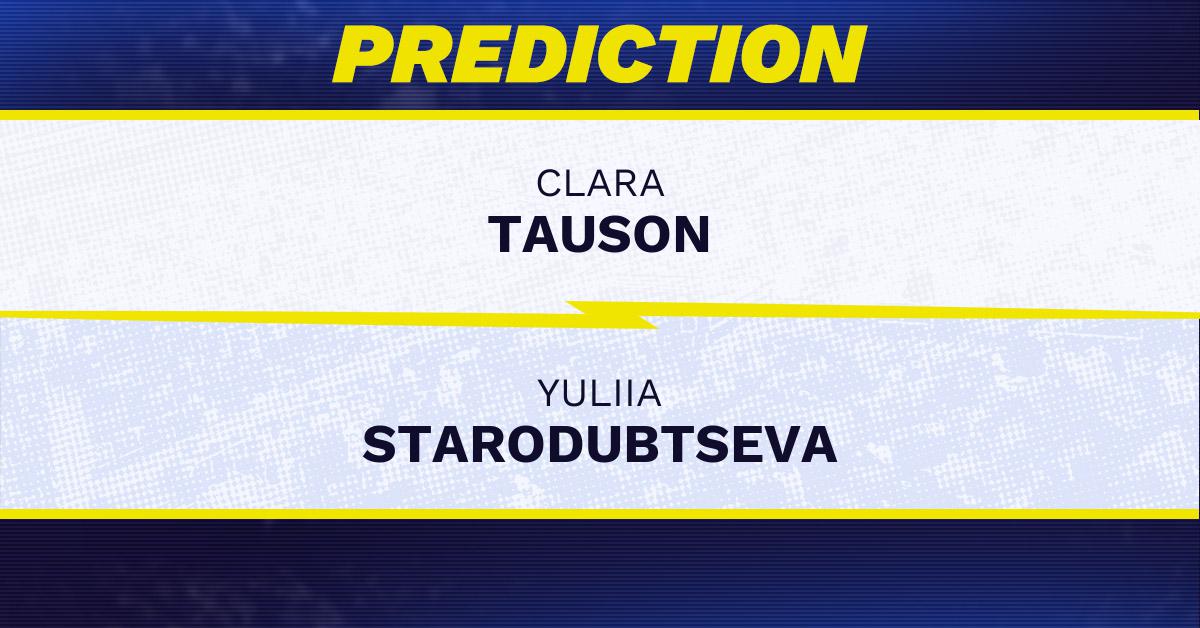

Clara Tauson Vs Yuliia Starodubtseva 2025 Canadian Open Prediction Analysis And Odds

Aug 01, 2025

Clara Tauson Vs Yuliia Starodubtseva 2025 Canadian Open Prediction Analysis And Odds

Aug 01, 2025