Internal Risks Pose Significant Threat To US Economy, JPMorgan CEO Claims

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Internal Risks Pose Significant Threat to US Economy, JPMorgan CEO Claims

Jamie Dimon's stark warning highlights vulnerabilities within the American economic landscape.

JPMorgan Chase & Co.'s CEO, Jamie Dimon, has issued a stark warning, asserting that internal risks pose a more significant threat to the US economy than external factors like the war in Ukraine or rising interest rates. This alarming statement, made during a recent earnings call, sent shockwaves through financial markets and ignited a heated debate among economists and policymakers. Dimon's concerns center on several key areas, painting a picture of a US economy grappling with internal fragility.

The Internal Threats: A Deeper Dive

Dimon didn't mince words, highlighting several key internal vulnerabilities:

-

Government Debt and Spending: The soaring national debt and unsustainable government spending practices were cited as major concerns. The potential for a debt ceiling crisis, coupled with ongoing budget battles, creates significant uncertainty and could trigger a market downturn. [Link to relevant government debt statistics]

-

Political Polarization: The increasing political polarization within the United States is another significant factor contributing to economic instability. Dimon suggested that the inability to reach bipartisan consensus on critical economic issues hinders effective policymaking and creates an unpredictable environment for businesses. [Link to article on political polarization and its economic impact]

-

Geopolitical Risks: While acknowledging external factors, Dimon emphasized that the US's internal vulnerabilities make it more susceptible to these external shocks. He stressed that the current geopolitical climate, including the war in Ukraine, further exacerbates existing domestic weaknesses.

-

Inflation and Potential Recession: The persistent inflation and the looming threat of a recession are, according to Dimon, significantly amplified by the internal weaknesses mentioned above. The lack of cohesive policy responses to these challenges makes the situation even more precarious. [Link to article on current inflation rates]

What Does This Mean for the Average American?

Dimon's warning isn't just about Wall Street; it has significant implications for everyday Americans. The potential for economic instability translates to:

- Job insecurity: A recession triggered by these internal factors could lead to widespread job losses and increased unemployment.

- Increased cost of living: Inflation, exacerbated by internal vulnerabilities, continues to erode purchasing power, impacting household budgets.

- Market volatility: Uncertainty in the markets can lead to losses for investors and further economic instability.

The Path Forward: A Call for Unity and Action

Dimon's call to action emphasizes the need for bipartisan cooperation and responsible fiscal policies to address these internal threats. He suggests that a united front, focused on long-term sustainable solutions, is crucial to mitigate the risks and ensure the long-term health of the US economy. This includes addressing the national debt, fostering a more stable political climate, and implementing effective strategies to curb inflation.

Conclusion: A Wake-Up Call

Jamie Dimon's warning serves as a crucial wake-up call. The US economy faces significant challenges stemming from internal vulnerabilities, demanding immediate and decisive action. Addressing these issues requires a collective effort from policymakers, businesses, and individuals to safeguard the nation's economic future. The time for political posturing is over; the time for collaborative solutions is now. What are your thoughts on this critical economic assessment? Share your opinions in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Internal Risks Pose Significant Threat To US Economy, JPMorgan CEO Claims. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

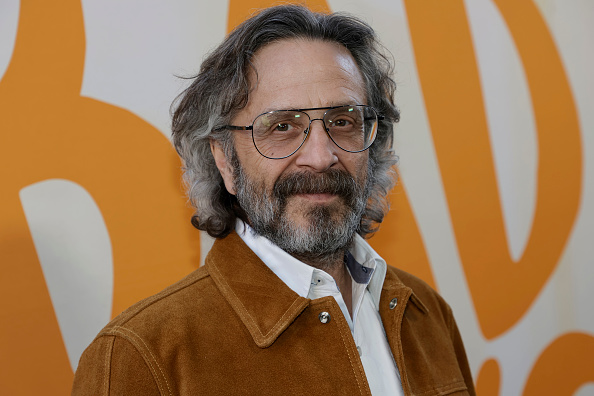

Wtf With Marc Maron Concludes A 16 Year Retrospective

Jun 02, 2025

Wtf With Marc Maron Concludes A 16 Year Retrospective

Jun 02, 2025 -

Controversy Erupts White House Addresses Musks Drug Use Speculation

Jun 02, 2025

Controversy Erupts White House Addresses Musks Drug Use Speculation

Jun 02, 2025 -

Holiday Closure China And New Zealand Markets Closed June 2nd 2025

Jun 02, 2025

Holiday Closure China And New Zealand Markets Closed June 2nd 2025

Jun 02, 2025 -

June 2nd 2025 Important Asian Economic Releases And Indicators

Jun 02, 2025

June 2nd 2025 Important Asian Economic Releases And Indicators

Jun 02, 2025 -

The Business Of Bathwater Examining Sydney Sweeneys New Venture

Jun 02, 2025

The Business Of Bathwater Examining Sydney Sweeneys New Venture

Jun 02, 2025