Interest Rates Unchanged: Reserve Bank Maintains 3.85% Rate

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Interest Rates Unchanged: Reserve Bank Holds Steady at 3.85%

The Reserve Bank (RBA) has announced today that the official cash rate will remain unchanged at 3.85%. This decision, widely anticipated by economists, marks a pause in the aggressive interest rate hikes seen earlier this year. While many homeowners breathed a collective sigh of relief, the RBA's statement hints at a watchful approach, leaving the door open for future adjustments depending on economic indicators.

This decision follows months of increasing interest rates aimed at curbing inflation. The RBA's goal is to bring inflation back down to its target range of 2-3%, a figure that has remained stubbornly above target for several months. The current inflation rate, while showing signs of easing, remains a key concern for the central bank.

What does this mean for borrowers and savers?

For homeowners with variable-rate mortgages, the news brings temporary stability. However, the RBA's statement emphasizes that the current pause is not a signal of the end of the rate-hiking cycle. Further adjustments will depend on incoming economic data, including inflation figures, wage growth, and unemployment rates.

-

Borrowers: While no immediate changes are expected to their mortgage repayments, borrowers should remain vigilant and continue to budget carefully, anticipating potential future rate increases. Consider exploring strategies for managing debt and improving your financial resilience. [Link to article on managing mortgage repayments]

-

Savers: The unchanged cash rate maintains current interest rates on savings accounts. While this may not represent significant gains, it provides a degree of certainty for those relying on interest income. Comparing savings accounts and exploring higher-yield options remains advisable. [Link to article comparing savings accounts]

The RBA's reasoning:

The RBA's decision to hold the cash rate at 3.85% reflects a cautious approach to navigating the current economic climate. The bank cited slowing economic growth globally as a factor in its decision, alongside the lagged effects of previous rate hikes. They acknowledged that the full impact of past increases is yet to be fully felt within the economy.

The statement highlighted the ongoing monitoring of inflation and employment data. Future decisions will hinge on the interplay between these two critical economic indicators. A persistent rise in inflation could trigger further rate increases, whereas signs of a significant economic slowdown could lead to a different approach.

Looking Ahead:

While today's announcement offers a temporary reprieve, uncertainty remains. Economists are divided on the future trajectory of interest rates, with some predicting further increases in the coming months, while others anticipate a period of stability. The next few months will be critical in determining the RBA's next move. Closely monitoring key economic indicators will be crucial for both borrowers and savers alike. The RBA's next meeting is scheduled for [Date of next meeting], and any changes will be announced then.

Keywords: Reserve Bank, RBA, interest rates, cash rate, 3.85%, inflation, mortgage rates, savings rates, Australian economy, economic growth, monetary policy, variable rate mortgage, fixed rate mortgage.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Interest Rates Unchanged: Reserve Bank Maintains 3.85% Rate. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Who Is Babydoll Archi The Viral Assam Tik Tok Star Explained

