Investing In Intel: Will 2025 Bring A Profitable Turnaround?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

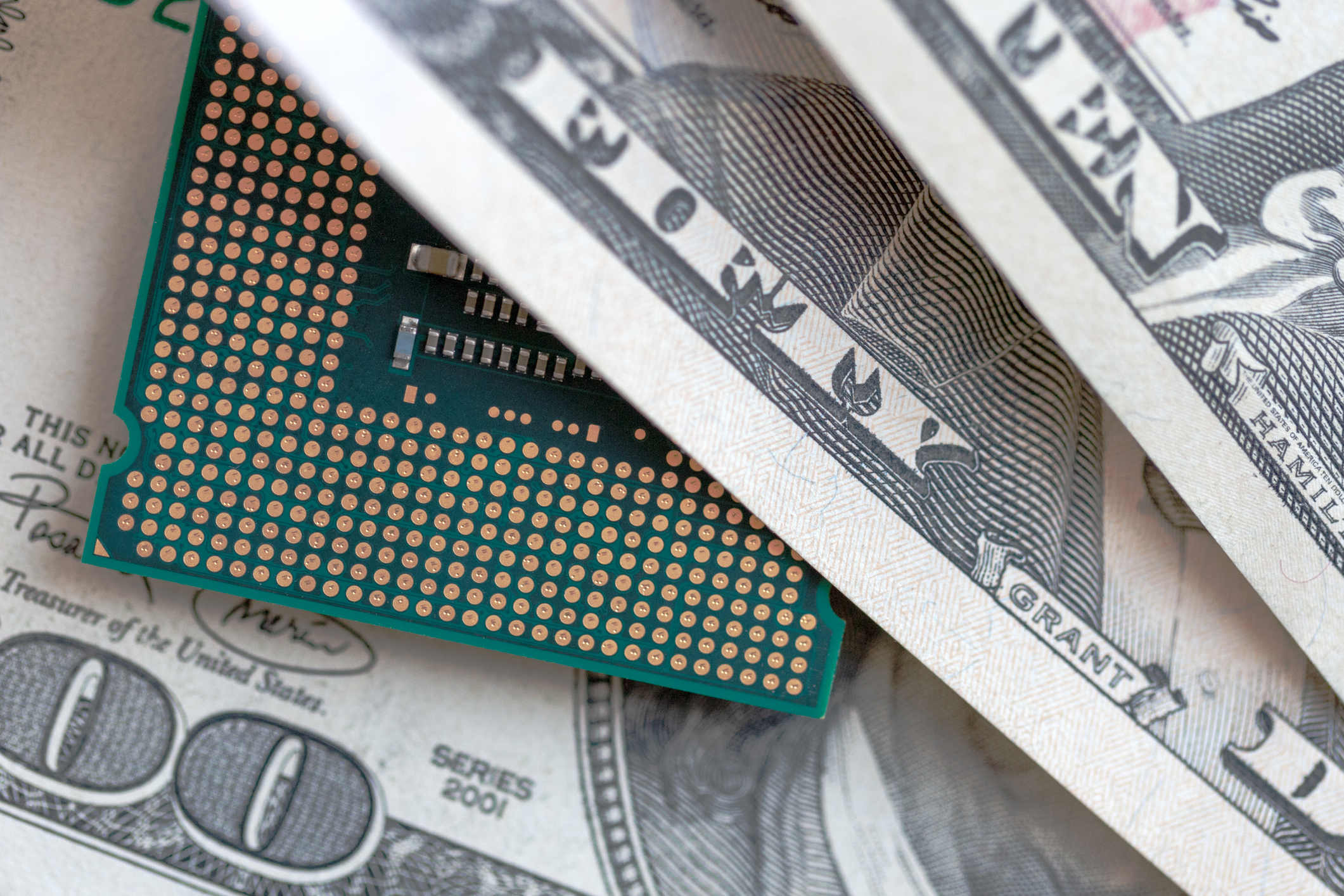

Investing in Intel: Will 2025 Bring a Profitable Turnaround?

Intel, a name synonymous with computing for decades, has faced significant headwinds in recent years. The once-dominant chipmaker has struggled to compete with rivals like TSMC and Samsung in the advanced process node race, leading to investor uncertainty. But with a renewed focus on manufacturing and a massive investment in its fabrication plants, the question on many investors' minds is: will 2025 mark a profitable turnaround for Intel?

