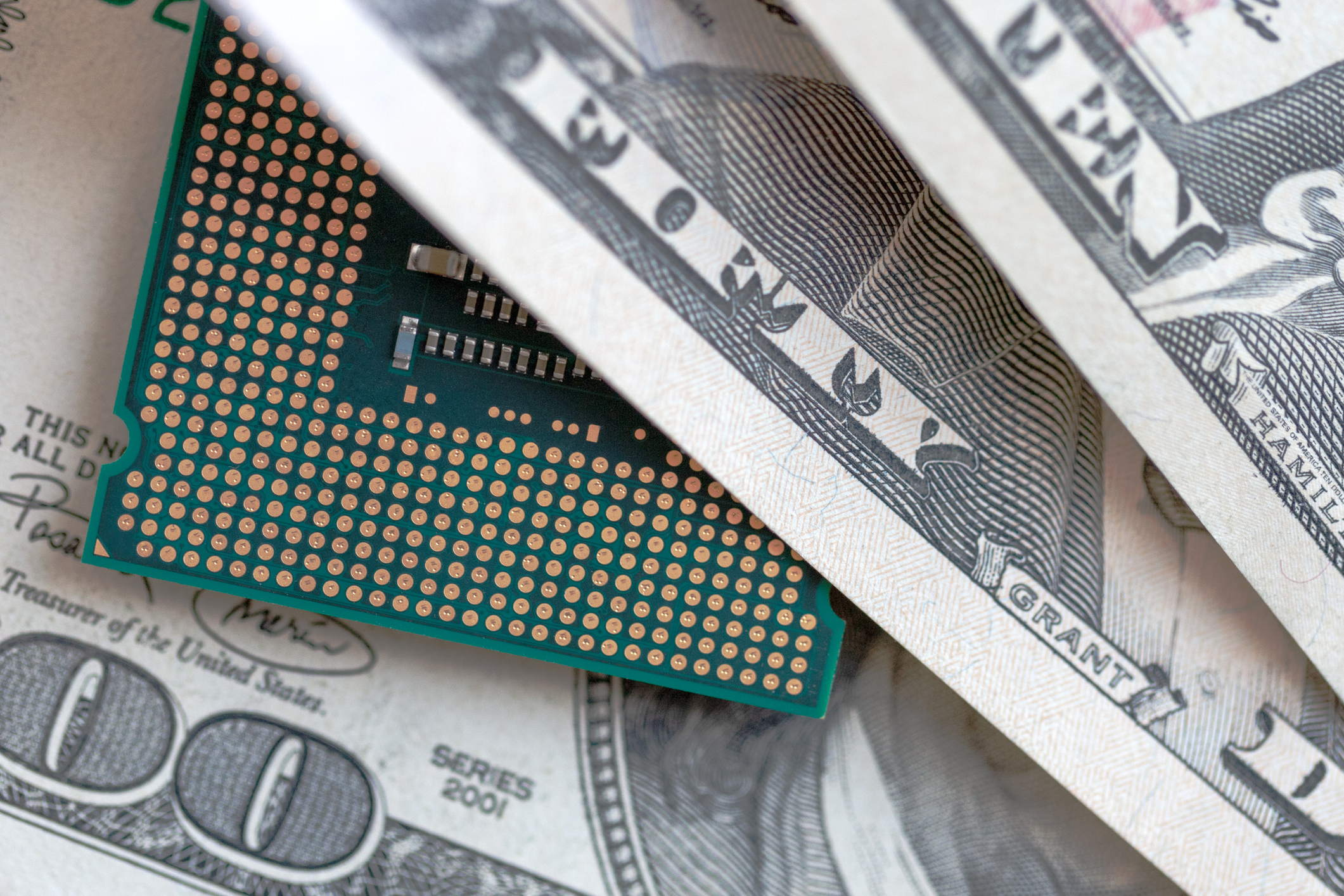

Investing In Intel: A 2025 Turnaround Analysis For Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investing in Intel: A 2025 Turnaround Analysis for Investors

Intel. The name synonymous with computing for decades, has faced turbulent times recently. Falling behind in the race for cutting-edge chip technology, the company has struggled to maintain its market share against formidable competitors like AMD and TSMC. But whispers of a turnaround are circulating, and savvy investors are wondering: is now the time to buy? This in-depth analysis examines Intel's potential for a 2025 turnaround and explores whether it's a worthwhile investment.

