Intel's Turnaround Strategy: A 2025 Investment Perspective.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Intel's Turnaround Strategy: A 2025 Investment Perspective

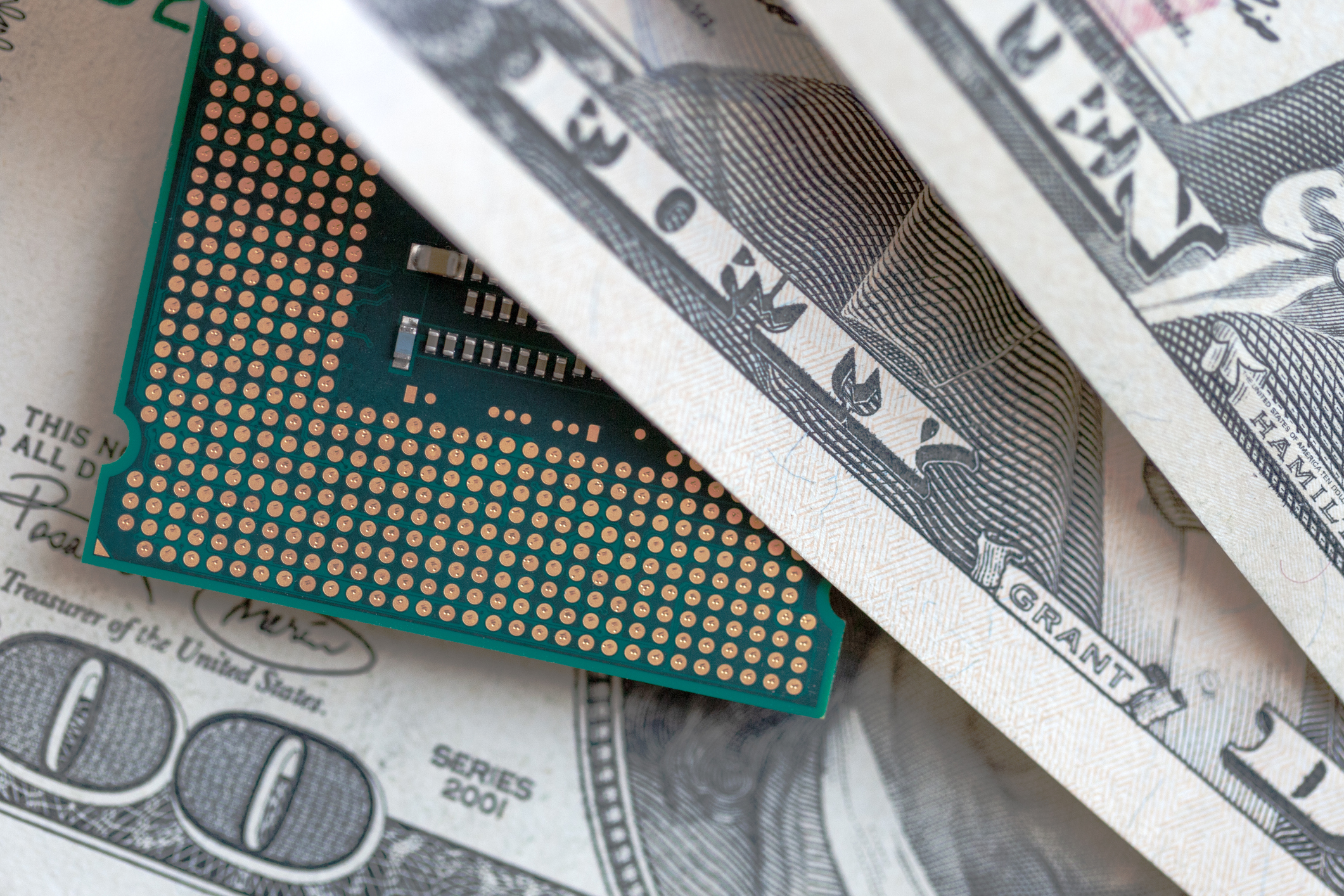

Intel, once the undisputed king of the microprocessor industry, has faced significant challenges in recent years. The company's dominance has been eroded by competitors like TSMC and AMD, prompting a radical shift in strategy. But is Intel's turnaround plan a sound investment for 2025 and beyond? This article delves into Intel's current initiatives and assesses their potential impact on future profitability and market share.

Intel's Multi-pronged Approach to Regaining Market Leadership

Intel's turnaround strategy isn't a single initiative, but rather a multifaceted approach encompassing several key areas:

-

Increased Capital Expenditure (CAPEX): Intel has significantly boosted its investment in advanced manufacturing capabilities, aiming to regain its technological edge. This includes constructing new fabrication plants (fabs) and upgrading existing ones to produce cutting-edge chips using leading-edge process nodes. This massive investment, while risky, signifies Intel's commitment to regaining its manufacturing prowess. The success of this strategy hinges on timely execution and overcoming potential yield challenges.

-

Focus on High-Performance Computing (HPC): Intel is doubling down on the rapidly growing HPC market, crucial for applications like artificial intelligence (AI) and high-performance computing clusters. Their focus on Xeon processors and advanced interconnect technologies like Ponte Vecchio positions them to capitalize on this lucrative segment. This strategic shift recognizes the evolving demands of modern computing and positions Intel for growth in a high-margin market.

-

IDM 2.0 Strategy: Intel's integrated device manufacturer (IDM) 2.0 strategy involves a hybrid approach, combining internal manufacturing with external partnerships. This allows them to leverage external foundries for certain products while maintaining control over their most critical technologies. This nuanced approach aims to balance control over intellectual property with cost-effectiveness and faster time-to-market.

