Internal Factors Pose Significant Risk To US Economy: JPMorgan CEO

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Internal Factors Pose Significant Risk to US Economy: JPMorgan CEO Jamie Dimon Sounds the Alarm

JPMorgan Chase & Co.'s CEO Jamie Dimon issued a stark warning this week, highlighting the significant internal risks threatening the US economy. While external factors like the war in Ukraine and global inflation remain concerns, Dimon emphasized that domestic issues pose a more immediate and potentially devastating threat to the nation's economic stability. His comments, made during a recent earnings call, sent shockwaves through financial markets and ignited a renewed debate about the resilience of the US economy.

Dimon's concerns aren't based on fleeting market fluctuations; they stem from a confluence of deeply rooted internal factors. He painted a picture far from the rosy economic projections often presented by others, underscoring the importance of understanding the underlying vulnerabilities.

The Looming Debt Ceiling Crisis: A Ticking Time Bomb

One of the most pressing issues highlighted by Dimon is the ongoing standoff regarding the US debt ceiling. The potential for a default, even a temporary one, carries catastrophic consequences. Dimon warned that such an event could trigger a global financial crisis, far exceeding the impact of the 2008 financial meltdown. He urged swift and decisive action from policymakers to avoid this potential catastrophe. The situation is incredibly complex, and understanding the intricacies of the debt ceiling debate is crucial for every American. [Link to article explaining the debt ceiling crisis]

Inflation and the Federal Reserve's Response: A Delicate Balancing Act

While inflation is a global concern, Dimon stressed the challenges the Federal Reserve faces in navigating its response within the US context. Balancing the need to curb inflation without triggering a recession is a precarious tightrope walk. Aggressive interest rate hikes, while intended to cool inflation, could inadvertently stifle economic growth and lead to job losses. The Federal Reserve's actions will have a profound impact on the coming months, and careful observation of their policy decisions is essential.

Political Polarization and Its Economic Ramifications

Dimon also pointed to the increasingly polarized political climate as a significant impediment to effective economic policymaking. Gridlock and partisan bickering hinder the ability of lawmakers to address critical issues, further exacerbating existing economic vulnerabilities. This political dysfunction is not just a matter of political debate; it directly impacts the country's economic health and stability. [Link to article discussing the impact of political polarization on the economy]

Other Internal Threats: Geopolitical Uncertainty and Supply Chain Vulnerabilities

Beyond the major factors highlighted above, Dimon alluded to other internal weaknesses, including lingering supply chain vulnerabilities and the ongoing uncertainty surrounding geopolitical events that could have knock-on effects on the US economy. These factors contribute to a complex and unpredictable economic landscape.

What Does This Mean for the Average American?

Dimon's warning isn't just for Wall Street; it has significant implications for everyday Americans. The potential for a recession, job losses, and increased financial instability are all real possibilities if these issues aren't addressed effectively. Staying informed about economic developments and understanding the potential risks is crucial for making informed financial decisions.

Looking Ahead: A Call for Responsible Policymaking

Dimon's message is clear: the US economy faces substantial internal threats that require immediate and decisive action. Responsible policymaking, bipartisanship, and a clear understanding of the interconnectedness of these challenges are essential to navigating this turbulent period. The future economic stability of the United States depends on it.

Keywords: US economy, JPMorgan Chase, Jamie Dimon, debt ceiling, inflation, Federal Reserve, recession, political polarization, economic risk, supply chain, geopolitical uncertainty, financial crisis.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Internal Factors Pose Significant Risk To US Economy: JPMorgan CEO. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

How Getting Older Shaped Miley Cyrus View Of Her Mother And Father

Jun 03, 2025

How Getting Older Shaped Miley Cyrus View Of Her Mother And Father

Jun 03, 2025 -

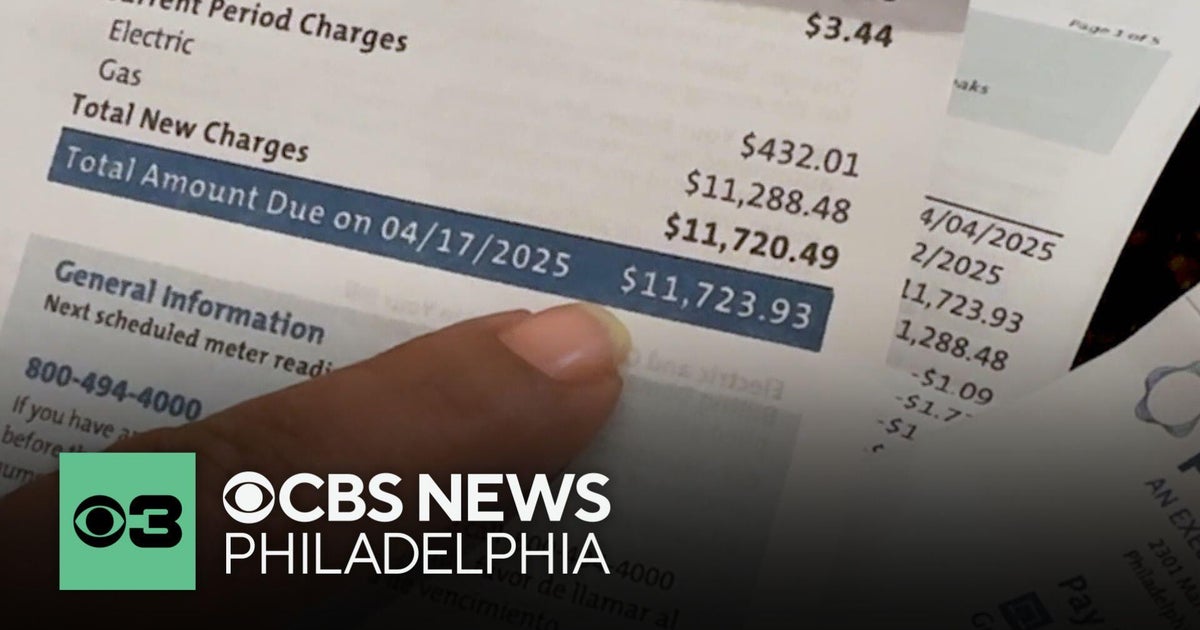

Pennsylvania Peco Customer Faces 12 000 Bill Following Months Without Billing

Jun 03, 2025

Pennsylvania Peco Customer Faces 12 000 Bill Following Months Without Billing

Jun 03, 2025 -

Community Uprising Detroit Residents Fight Back Against Dte Energy Rate Increases

Jun 03, 2025

Community Uprising Detroit Residents Fight Back Against Dte Energy Rate Increases

Jun 03, 2025 -

Is Nio Stock A Bargain After Its Recent Price Drop

Jun 03, 2025

Is Nio Stock A Bargain After Its Recent Price Drop

Jun 03, 2025 -

Is Sydney Sweeneys Used Bathwater Sale A Publicity Stunt

Jun 03, 2025

Is Sydney Sweeneys Used Bathwater Sale A Publicity Stunt

Jun 03, 2025