Investing In Hims & Hers (HIMS): A Risky Proposition?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investing in Hims & Hers (HIMS): A Risky Proposition?

The telehealth revolution has brought convenient healthcare access to millions, and Hims & Hers (HIMS) has ridden that wave to significant growth. But is investing in this telehealth giant a smart move, or a risky proposition? This in-depth analysis explores the potential rewards and significant challenges facing investors considering a stake in HIMS.

Hims & Hers: A Telehealth Pioneer

Hims & Hers, a leading telehealth platform, offers a wide range of treatments for men and women, focusing on hair loss, sexual health, skincare, and mental wellness. Their direct-to-consumer model, utilizing convenient online consultations and home delivery of medications and products, has disrupted traditional healthcare delivery. This business model has attracted a substantial customer base and positioned HIMS as a major player in the rapidly expanding telehealth market. However, success in this competitive landscape isn't guaranteed.

The Allure of HIMS Stock:

The company's appeal to investors stems from several factors:

- Massive Market Potential: The telehealth market is booming, presenting immense growth opportunities for companies like HIMS. The increasing demand for convenient and accessible healthcare solutions fuels this expansion.

- Strong Brand Recognition: Hims & Hers has successfully cultivated strong brand recognition through targeted marketing campaigns, creating a recognizable and trusted name in the telehealth space.

- Diversified Product Offerings: Their diverse range of products and services caters to a broader customer base, reducing reliance on any single offering.

Navigating the Risks:

Despite the potential upsides, several significant risks accompany investing in HIMS:

- Regulatory Scrutiny: The telehealth industry faces increasing regulatory scrutiny, and changes in regulations could negatively impact HIMS's operations and profitability. This is a crucial factor to consider for any potential investor. [Link to relevant FDA regulations]

- Competition: The telehealth sector is becoming increasingly crowded, with established players and new entrants vying for market share. Intense competition can pressure pricing and profit margins.

- Dependence on Marketing: HIMS relies heavily on marketing and advertising to acquire new customers. Reduced marketing effectiveness or increased competition could hinder growth.

- Profitability Concerns: While revenue is growing, HIMS hasn't consistently demonstrated profitability, raising concerns about its long-term financial sustainability. A thorough examination of their financial statements is crucial before investing. [Link to HIMS investor relations page]

Is it Worth the Risk?

Investing in HIMS presents a classic high-reward, high-risk scenario. The company's innovative approach and significant market opportunity are attractive, but the regulatory challenges, competition, and profitability concerns cannot be ignored.

Before making any investment decisions, potential investors should:

- Conduct thorough due diligence: Examine HIMS's financial statements, understand its business model, and assess the competitive landscape.

- Diversify your portfolio: Don't put all your eggs in one basket. Spread your investments across various asset classes to mitigate risk.

- Consult with a financial advisor: Seek professional advice tailored to your individual financial situation and risk tolerance.

The future of Hims & Hers, and by extension its stock price, remains uncertain. While the potential for significant returns exists, investors must carefully weigh the inherent risks before committing their capital. This is not financial advice; always conduct your own research and consult with a professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investing In Hims & Hers (HIMS): A Risky Proposition?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

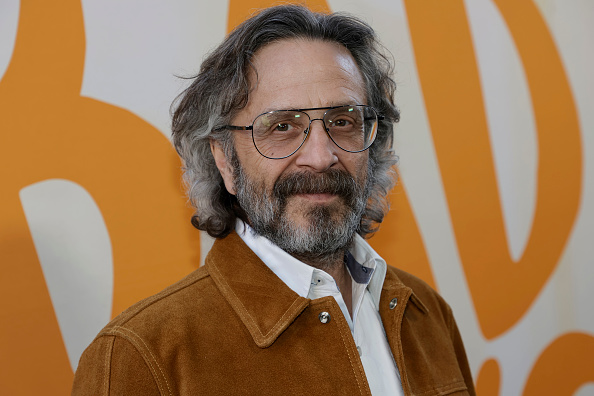

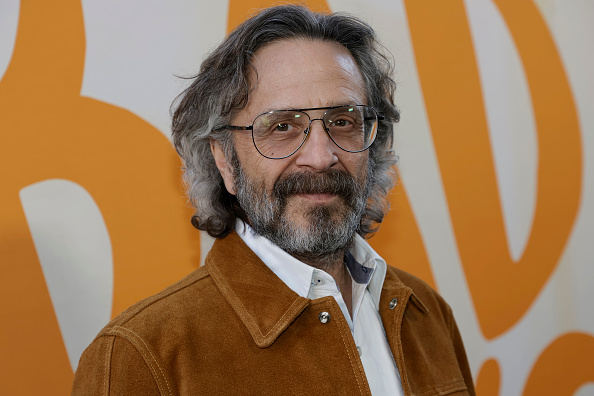

Wtf With Marc Maron Signs Off A Legacy Of Unfiltered Conversations

Jun 03, 2025

Wtf With Marc Maron Signs Off A Legacy Of Unfiltered Conversations

Jun 03, 2025 -

16 Years Of Wtf Marc Maron Announces Podcasts Final Episodes

Jun 03, 2025

16 Years Of Wtf Marc Maron Announces Podcasts Final Episodes

Jun 03, 2025 -

Us China Trade War Jamie Dimons Warning On The Ineffectiveness Of Tariffs

Jun 03, 2025

Us China Trade War Jamie Dimons Warning On The Ineffectiveness Of Tariffs

Jun 03, 2025 -

Al Rokers Weight Loss Journey Strategies For Long Term Success

Jun 03, 2025

Al Rokers Weight Loss Journey Strategies For Long Term Success

Jun 03, 2025 -

After 16 Years Marc Marons Wtf Podcast Is Conclude

Jun 03, 2025

After 16 Years Marc Marons Wtf Podcast Is Conclude

Jun 03, 2025