This article delves into the factors that will determine Intel's success in the coming years, analyzing the company's strategy, competitive landscape, and potential market opportunities.

Intel's Turnaround Strategy: A Multi-pronged Approach

Intel's CEO, Pat Gelsinger, has spearheaded a significant restructuring since taking the helm. His "IDM 2.0" strategy is ambitious, focusing on several key areas:

-

Increased Capital Expenditure (CAPEX): Intel is investing billions in expanding its manufacturing capabilities, building new fabs in Arizona, Ohio, and potentially Europe. This aims to regain its technological edge and reduce reliance on external foundries. This massive investment is a gamble, but a necessary one if Intel hopes to compete with the leading foundries.

-

Focus on Advanced Process Nodes: Falling behind in process node technology has been a major setback. Intel is aggressively pursuing improvements in its manufacturing processes, aiming to catch up with TSMC and Samsung in the race to produce smaller, more powerful chips. Success here is crucial for future profitability.

-

Diversification beyond CPUs: While CPUs remain core to Intel's business, the company is expanding into other areas, such as GPUs, networking chips, and AI accelerators. This diversification reduces reliance on a single product category and opens up new revenue streams. This move is particularly important in the burgeoning AI market.

-

Strategic Partnerships: Intel is forming strategic alliances with other companies to broaden its reach and access new technologies. This collaborative approach is crucial in navigating the complex and competitive semiconductor landscape.

The Competitive Landscape: A Tough Fight Ahead

Despite Intel's efforts, the competitive landscape remains intensely challenging. TSMC and Samsung currently hold a significant lead in advanced process node technology. Furthermore, the semiconductor industry is cyclical, meaning that profitability can fluctuate significantly depending on global economic conditions and demand. Intel's success will depend on its ability to execute its turnaround strategy effectively and overcome these challenges.

Will 2025 See a Profitable Turnaround? A Cautious Outlook

Predicting the future of any company is inherently difficult, and Intel's situation is no exception. While Intel's renewed focus on manufacturing and diversification is promising, it's crucial to remember that significant challenges remain. The massive CAPEX investments will take time to yield returns, and success hinges on achieving technological parity with its competitors.

While 2025 might not represent a complete turnaround, significant progress in key areas – such as successfully ramping up production at its new fabs and achieving competitive process node technology – could indicate a positive trajectory. Investors should closely monitor Intel's progress in these areas, along with overall market trends, before making any investment decisions.

Investing in Intel: What to Consider

Before investing in Intel, conduct thorough due diligence. Consider factors like:

- Financial Performance: Analyze Intel's financial statements to assess its financial health and profitability.

- Technological Advancements: Stay updated on Intel's progress in its manufacturing processes and new product development.

- Market Conditions: Understand the overall state of the semiconductor industry and potential market disruptions.

- Risk Tolerance: Investing in Intel involves significant risk given the competitive landscape and the cyclical nature of the semiconductor industry.

Ultimately, investing in Intel in 2024 and beyond requires a long-term perspective. While a significant turnaround in 2025 is not guaranteed, the company's strategic initiatives offer a potential path to future profitability. However, investors should carefully weigh the risks and rewards before making any investment decisions. Consult with a financial advisor for personalized guidance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investing In Intel: Will 2025 Bring A Profitable Turnaround?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Brewers Pipeline Update Jacob Misiorowskis Call Up And Its Implications

Jun 10, 2025

Brewers Pipeline Update Jacob Misiorowskis Call Up And Its Implications

Jun 10, 2025 -

Pg And Es Family Electric Rate Assistance Program Gets Bigger

Jun 10, 2025

Pg And Es Family Electric Rate Assistance Program Gets Bigger

Jun 10, 2025 -

Bengals Roster Shakeup Germaine Pratts Release Confirmed

Jun 10, 2025

Bengals Roster Shakeup Germaine Pratts Release Confirmed

Jun 10, 2025 -

Musk Launches Potential Political Party Amid Trump Feud

Jun 10, 2025

Musk Launches Potential Political Party Amid Trump Feud

Jun 10, 2025 -

Whoopi Goldberg Accuses View Co Hosts Of Believing Fake Trump Musk Feud

Jun 10, 2025

Whoopi Goldberg Accuses View Co Hosts Of Believing Fake Trump Musk Feud

Jun 10, 2025