-

Expansion into New Markets: Beyond traditional CPUs, Intel is expanding into new areas like GPUs and network processors. This diversification mitigates risk and opens avenues for growth in complementary markets. The success of their discrete GPUs, for example, will be a significant indicator of this diversification strategy's effectiveness.

Challenges and Risks Facing Intel's Turnaround

Despite the ambitious nature of Intel's plan, several challenges remain:

-

Competition: The intense competition from AMD and TSMC, both technologically advanced and operationally efficient, presents a formidable hurdle. Intel needs to demonstrate clear technological leadership to win back market share.

-

Execution Risks: The sheer scale of Intel's CAPEX and the complexities involved in advanced chip manufacturing introduce significant execution risk. Delays or yield issues could seriously impact their turnaround timeline and profitability.

-

Geopolitical Factors: Global geopolitical tensions and supply chain disruptions could impact Intel's ability to execute its plans effectively.

Investment Perspective for 2025

Predicting the success of Intel's turnaround by 2025 requires careful consideration of these factors. While the long-term prospects appear positive, significant short-term challenges persist. Investors should monitor:

- Progress on new fabrication technologies: Achieving leading-edge process nodes on schedule is paramount.

- Market share gains in key segments: Tracking progress against competitors in HPC and other target markets is crucial.

- Profitability improvement: Demonstrating a clear path to profitability despite high CAPEX is essential.

A successful turnaround is not guaranteed, and significant risks remain. However, Intel's ambitious investment and strategic shifts could potentially lead to substantial gains by 2025, making it a compelling, albeit high-risk, investment opportunity for those with a long-term perspective. Further research and due diligence are strongly recommended before making any investment decisions. Consult with a financial advisor for personalized guidance.

Keywords: Intel, Turnaround Strategy, 2025 Investment, Semiconductor Industry, TSMC, AMD, High-Performance Computing (HPC), Capital Expenditure (CAPEX), IDM 2.0, Stock Market, Investment Analysis, Technology Stock, Intel Stock.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Intel's Turnaround Strategy: A 2025 Investment Perspective.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Bronx River Search Intensifies 2 Year Old Missing Father Under Scrutiny

Jun 11, 2025

Bronx River Search Intensifies 2 Year Old Missing Father Under Scrutiny

Jun 11, 2025 -

West Indies Tour Of England Live Coverage Of The Final T20

Jun 11, 2025

West Indies Tour Of England Live Coverage Of The Final T20

Jun 11, 2025 -

The Never Enough Tour Turnstile Announces Extensive 2024 Dates

Jun 11, 2025

The Never Enough Tour Turnstile Announces Extensive 2024 Dates

Jun 11, 2025 -

Turnstile 2025 Us Tour Cities Dates And Ticket Information

Jun 11, 2025

Turnstile 2025 Us Tour Cities Dates And Ticket Information

Jun 11, 2025 -

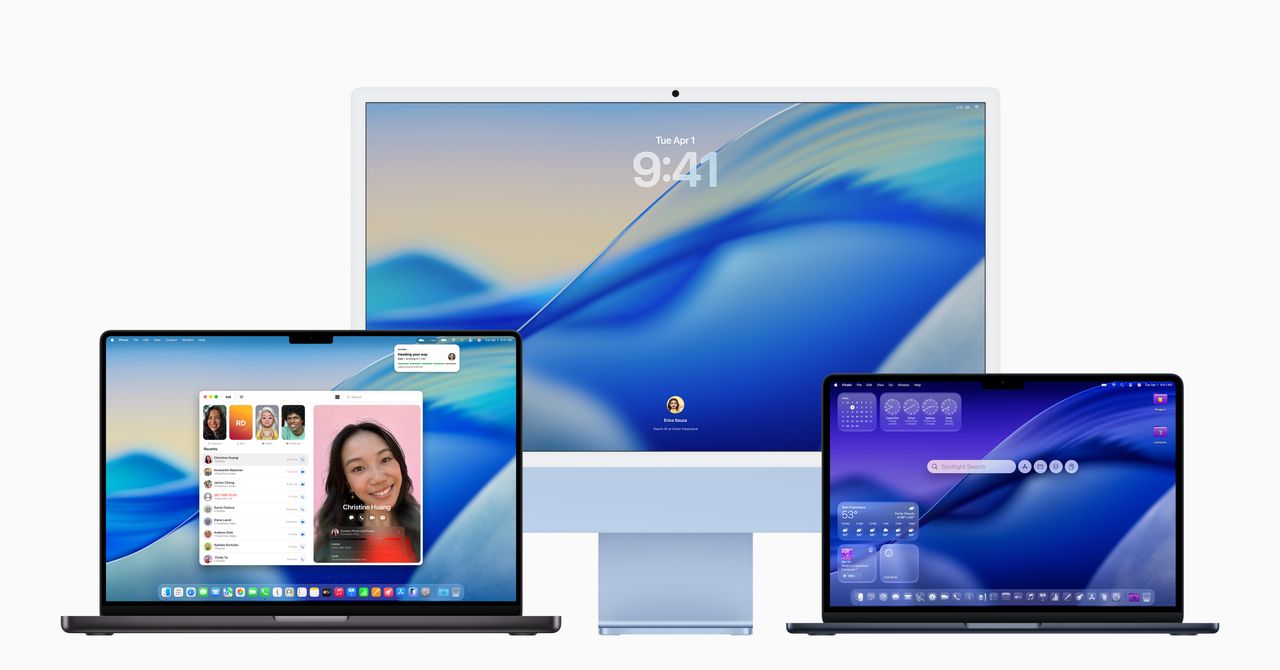

Intel Macs Officially Retired A New Era Of Apple Silicon Begins

Jun 11, 2025

Intel Macs Officially Retired A New Era Of Apple Silicon Begins

Jun 11, 2025