Intel's Challenges: A Rocky Road

Intel's recent struggles are well-documented. The company's manufacturing process has lagged behind competitors, resulting in delays in releasing next-generation processors and a loss of market share in both the CPU and GPU markets. This has impacted profitability and investor confidence. Furthermore, increased competition in the semiconductor industry has created a challenging landscape.

However, acknowledging the challenges is only half the battle. Intel's management has recognized these shortcomings and implemented aggressive strategies to address them.

Intel's Turnaround Strategy: A Path to Recovery?

Intel's turnaround strategy hinges on several key pillars:

- Investing in Advanced Manufacturing: Intel is heavily investing in its fabs (fabrication plants) to improve its manufacturing process and regain its technological edge. This includes advancements in EUV lithography and a commitment to leading-edge node production. Success here is crucial for future competitiveness.

- Expanding into New Markets: Intel is diversifying beyond its traditional CPU market. This includes increased focus on data center solutions, AI accelerators, and autonomous driving technologies. This diversification mitigates risk and opens up new revenue streams.

- Strategic Partnerships and Acquisitions: Intel is actively pursuing strategic partnerships and acquisitions to bolster its technological capabilities and expand its market reach. These collaborations help accelerate innovation and gain access to specialized technologies.

- Focus on R&D: Continued investment in research and development is paramount. Intel recognizes the need for constant innovation to stay competitive in the rapidly evolving semiconductor landscape. This ensures a pipeline of future technologies and maintains a technological edge.

The 2025 Outlook: Is a Turnaround Possible?

Predicting the future is always risky, but several factors suggest a potential turnaround by 2025:

- Improved Manufacturing Capabilities: If Intel's investments in its fabs bear fruit, we can expect to see a significant improvement in its manufacturing capabilities. This would allow them to produce more competitive chips, potentially regaining lost market share.

- New Product Launches: Successful launches of new processors and other products across their diversified portfolio are essential. Strong product performance and market adoption will drive revenue growth.

- Stronger Financial Performance: Ultimately, investor confidence hinges on demonstrably improved financial performance. Increased revenue, higher profit margins, and a return to consistent growth are crucial indicators of a successful turnaround.

- Market Conditions: The overall semiconductor market plays a significant role. Favorable market conditions and strong demand will certainly benefit Intel's recovery efforts.

Investing in Intel: A Calculated Risk?

Investing in Intel in 2024 involves a degree of risk. The turnaround strategy is ambitious, and its success is not guaranteed. However, the potential rewards could be substantial for those who believe in Intel's ability to execute its plan. It's crucial to conduct thorough due diligence, monitor Intel's progress, and remain aware of market fluctuations.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct thorough research and consider consulting with a financial advisor before making any investment decisions.

Further Reading:

- – For official company information and financial reports.

-

- Stay updated on the latest news and analysis.

By carefully considering the challenges, the strategy, and the potential outcomes, investors can make a more informed decision about whether to include Intel in their portfolios. The 2025 timeline offers a reasonable timeframe to gauge the success of Intel’s ambitious turnaround plan. The coming years will be crucial in determining whether Intel can truly reclaim its position as a leading force in the semiconductor industry.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investing In Intel: A 2025 Turnaround Analysis For Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Apples Upcoming Mac Book Pro Lineup A Farewell To Classic Designs

Jun 11, 2025

Apples Upcoming Mac Book Pro Lineup A Farewell To Classic Designs

Jun 11, 2025 -

Apple Poised To Discontinue Classic Mac Book Pro Lineup

Jun 11, 2025

Apple Poised To Discontinue Classic Mac Book Pro Lineup

Jun 11, 2025 -

Cricket Live England Vs West Indies Third T20 International Match

Jun 11, 2025

Cricket Live England Vs West Indies Third T20 International Match

Jun 11, 2025 -

Heated Exchange Elon Musk And Scott Bessant Confrontation At White House

Jun 11, 2025

Heated Exchange Elon Musk And Scott Bessant Confrontation At White House

Jun 11, 2025 -

The Best New Songs Of 2025 Our Editors Picks

Jun 11, 2025

The Best New Songs Of 2025 Our Editors Picks

Jun 11, 2025