Investing In Hims & Hers (HIMS): A Risk Assessment

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investing in Hims & Hers (HIMS): A Risk Assessment

The telehealth revolution is booming, and Hims & Hers (HIMS) is a prominent player. But is investing in this company a smart move? This in-depth analysis provides a comprehensive risk assessment for potential investors, weighing the exciting opportunities against the inherent challenges.

Hims & Hers, a digitally native company offering telehealth services for men's and women's health, has seen significant growth since its inception. Their direct-to-consumer model, focusing on convenience and accessibility, has attracted a substantial customer base. However, the company operates in a rapidly evolving and highly competitive landscape, making a thorough risk assessment crucial before investing.

H2: Growth Potential and Market Opportunity:

The telehealth market is experiencing explosive growth, driven by increased consumer demand for convenient healthcare solutions. Hims & Hers's focus on men's and women's health, specifically addressing areas like hair loss, sexual health, and skincare, taps into a large and underserved market. This presents a significant opportunity for future expansion and revenue generation. They've successfully leveraged social media marketing and influencer collaborations to reach a wider audience, further solidifying their brand recognition.

H2: Key Risks to Consider:

While the potential for growth is undeniable, investors must carefully consider several key risks:

- Increased Competition: The telehealth sector is attracting significant investment, leading to increased competition. New entrants and established players are constantly vying for market share, potentially squeezing Hims & Hers's profit margins.

- Regulatory Uncertainty: The regulatory landscape surrounding telehealth is constantly evolving. Changes in regulations could significantly impact the company's operations and profitability. Staying abreast of these changes is crucial for long-term success.

- Reliance on Marketing and Advertising: Hims & Hers's business model relies heavily on marketing and advertising. Changes in advertising costs or effectiveness could negatively impact their bottom line.

- Data Privacy and Security: Handling sensitive patient data requires robust security measures. Any data breach or privacy violation could severely damage the company's reputation and lead to significant financial losses. This is a major concern for any telehealth provider.

- Dependence on Subscription Model: A significant portion of Hims & Hers's revenue comes from subscription services. Customer churn and retention rates are critical factors influencing financial performance. Losing subscribers could significantly impact revenue.

- Product Liability: Offering medical products and services carries inherent risks of product liability lawsuits. Any legal challenges related to product efficacy or safety could have substantial financial implications.

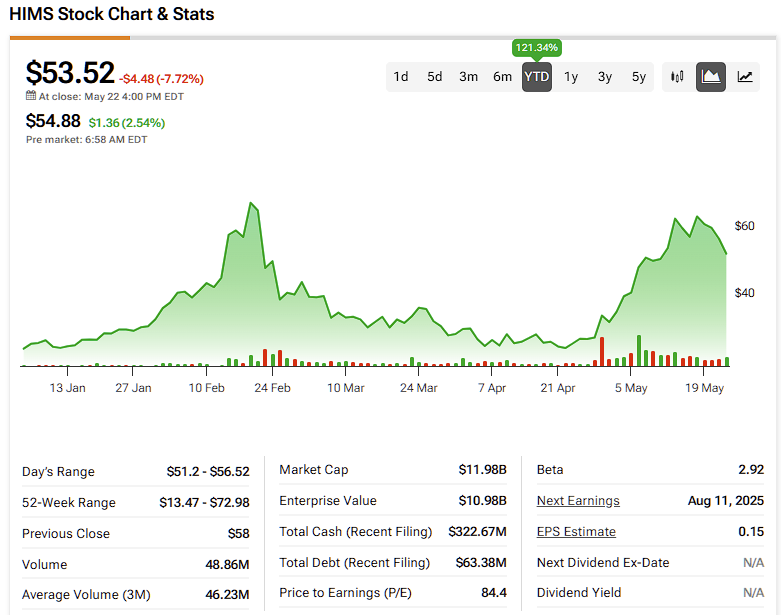

H2: Financial Performance and Valuation:

Investors should thoroughly analyze Hims & Hers's financial statements, including revenue growth, profitability, and cash flow. Comparing their performance to industry benchmarks is essential for determining their valuation and assessing their long-term financial health. [Link to Hims & Hers investor relations page].

H2: Conclusion: Weighing the Risks and Rewards:

Investing in Hims & Hers presents both significant opportunities and substantial risks. The company operates in a rapidly growing market with considerable potential. However, competition, regulatory uncertainty, and operational challenges must be carefully considered. Potential investors should conduct thorough due diligence, including a comprehensive analysis of the company's financials, competitive landscape, and regulatory environment, before making any investment decisions. Consulting with a qualified financial advisor is strongly recommended.

Disclaimer: This article provides general information and should not be considered investment advice. Investing in the stock market involves inherent risks, and you could lose money. Always conduct your own research and seek professional advice before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investing In Hims & Hers (HIMS): A Risk Assessment. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

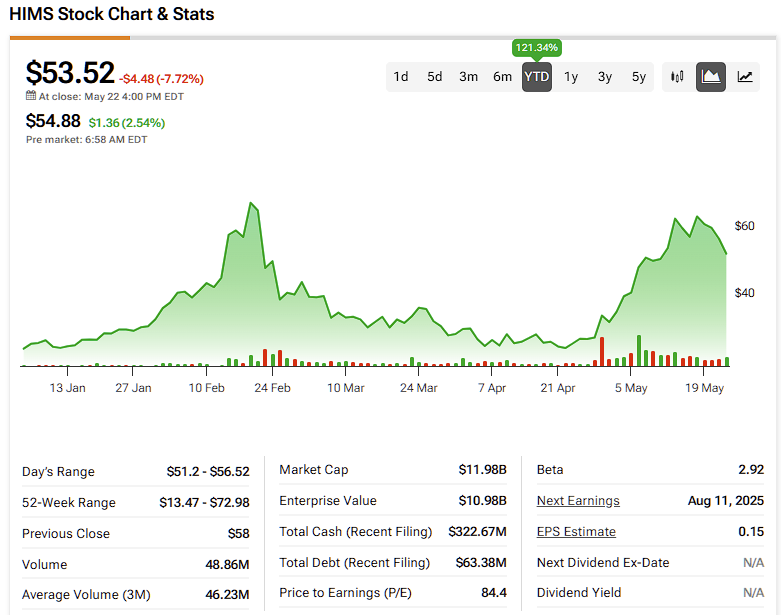

Al Rokers Lasting Weight Loss Insights And Inspiration After 20 Years

Jun 04, 2025

Al Rokers Lasting Weight Loss Insights And Inspiration After 20 Years

Jun 04, 2025 -

Social Media Firestorm Ex Wvu Player And The Pitt Logo Incident

Jun 04, 2025

Social Media Firestorm Ex Wvu Player And The Pitt Logo Incident

Jun 04, 2025 -

Social Media Firestorm Wvu Players Pitt Logo Disrespect Ignites Twitter

Jun 04, 2025

Social Media Firestorm Wvu Players Pitt Logo Disrespect Ignites Twitter

Jun 04, 2025 -

Pre Match Analysis Marquez Highlights Roster Turnover For India Thailand Game

Jun 04, 2025

Pre Match Analysis Marquez Highlights Roster Turnover For India Thailand Game

Jun 04, 2025 -

La 500 2025 An Interview With Tech Innovator Lucy Guo

Jun 04, 2025

La 500 2025 An Interview With Tech Innovator Lucy Guo

Jun 04, 2025