Internal Threats To US Economy: A Warning From JPMorgan's CEO

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Internal Threats to US Economy: JPMorgan Chase CEO Sounds the Alarm

JPMorgan Chase CEO Jamie Dimon's recent warning about significant internal threats to the US economy has sent shockwaves through financial markets. Dimon, known for his candid assessments, highlighted several key vulnerabilities that could derail the nation's economic progress, moving beyond the usual concerns about inflation and potential recession. This isn't just another Wall Street prediction; it's a stark reminder of the fragility of the US economy and the need for proactive measures.

Dimon's Key Concerns: A Deeper Dive

Dimon's warning wasn't a generalized concern; he specifically pointed to several significant internal risks:

1. The Looming Debt Ceiling Crisis: The ongoing political deadlock surrounding the US debt ceiling remains a major point of concern. Failure to raise the debt ceiling could trigger a catastrophic default, crippling the US economy and potentially triggering a global financial crisis. This isn't a hypothetical scenario; experts have warned of the devastating consequences for years. [Link to article about the debt ceiling crisis]

2. Political Polarization and Gridlock: Dimon emphasized the detrimental effect of extreme political polarization on effective governance. The inability to reach bipartisan consensus on crucial economic issues hinders progress and creates uncertainty, discouraging investment and hindering long-term economic growth. This political climate creates a volatile environment for businesses and investors alike.

3. The Uncertain Future of Geopolitical Relations: While not strictly an "internal" threat, the increasingly complex geopolitical landscape significantly impacts the US economy. Global tensions, trade wars, and supply chain disruptions all contribute to economic instability. Dimon implicitly linked this external instability to the internal fragility of the US economic system.

4. The Unpredictability of Monetary Policy: The Federal Reserve's aggressive interest rate hikes, aimed at curbing inflation, carry their own set of risks. While inflation control is crucial, the potential for triggering a recession through overly aggressive monetary policy remains a significant concern. This delicate balancing act requires careful navigation to avoid a hard landing.

What Does This Mean for the Average American?

Dimon's warning isn't just for economists and Wall Street analysts; it has real-world consequences for everyday Americans. The potential for economic instability could translate to:

- Job losses: Economic downturns often lead to job cuts and increased unemployment.

- Reduced investment: Uncertainty discourages investment, hindering business growth and creating fewer opportunities.

- Increased inflation: Economic instability can exacerbate inflationary pressures, further eroding purchasing power.

- Higher interest rates: Attempts to combat inflation can lead to higher borrowing costs, impacting everything from mortgages to car loans.

Looking Ahead: A Call for Action

Dimon's message is a clear call for action. Addressing these internal threats requires a concerted effort from policymakers, businesses, and individuals. This includes:

- Responsible fiscal policy: Addressing the debt ceiling and implementing sustainable fiscal policies are paramount.

- Bipartisan cooperation: Overcoming political gridlock and finding common ground on crucial economic issues is essential.

- Strengthening international alliances: Navigating the complex geopolitical landscape requires strong alliances and diplomatic efforts.

- Careful monetary policy: The Federal Reserve needs to carefully manage interest rates to avoid triggering a recession.

The US economy faces significant challenges. While external factors contribute to economic uncertainty, Dimon's warning highlights the critical importance of addressing internal vulnerabilities. Ignoring these threats would be a grave mistake, potentially leading to significant economic hardship for millions of Americans. The time for proactive measures is now.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Internal Threats To US Economy: A Warning From JPMorgan's CEO. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

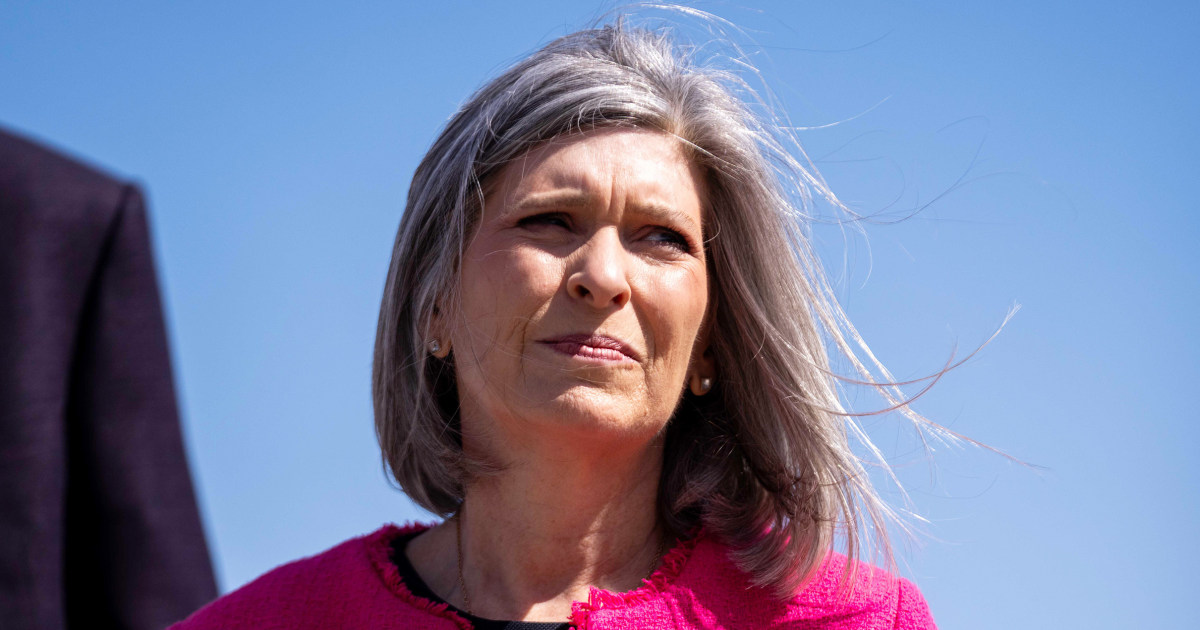

Ernsts Stern Medicaid Response Draws Fire

Jun 02, 2025

Ernsts Stern Medicaid Response Draws Fire

Jun 02, 2025 -

Luxury Enhanced Celebrity Cruises Details 250 Million Solstice Class Upgrade

Jun 02, 2025

Luxury Enhanced Celebrity Cruises Details 250 Million Solstice Class Upgrade

Jun 02, 2025 -

We All Are Going To Die Ernsts Blunt Defense Of Medicaid Cuts

Jun 02, 2025

We All Are Going To Die Ernsts Blunt Defense Of Medicaid Cuts

Jun 02, 2025 -

Sydney Sweeneys Unusual New Venture Bathwater Infused Soap

Jun 02, 2025

Sydney Sweeneys Unusual New Venture Bathwater Infused Soap

Jun 02, 2025 -

The Wire Actor S Son Injured In Henry County Tornado Thrown 300 Feet

Jun 02, 2025

The Wire Actor S Son Injured In Henry County Tornado Thrown 300 Feet

Jun 02, 2025