Internal Threats Pose Significant Risk To US Economy, Says JPMorgan CEO

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Internal Threats Pose Significant Risk to US Economy, Says JPMorgan CEO

JPMorgan Chase CEO Jamie Dimon's recent warning about significant internal threats to the US economy has sent shockwaves through financial markets and sparked urgent discussions about the nation's economic vulnerabilities. Dimon's comments, made during a [link to relevant source, e.g., JPMorgan earnings call transcript or news report], highlight concerns far beyond typical external factors like inflation and geopolitical instability. This isn't just about the usual economic anxieties; Dimon points to deep-seated internal issues that could significantly hamper future growth.

Beyond Inflation: The Unexpected Risks to the US Economy

While inflation and rising interest rates remain pressing concerns, Dimon's warning focuses on a different set of challenges. He pinpointed several key internal threats:

-

Political gridlock and dysfunction: The inability of Congress to address critical issues, leading to policy uncertainty and hindering long-term planning, is a major concern. This political stalemate creates an unpredictable environment for businesses, discouraging investment and hindering economic growth.

-

Fiscal irresponsibility: The growing national debt and unsustainable spending patterns pose a significant long-term risk. This puts pressure on the economy, potentially leading to higher interest rates and reduced government spending on essential services.

-

Declining workforce participation: The shrinking labor pool, attributed to factors like an aging population and declining birth rates, limits economic potential and fuels inflationary pressures through wage increases. Addressing this requires a multi-faceted approach, including immigration reform and investment in education and training.

-

Geopolitical instability: Although classified as an external factor, the US's entanglement in global conflicts and its response to them have profound internal consequences. These ripple effects can strain resources, disrupt supply chains, and impact investor confidence. Dimon’s comments likely factor in this ongoing uncertainty.

-

Social and political polarization: Deep divisions within the country are hindering productive dialogue and collaboration, impacting everything from policy-making to business operations. This polarization fuels uncertainty and instability, making it difficult to address critical economic challenges.

What Dimon's Warning Means for Investors and the Average American

Dimon's statement is a serious call to action. It's not just a pessimistic outlook; it's a warning that requires immediate and comprehensive action. For investors, it underscores the need for diversification and a cautious approach. For the average American, it highlights the importance of understanding these underlying economic pressures and engaging in informed civic participation.

What can be done? Addressing these internal threats requires a collaborative effort across all sectors of society. Policymakers need to prioritize responsible fiscal management, foster bipartisan cooperation, and invest in long-term solutions to address the shrinking workforce. Businesses need to adapt to the changing economic landscape and prioritize resilience. And individuals must engage in informed civic participation and demand accountability from their elected officials.

Looking Ahead: Navigating Uncertain Economic Waters

The economic outlook remains uncertain, but Dimon’s warning provides a valuable framework for understanding the complex challenges facing the US economy. By acknowledging these internal vulnerabilities, the nation can begin to address them proactively and work towards a more sustainable and prosperous future. The need for responsible leadership and proactive solutions is now more critical than ever. Staying informed about these developments and understanding their potential impact is crucial for both investors and citizens alike.

Call to action: Stay informed about economic news and engage in constructive conversations about the future of the US economy. Consider reaching out to your elected officials to voice your concerns and advocate for responsible policies.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Internal Threats Pose Significant Risk To US Economy, Says JPMorgan CEO. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

New South Loop Soccer Stadium Chicago Fires Major Development Announcement

Jun 03, 2025

New South Loop Soccer Stadium Chicago Fires Major Development Announcement

Jun 03, 2025 -

Ahead Of Mpsc Hearing Detroit Legislator Condemns Dte Energys Performance

Jun 03, 2025

Ahead Of Mpsc Hearing Detroit Legislator Condemns Dte Energys Performance

Jun 03, 2025 -

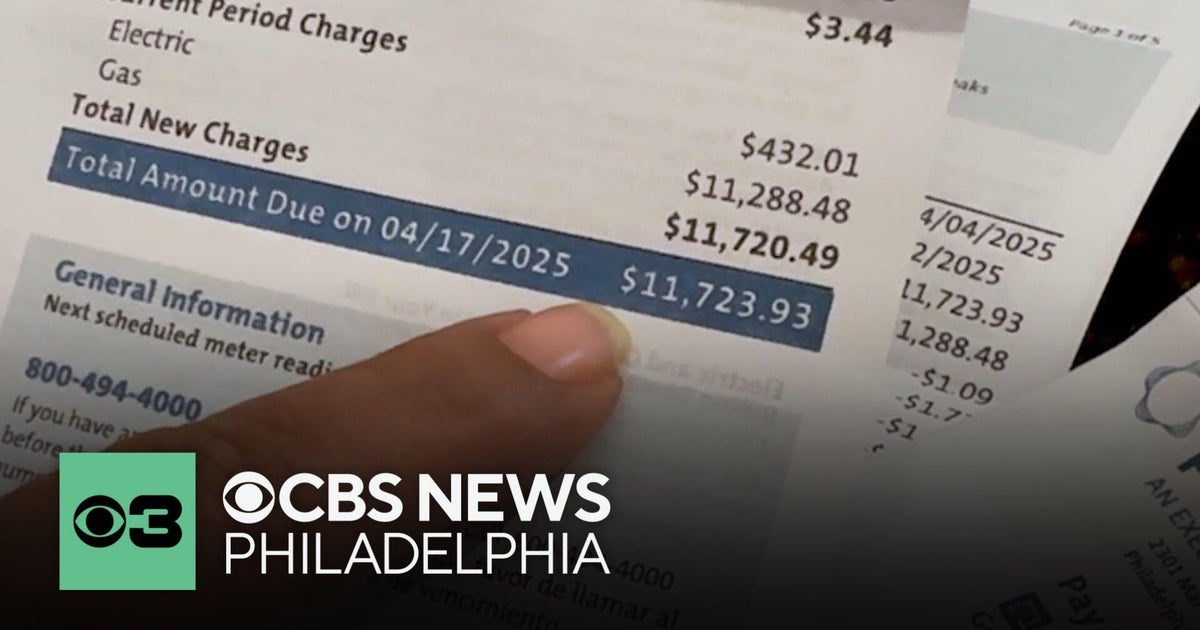

Peco Billing Error Customer Receives 12 000 Bill After Months Of No Statements

Jun 03, 2025

Peco Billing Error Customer Receives 12 000 Bill After Months Of No Statements

Jun 03, 2025 -

2 C Climate Change Urgent Actions For Businesses Today

Jun 03, 2025

2 C Climate Change Urgent Actions For Businesses Today

Jun 03, 2025 -

The Controversy Surrounding Sydney Sweeneys Bathwater Sales

Jun 03, 2025

The Controversy Surrounding Sydney Sweeneys Bathwater Sales

Jun 03, 2025