Investing In Hims & Hers (HIMS): A Prudent Approach To Stock Evaluation.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investing in Hims & Hers (HIMS): A Prudent Approach to Stock Evaluation

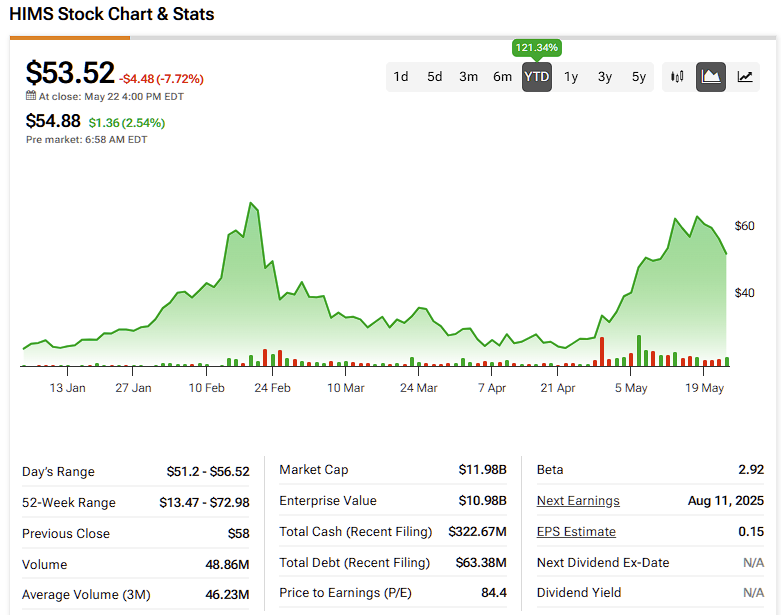

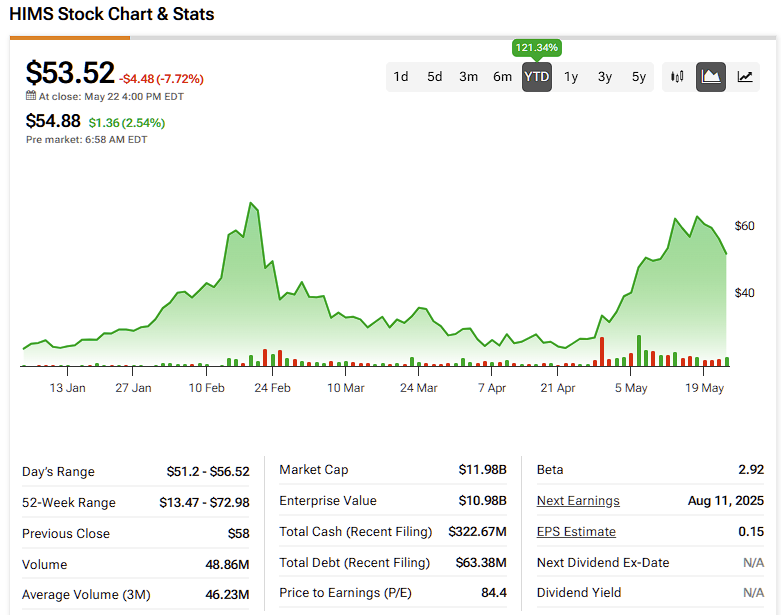

Hims & Hers Health (HIMS), the telehealth company revolutionizing the way people access healthcare for common conditions like hair loss, sexual health, and skincare, has captured the attention of many investors. But is investing in HIMS a prudent move? This article delves into a thorough stock evaluation, considering both the opportunities and risks associated with this dynamic company.

Hims & Hers: A Disruptive Force in Telehealth

Hims & Hers has carved a unique niche in the telehealth market by offering convenient, affordable, and discreet access to treatments previously shrouded in stigma or difficulty to obtain. Their direct-to-consumer model, leveraging a strong online presence and targeted advertising, has fueled significant growth. This disruption of traditional healthcare models is a key factor driving investor interest.

Key Strengths of HIMS:

- Strong Brand Recognition: The Hims & Hers brand is widely recognized and associated with ease of access and discretion, crucial factors for the sensitive health concerns they address.

- Scalable Business Model: Their online platform allows for significant scalability, reducing overhead costs compared to traditional brick-and-mortar clinics.

- Expanding Product Portfolio: Continuously expanding their product offerings beyond their initial focus allows them to tap into a broader customer base and increase revenue streams.

- Data-Driven Approach: The company utilizes data analytics to personalize treatment plans and optimize marketing efforts, improving efficiency and customer retention.

Challenges and Risks to Consider:

- Competition: The telehealth market is becoming increasingly competitive, with established players and new entrants vying for market share. Analyzing the competitive landscape is crucial before investing.

- Regulatory Scrutiny: The healthcare industry is heavily regulated, and changes in regulations could impact HIMS' operations and profitability. Staying informed about regulatory developments is vital.

- Dependence on Marketing: HIMS relies heavily on marketing and advertising to acquire new customers. Changes in marketing effectiveness or increased competition could affect their growth trajectory.

- Profitability Concerns: While the company shows significant revenue growth, achieving consistent profitability remains a key challenge. Investors need to carefully analyze their financial statements and future projections.

Evaluating HIMS Stock: A Prudent Investor's Checklist

Before making any investment decisions, a prudent investor should:

- Thoroughly Research the Company: Go beyond the headlines and delve into the company's financial reports, SEC filings (10-K, 10-Q), and investor presentations to understand their business model, financial performance, and future outlook.

- Analyze the Competitive Landscape: Identify key competitors and assess their strengths and weaknesses relative to HIMS.

- Assess the Risk Tolerance: HIMS, like any growth stock, carries inherent risks. Ensure your investment aligns with your overall risk tolerance.

- Diversify Your Portfolio: Never put all your eggs in one basket. Diversification is crucial for mitigating risk.

- Seek Professional Advice: Consult with a qualified financial advisor before making any significant investment decisions. They can provide personalized guidance based on your financial situation and goals.

Conclusion: A Long-Term Perspective?

Investing in HIMS presents both exciting opportunities and significant risks. Its innovative approach to telehealth has the potential for long-term growth, but investors need to carefully weigh the challenges and conduct thorough due diligence before committing capital. A long-term perspective, coupled with a clear understanding of the company's financials and market dynamics, is crucial for making an informed investment decision. Remember to always consult with a financial professional before making any investment choices. This article is for informational purposes only and should not be considered financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investing In Hims & Hers (HIMS): A Prudent Approach To Stock Evaluation.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

England Women Triumph Over West Indies A Century Celebration

Jun 04, 2025

England Women Triumph Over West Indies A Century Celebration

Jun 04, 2025 -

The Suhail Bhat Story A Kashmiri Footballers Remarkable Success

Jun 04, 2025

The Suhail Bhat Story A Kashmiri Footballers Remarkable Success

Jun 04, 2025 -

Suhail Bhats Ascent A Kashmiri Footballers Triumph

Jun 04, 2025

Suhail Bhats Ascent A Kashmiri Footballers Triumph

Jun 04, 2025 -

3 02 Gain For Hims Stock Hims And Hers Health Inc Market Update May 30th

Jun 04, 2025

3 02 Gain For Hims Stock Hims And Hers Health Inc Market Update May 30th

Jun 04, 2025 -

Is Trumps Big Beautiful Bill Doomed The Gops Uncertain Defense Strategy

Jun 04, 2025

Is Trumps Big Beautiful Bill Doomed The Gops Uncertain Defense Strategy

Jun 04, 2025