Jul 09, 2025

Who Is Babydoll Archi The Viral Assam Tik Tok Star Explained

Jul 09, 2025 -

Babydoll Archis Viral Video Exploring The Dame Un Grrr Phenomenon

Jul 09, 2025

Babydoll Archis Viral Video Exploring The Dame Un Grrr Phenomenon

Jul 09, 2025 -

Claim Your Free Spirit Empress Clash Royales Legendary Card And Meta Shift

Jul 09, 2025

Claim Your Free Spirit Empress Clash Royales Legendary Card And Meta Shift

Jul 09, 2025 -

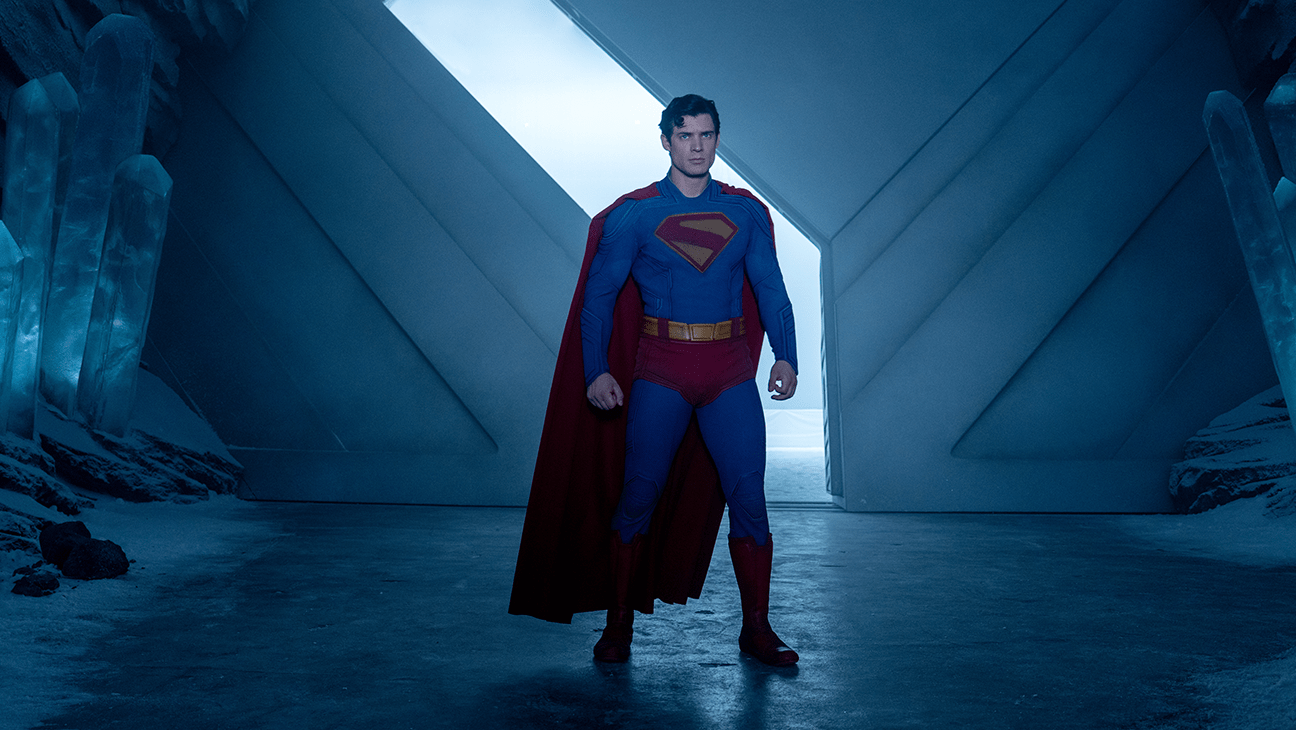

Leaked Superman Reviews Early Reactions Break Embargo

Jul 09, 2025

Leaked Superman Reviews Early Reactions Break Embargo

Jul 09, 2025 -

Superman First Reactions Highlight A Bold New Direction For Dc

Jul 09, 2025

Superman First Reactions Highlight A Bold New Direction For Dc

Jul 09, 2025

Latest Posts

-

Quentin Tarantinos Inglourious Basterds 2009 Cast Characters And Legacy

Jul 09, 2025

Quentin Tarantinos Inglourious Basterds 2009 Cast Characters And Legacy

Jul 09, 2025 -

R25 Lakh For Freedom Assamese Influencer Archita Phukans Struggle With Prostitution

Jul 09, 2025

R25 Lakh For Freedom Assamese Influencer Archita Phukans Struggle With Prostitution

Jul 09, 2025 -

Sarah Fergusons Refusal Of Kings Invitation A Royal Family Mystery

Jul 09, 2025

Sarah Fergusons Refusal Of Kings Invitation A Royal Family Mystery

Jul 09, 2025 -

Cape Canaveral Launch Follow Space Xs Falcon 9 Starlink Deployment Live

Jul 09, 2025

Cape Canaveral Launch Follow Space Xs Falcon 9 Starlink Deployment Live

Jul 09, 2025 -

Superman First Reactions Hail New Film As Thrilling Dcu Launch

Jul 09, 2025

Superman First Reactions Hail New Film As Thrilling Dcu Launch

Jul 09, 2025